Trump Train Derailed – USD Falls Across The Board

Markets reacted quite quietly to Trump’s inauguration as the 45th President of the US. He needed the weekend off to celebrate and so did markets. When things got back to business, the dollar is down.

Here are updates on the situation and views of EUR/USD, GBP/USD and USD/JPY.

Is this a “buy the rumor, sell the fact” phenomenon? Perhaps. The dollar has been running higher since the elections in November. On the other hand, 2017 began with bumps in the dollar rally. The Fed seemed over-reliant on Trump’s fiscal stimulus and his recent press conference was not convincing.

But Trump actually mentioned fiscal stimulus in the inauguration ceremony. So why isn’t the greenback responding? Well, afterward Trump was busy arguing about the numbers in the event against the number of protesters in the following day. Around 3.5 million people came out to demonstrate against the new president on Saturday.

If we return back to markets, the US dollar needs Trump’s promises of fiscal stimulus to begin turning into reality. Without that, there are reasons to see the trend unwind.

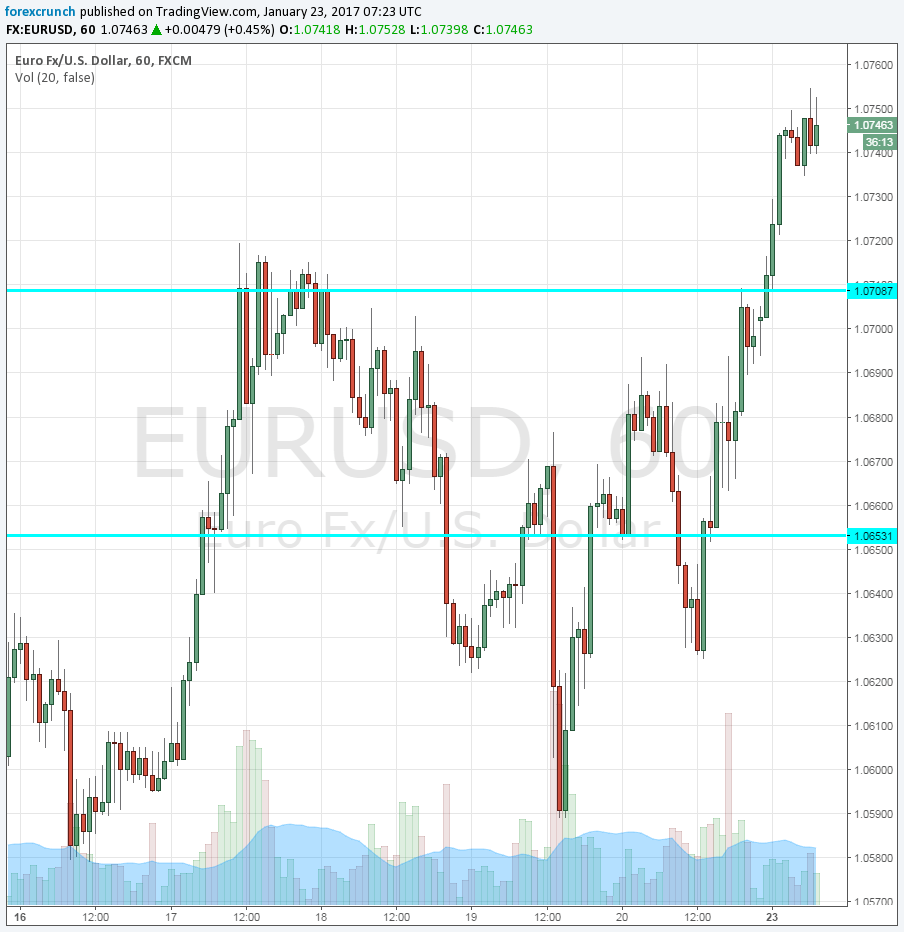

EUR/USD is currently trading at 1.0745, above the previous resistance line at 1.0720. The next line to watch is the swing high of 1.0870. Support is at 1.0650.

More: Could Trump Talk Down The USD Successfully – Morgan Stanley

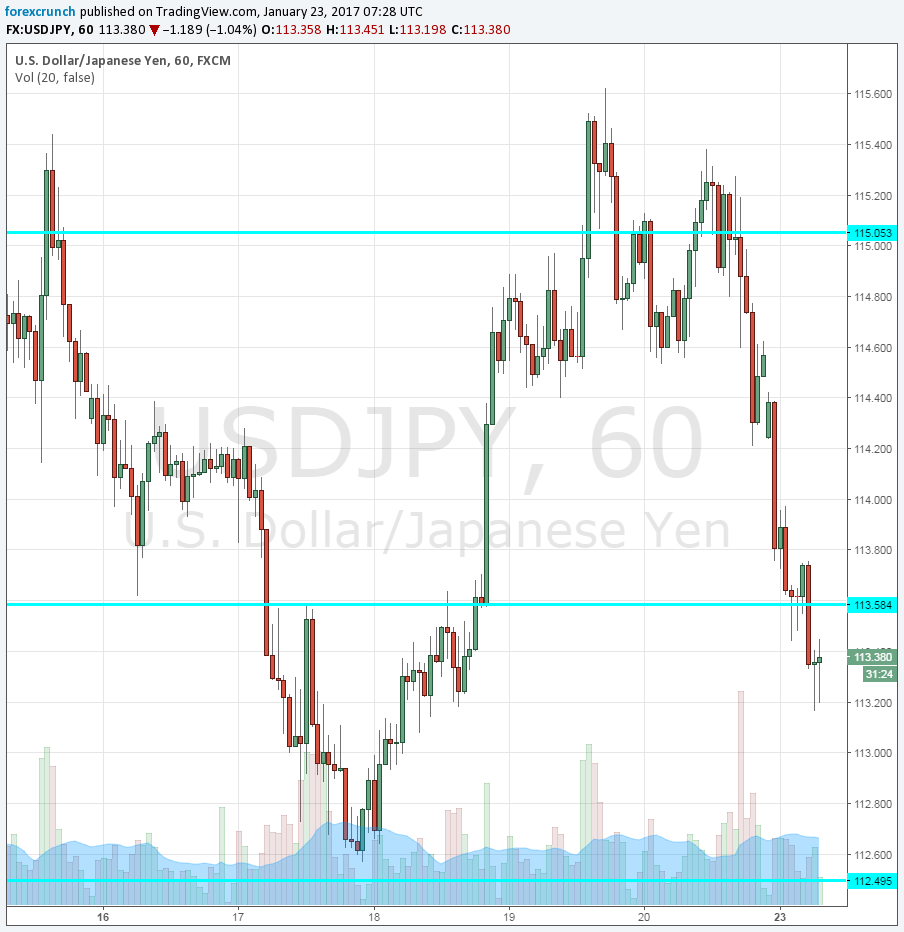

USD/JPY is trading around 1% lower at 113.37. This currency pair often provides the best proxy for the strength or weakness of the US dollar. Further support awaits at 112.50 and 111.30. It pierced through support at 113.60.

More: Elliott Wave Analysis: USD Index and USDJPY

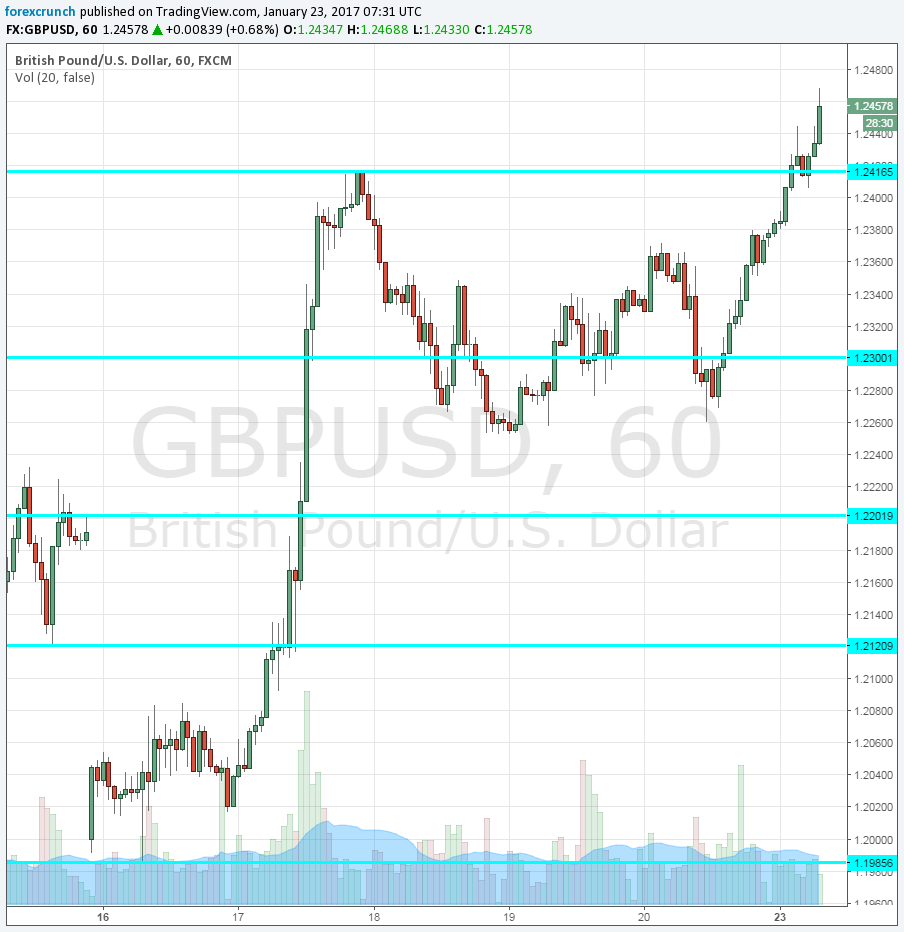

GBP/USD extends its post “singled out” recovery and reaches 1.2460. The 80+ pip move places cable at a close reach to the 1.25 level. Support is at 1.2420. The pound awaits the decision of the supreme court tomorrow.