Why Has Emerging Market Sovereign Debt Become Such An Issue In Financial Markets?

Sovereign debt are simply bonds issued by a national government in either a domestic or foreign currency.

Sovereign debt is generally a riskier investment when it comes from a developing country rather than a developed economy. From the issuing country’s perspective, however, sovereign debt becomes a larger problem when the domestic currency is depreciating against the lending country (e.g. the U.S.)

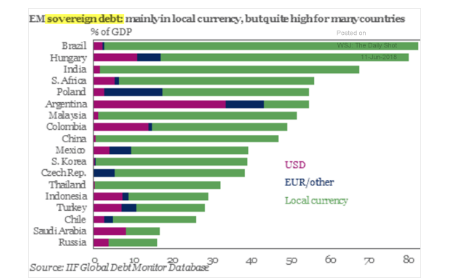

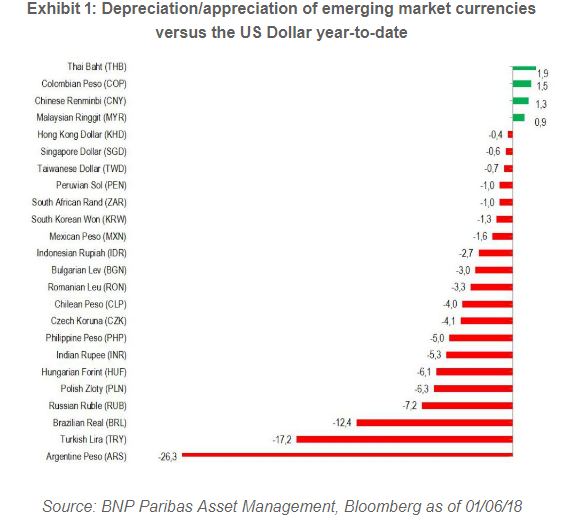

The following two charts focus on the extent of sovereign debt in the emerging market world and the associated problems which occur when the U.S. denominated debt encounters a strengthening U.S. dollar.

Among the large emerging market economies, Brazil, Argentina, Turkey and South Africa currently stand out in terms of the size of their outstanding sovereign debt.

Brazil is notable for having the largest sovereign debt exposure relative to its GDP, and of course, some of its debt is also denominated in U.S. dollars. Argentina’s sovereign debt is huge relative to its GDP, and its exposure to the U.S. dollar financing is also huge.

It is interesting to observe that compared to other emerging market economies, Turkey seems to have a comparatively low sovereign debt relative to its GDP, but financing its debt is still vulnerable because of its heavy U.S. dollar exposure.

As the second chart below indicates, Argentina has already experienced a 26% devaluation of its currency against the U.S. dollar this year, followed by a 17% decline in the Turkish Lira and a 12% drop in the Brazilian Real.

Argentina’s currency slump is not surprising since once again the country is experiencing hyperinflation (25% y/y). Turkey’s recent inflation rate was 11% and Brazil’s 13%.

Argentina and Turkey have already sent chills in the emerging market financing world due to their weaker currencies, and Brazil is not far behind.

Hard And Local Currency Sovereign Debt Of Emerging Market Countries

(% Of GDP).

Source: The Daily Shot, June 12, 2018

Disclosure: None.