Why The Bank Of Canada Cannot Raise Rates

Canada’s unemployment rate fell to 6.5 %, the lowest rate since October 2008, just prior to the financial crisis and the onset of the Great Recession. Over the past 12 months, total employment was up 276,000 (1.5%). While this is welcome news, a look under the hood reveals a rather disquieting situation regarding wage growth. Many workers have yet to benefit from a revival in wage growth and, in some industries, average wages have slightly decreased. Time and again, the Bank of Canada in its deliberations has focused on the lack of wage growth as a sign that the economy is operating below full capacity and monetary continued support is needed.

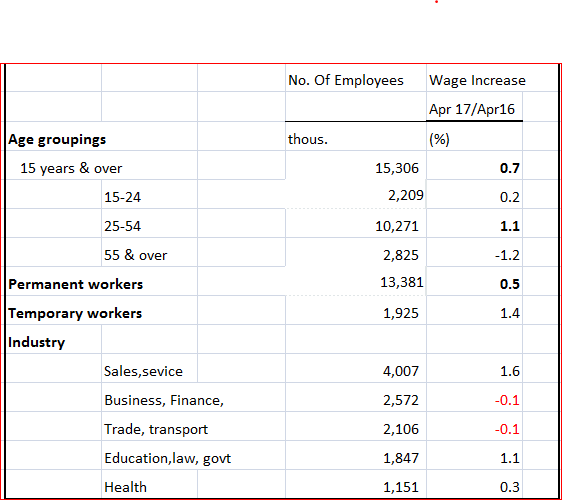

The results of the April labour force survey reveals several weaknesses in the Canadian job market (accompanying table).

Source: Statistics Canada

Overall, annual wages increased by a mere 0.7 %, largely on the strength of 1.1 % wage growth for workers aged 25-64, the largest segment. As the labour force ages, the fastest growing segment is those workers who are 55 and over, yet their wages declined significantly by 1.2%. Although we read a lot about the “gig” economy, the largest segment continues to be permanent workers (defined as a job that is expected to last as long as the employee chooses to work at the job). Permanent workers’ wage growth was 0.5 % slightly below the national average. It seems that job preservation takes precedent of demanding higher wages, a sign that the labour market is far from robust and that employees have very little bargaining power.

Within the various industry categories, there are considerable differences in wage growth. Employees in sales and general services have been able to push up their wages by an average of 1.6%. However, it is interesting to note that two very large groupings---business/finance and trade/transportation—suffered slight declines in average wage growth. Health care workers, one of the fastest growing segments, saw their wages advance at a paltry 0.3 % over the last 12 months.

So, while there is welcome news on the broad employment front, the devil is in the details. Wages continue to lag, especially, when adjusted for inflation. The average worker is falling behind in terms of real wages and in specific industries this situation is more serious. Any fall in the unemployment rate comes from a shrinking of the labour force as the baby boomers head for retirement. The unemployment rate must be carefully assessed in the context of wage growth. To the extent that wage developments are a sign of capacity utilization and inflation, there is little comfort for the Bank of Canada to raise rates.

Disclosure: None.