The Hidden Political Risks In The Australian Dollar

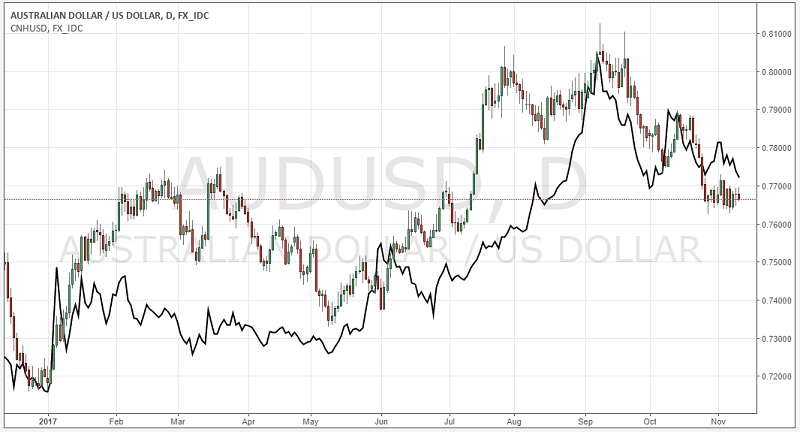

For Australian dollar speculators, assessments of political risk are usually limited to developments within the country. Last month, the stability of the ruling government was called into question after the deputy prime minister and four senators were disqualified from holding office due to maintaining dual citizenship. Following Deputy Prime Minister Barnaby Joyce’s disqualification, the government lost its one-seat majority in the lower house of Parliament. While the event caused a small drop in the currency, domestic political events have had a limited impact on the Australian dollar in recent times. In general, the country enjoys a fair degree of political stability. Instead, we argue that the main political risk for Australia comes from China. The correlation between the Aussie and the Chinese yuan remains strong for a good reason. This is shown below:

The strong correlation between AUD and CNH continues in 2017

Note: USD/CNH (inversed) and shown as black line

The emerging markets flavor of the Australian dollar

Looking at the recent political upheaval occurring in Saudi Arabia, one can’t help but draw parallels with earlier developments in China. Only a few years ago, both countries appeared to be in a golden age. Key indicators such as foreign exchange reserves, export surpluses and investment were all accelerating by leaps and bounds. Speculators were making lots of money by investing in the Chinese yuan, thanks to both an appreciating exchange rate and generous interest rates. In Saudi Arabia, there were rumors that the central bank would re-peg the Saudi riyal to strengthen the currency against the US dollar. Today, the economic outlook is far murkier. While Saudi Arabia is now regularly borrowing US dollars via global bond markets, China is trying to attract foreign bond investors to its interbank funding market via the Hong Kong Bond Connect program. Looking at the Australian dollar, the currency is far weaker relative to its peak between 2011 and 2013, although it has rebounded slightly this year. For China and Saudi Arabia, both countries have experienced significant capital flight since 2014, and are now looking for ways to replenish foreign currency reserves.

Needless to say, China and Saudi Arabia are economically very different countries. But what is interesting is the striking similarity in how both countries are experiencing and responding to capital flight. For both countries, foreign exchange reserves peaked around the summer of 2014, and have been trending down since that time. In response to the growing perception that the politically-connected elite have been “milking” their country during the boom, both governments have engaged in a broad anti-corruption crackdown. The biggest losers appear to be factions opposed to the ruling elite. Lastly, political leaders in both China and Saudi Arabia have sought to centralize decision-making power, moving away from ‘consensus-based’ authoritarian rule.

Implications for the currency

Big political upheavals tend to foreshadow difficult times in the future, and the recent events in Saudi Arabia are one indication that the golden age for emerging market growth is officially over. Given Australia’s reliance on commodity exports to China, investors in the country should be especially attuned to significant political changes occurring in the country. Recent events, including Xi Jinping’s corruption crackdown and ascendancy to the “core” of the Chinese Communist Party, suggest that China is preparing for more difficult times in 2018 and beyond.

While the latest trade balance figures showed that Australian commodity exports remain strong, this may change in the future. Rapid increases in debt, ongoing capital flight and falling foreign reserves suggest that there is a natural limit to China’s investment-driven growth. Today, exports remain one of the few bullish drivers for Australian GDP growth as consumers reduce their spending and housing investment remains subdued. If and when exports weaken in the future, the currency is likely to resume weakening. For speculators in the Australian dollar, going short the currency looks like a better trade over the next few quarters.

Any opinions, news, research, analyses, prices or other information is provided as general market commentary and does not constitute investment advice. MarketsNow will not accept liability for any ...

more