USD/JPY Losses To Persist As Sentiment Abates & Double-Top Takes Shape

|

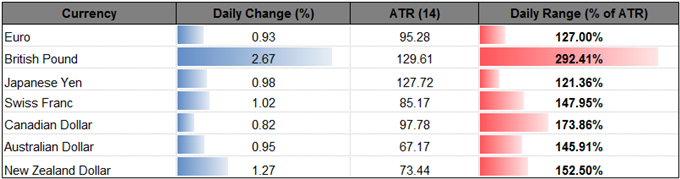

Currency |

Last |

High |

Low |

Daily Change (pip) |

Daily Range (pip) |

|

GBP/USD |

1.2369 |

1.2397 |

1.2018 |

322 |

379 |

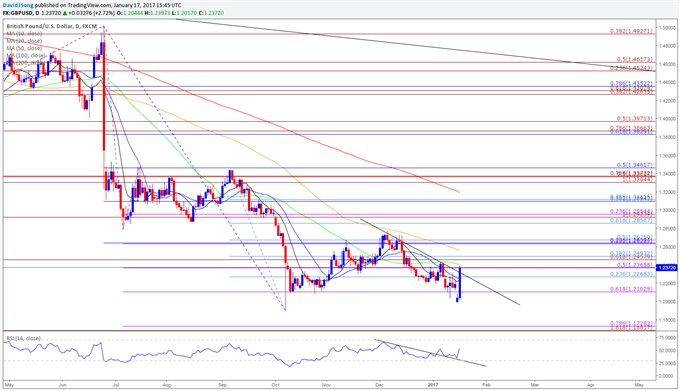

GBP/USD Daily

Chart - Created Using Trading View

- GBP/USD fills the gap from earlier this week and looks poised for a larger recovery as it breaks out of the downward trend carried over from November and appears to be highlighting a similar dynamic to the Relative Strength Index (RSI); may see the pound-dollar exchange rate move back towards the monthly high (1.2433) especially as the momentum indicator appears to be reversing course ahead of oversold territory.

- Despite the limited market reaction to the pickup in the U.K. Consumer Price Index (CPI), rising price pressures may encourage the Bank of England (BoE) to adopt a more hawkish tone and boost its economic forecasts at the next ‘Super Thursday’ event on February 2 especially as Prime Minister Theresa May starts to lay out a more detailed plan and appears to be on course to avoid a ‘hard Brexit;’ may see Governor Mark Carney continue to warn of ‘notable’ inflation as U.K. Average Weekly Earnings are projected to climb an annualized 2.6% in November following a 2.5% expansion the month prior.

- Will keep a close eye on the monthly opening range as GBP/USD takes out the topside targets, with a close above 1.2370 (50% expansion) raising the risk for a move back towards the 2017-high (1.2433) followed by the next area of interest around 1.2460 (61.8% expansion) to 1.2490 (38.2% retracement).

|

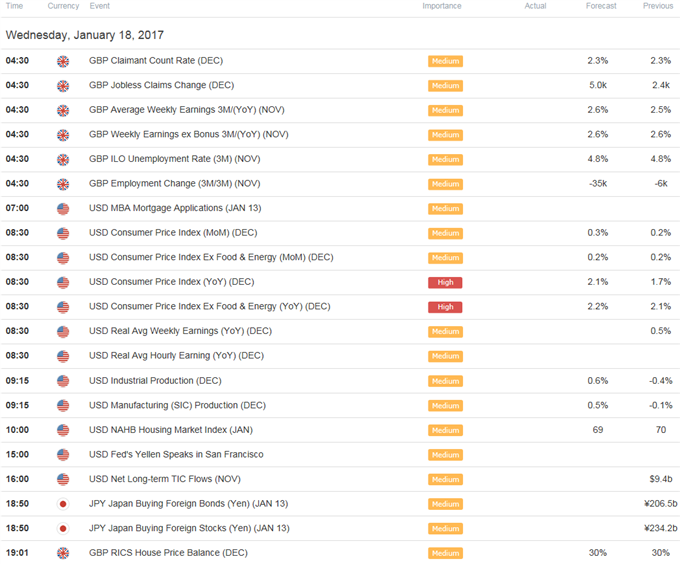

Currency |

Last |

High |

Low |

Daily Change (pip) |

Daily Range (pip) |

|

USD/JPY |

113.07 |

114.28 |

112.73 |

113 |

155 |

USD/JPY Daily

Chart - Created Using Trading View

- The ongoing series of lower highs & lows in USD/JPY has dampened the scope for a near-term bull-flag formation, with the downside targets still in focus especially as market participants appear to be scaling back their appetite for risk; will keep a close eye on the Nikkei 225 as it appears to be moving in tandem with the dollar-yen exchange rate, with the benchmark equity index also at risk for further losses as a double-top formation appears to be panning out.

- Nevertheless, the broader outlook for USD/JPY remains bullish as Fed Fund Futures continue to reflect a greater than 60% probability for a June rate-hike, but the central bank may persistently struggle to achieve its 2% target for inflation as New York Fed President William Dudley warns ‘the recent strengthen of the dollar will put downward pressure on import prices and limit the ability of domestic producers to raise their prices;’ may see a limited market reaction to a pickup in the U.S. Consumer Price Index (CPI) as the core rate is projected to hold steady at an annualized 2.1% for the third consecutive month in December.

- The bearish RSI trigger keeps the downside targets in focus for the days ahead, with a close below 112.90 (38.2% retracement) raising the risk for a more meaningful run at the Fibonacci overlap around 112.40 (61.8% retracement) to 112.50 (38.2% retracement) followed by the May high (111.45).

For More Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

Click HERE for the Entire DailyFX Webinar schedule.

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!