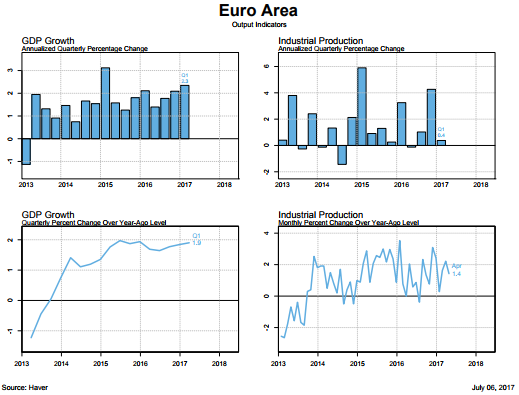

The Euro Area Economy Continues On A Slow Growth Path

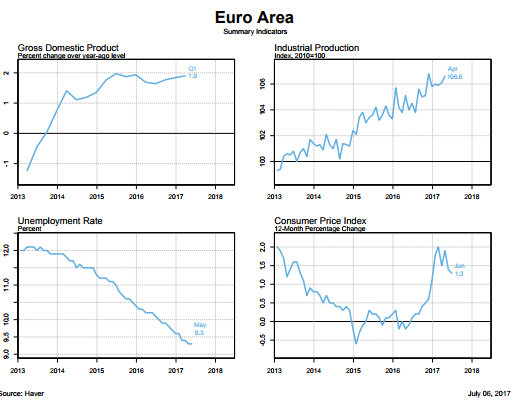

“The European economy continues to grow at a steady pace despite numerous political uncertainties and challenges. For two years, GDP growth has been steady, employment growth has been healthy and unemployment has been receding gradually. In what has been a context of depressed global activity, private consumption has been the main driver of growth, fuelled in recent quarters by very accommodative monetary policies and the very low price of oil. The economic expansion has continued into 2017. Elevated uncertainty seems to have started giving way to improved economic sentiment, but this has yet to be reflected in hard economic indicators. Constraints to growth remain both in the short run (related to the lingering effects of past crises) and in the medium run (as cyclical weakness also reduces potential growth and productivity growth remains very sluggish).” (European Commission Directorate, European Economic Forecast, Spring 2017)

While the Eura Area economies have been growing positively for a few years now, in many obvious ways the economic recovery remains rather unsatisfactory. At an aggregate level, even though there has been some revival in consumer spending, capital investment in the area remains rather weak. On the other hand, the investment weakness has its own by-product of a rather large 3% of GDP current account surplus for the entire region.

Moreover, the gains from the aggregate economy have not been distributed evenly among its 26-member states. There is the obvious North-South divide as well as the rather large differences in country unemployment rates and budget balances.

Clearly, the deficit and debt problems of some of the countries carries with them some worrying negative feedbacks between weak banks and sovereign debt problems.

An example of some of these differences can be seen in the unemployment rate and budget balance differences.

For example, in May the unemployment rate in Germany was 3.9%, in France 9.6%, in Italy 11.3% and in Spain 17.7%. At the same time, Germany reported a budget surplus of about 0.5% of GDP, while Italy, France, and Spain recorded budget deficits ranging between 2.3% and 3.3% of GDP.

Disclosure: None.