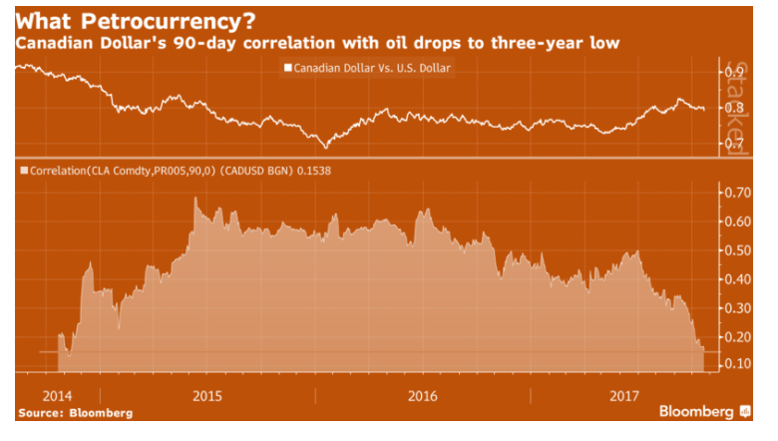

The Oil Price Impact On Canada’s Currency Has Weakened Since The Central Bank Started Raising Interest Rates

“The Canadian dollar’s link with crude has been falling sharply since the end of June, spurred by the central bank raising interest rates for the first time since 2010. The currency’s 90-day correlation with WTI crude is now at the lowest level in almost three years.” (Bloomberg News, October 24, 2017.)

World oil prices have been in a bear market for the past six years.

Canada’s economy is widely thought of as a commodity-based economy, and at times it seems as if the Canadian currency follows the ups and downs of oil prices.

Indeed, it is well understood that the Canadian dollar is positively correlated with the price of oil. That same relationship also holds for other so-called commodity-oriented economies, such as Denmark and Russia.

As the price of oil goes up, the Canadian dollar tends to appreciate against other major currencies.

A correlation analysis of data going back to January 2005 indicates that on average there was a 0.78 positive correlation between the Canadian/US dollar exchange rate and oil prices.

As an October 23rd article by Bloomberg points out “Commodity currencies are typically more correlated with oil when it is falling because a decline in prices often indicates a reduction in demand, which is disproportionately damaging to energy-dependent economies. The link rose during the 2015-16 oil price slump, but now that foreign exchange traders have adapted to the new normal of oil below $60 a barrel, monetary policy and idiosyncratic factors have taken precedence for exchange-rate moves.”

In Canada’s case, the break in the oil price impact on the currency can also be associated with the recent interest rate hikes by the central bank.

In other words, in the current environment, U.S.-Canadian interest rate differentials have suddenly begun to play a much more prominent role in determining the value of the Canadian dollar.

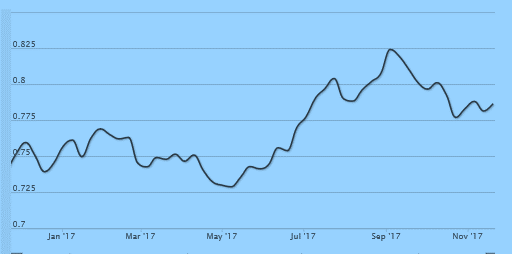

The Canadian / U.S. Dollar Exchange Rate In 2017

Disclosure: None.