The Canadian Economy Will Temporarily Grow More Rapidly Than The American

It will probably be a surprise to some investors that Canada could emerge as one of the fastest growing economies in the developed world this year.

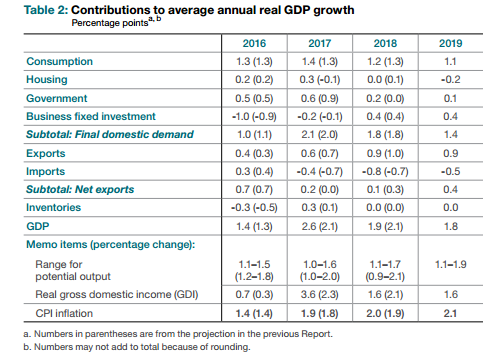

According to the Bank of Canada’s latest projections, Canada’s real GDP should increase by about 4% in the first quarter of this year, outpacing other advanced countries. For all of 2017, the Bank is projecting 2.6% growth which would make Canada the growth leader of the G7 countries. Next year, the economy is projected to grow a bit slower, only 1.9%.

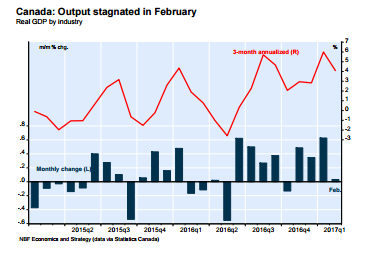

Monthly GDP figures for the Canada also confirm that the economy picked up sharply early in 2017.

(A word of caution. While monthly GDP data provide a pretty good fix on how the economy is performing, they are rather incomplete. The monthly data are presented on an industry basis, while the more familiar quarterly GDP figures use an expenditure focus.)

The latest published monthly data was for February. While the first chart shows that there was no growth in Canadian GDP in February, on a y/y basis the economy expanded by 2.5%, and manufacturing output increased by 2.6%. Moreover, the preceding three months of data were unusually strong, averaging 0.5% monthly growth as of January. In other words, the preceding t monthly growth rates were so fast that they were clearly unsustainable.

Despite the sudden improvement in Canada’s economic growth and job prospects, the Canadian dollar has been very weak lately, declining below 73 cents U.S. on May 3rd. This weakness is quite understandable considering recently lower oil prices and the expected U.S. interest rate increase in June.

Returning to the Bank of Canada projections, the Canadian central bank also believes, quite correctly, that Canada’s economic growth will slow rather sharply next year based on three significant reasons. While the energy sector drag on the economy probably bottomed out this year, it is hard to be optimistic for any significant momentum in this sector going forward.

Secondly, there was a major increase in government transfer payments to households this year, which helped to boost economic growth. Unfortunately, this boost the economy will level off next year.

Finally, it is rather likely that housing construction will slow in the booming Toronto region next year. Moreover, as the central bank points our, the outlook for Canada’s foreign trade and business investment is still looking very weak. Indeed, the Bank projects business investment to decline for a third straight year in 2017.

In closing, the Canadian economy has probably shrugged off the worst effects of the oil crash. The economy seems to have returned to a phase of stronger economic growth and job creation. All of this suggests that the Canada’s economy could grow faster than the American economy this year, but not necessarily in 2018.

Bank of Canada’s April 2017 Forecast Of The Canadian Economy: 2017-2019

Disclosure: None.