The Best Canadian Bank Stocks Today, Ranked In Order

The largest Canadian banks have proven over the past decade that they not only endure times of economic duress better than their American counterparts, but that they can grow at high rates coming out of a recession as well. The group as a whole also pays very nice dividends, making them attractive for income investors.

Valuations have come down of late, making stocks that were somewhat expensive last year more in line with fair value, and increasing their respective total return profiles as a result.

In this article, we’ll take a look at four large Canadian banks – The Royal Bank of Canada (RY), The Bank of Nova Scotia (BNS), Bank of Montreal (BMO) and Toronto-Dominion Bank (TD) – and rank them in order of highest prospective total returns.

The top four big banks in Canada are very shareholder-friendly, with attractive cash returns.

Read on to see which Canadian bank is ranked highest in our Sure Analysis Research Database.

Canadian Bank Stock #4: Bank of Montreal

Bank of Montreal was formed in 1817, becoming Canada’s first bank. The past two centuries have seen BMO grow into a global powerhouse of financial services and today, it has more than 1,500 branches. BMO stock has a market cap of $50B.

In addition to trading on the New York Stock Exchange, Bank of Montreal stock also trades on the Toronto Stock Exchange, as do the other stocks in this article. You can download a database of the companies within the TSX 60 below:

Click here to download your TSX 60 Index stocks list now.

BMO’s recent Q2 earnings were strong as adjusted earnings-per-share rose 15%. Broad strength across the company’s segments contributed to not only revenue growth, but operating leverage as well, with the latter metric rising 3.5% against the company’s target of 2%. Loan performance remains healthy and the company raised its dividend 7% while also repurchasing 5M shares of its own stock. Management’s commentary was upbeat for the rest of the year so BMO’s outlook certainly looks positive.

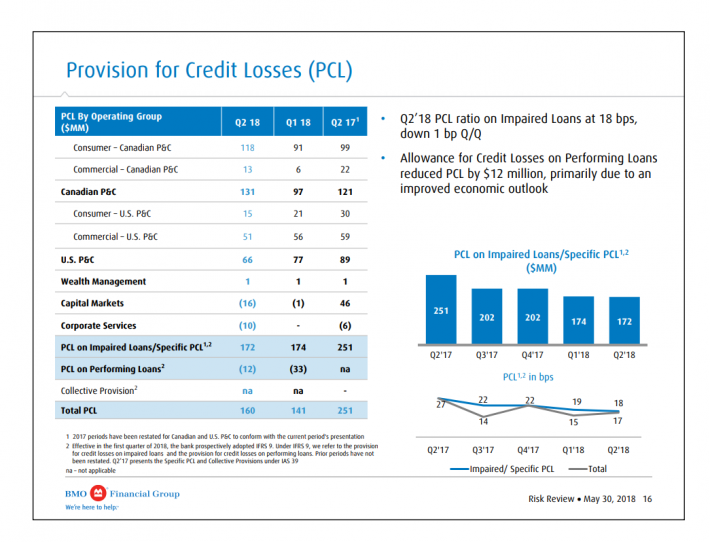

Source: Q2 Investor Presentation, page 16

This chart from the company’s Q2 investor presentation shows improvement in its provision for credit losses. This is a critical metric for banks that shows management’s expectations for how many of its loans will likely require impairment down the road. This positively impacts earnings as a lower PCL number means fewer loans will be impaired and thus, will not detract from future earnings. BMO’s PCL number was $251M in Q2 of last year but that number fell markedly to $160M in this year’s Q2.

BMO’s earnings performance was very stable in the past decade. BMO has produced higher earnings-per-share every year since 2009 and for this year, we are forecasting earnings-per-share of $8.15, and we expect 4% annual growth thereafter.

We see low single digit revenue growth as the primary driver of earnings-per-share growth moving forward, as well as a low-single-digit tailwind from share buybacks. Further margin expansion will be challenging to achieve, given they are already increased significantly. BMO will continue to perform well, but future growth from record highs will be difficult to achieve.

The dividend should grow at about the rate of earnings-per-share growth in the mid-single digits, implying a payout of $4.75 in 2023. That should keep the yield in the area of 4%, keeping BMO firmly in the category of income stocks.

BMO’s price-to-earnings ratio hasn’t moved around much in the past decade and its current multiple of 12.4 compares somewhat unfavorably to its longer term average of 11.7, which we see as fair value. Should BMO’s valuation revert back to historical norms, we see a 1.2% annual headwind from a lower valuation.

BMO looks like a decent choice for new investors, although it is trading slightly in excess of its fair value at present. We are forecasting 6.7% in total returns annually looking forward, consisting of the 3.9% dividend yield, 4% earnings-per-share growth, and a modest 1.2% headwind from a lower valuation. BMO is a strong choice for income investors today but for those seeking value, waiting for a lower entry price seems prudent.

Canadian Bank Stock #3: Toronto-Dominion Bank

Toronto-Dominion Bank traces its lineage back to 1855 when the Bank of Toronto was founded. The small institution – formed by millers and merchants – has since blossomed into a global organization with 85,000 employees and more than C$1.3T in assets.

Its recent Q2 earnings report showed 18% in earnings-per-share growth over last year’s Q2. Strength in the company’s flagship retail business helped push revenue up 12% as lending volumes and credit quality remain key drivers. Provisions for credit losses were much lower as well, as the U.S. card and auto portfolios remain robust. Operating expenses rose just 1%, leading to margin expansion as well.

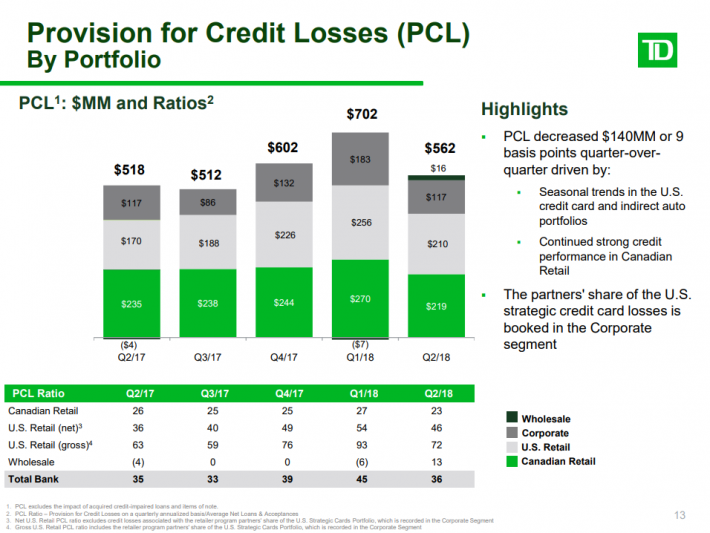

TD’s provision for credit losses were about flat with last year’s Q2 but off significantly from this year’s Q1. Seasonal trends are responsible for the Q/Q improvement but overall, TD’s portfolio looks stable at these very low levels.

Source: Q2 Investor Presentation, page 13

TD’s credit quality is certainly at strong levels, but if its credit metrics fail to improve further over time, earnings growth will be slower as a result.

The company’s earnings-per-share has been very strong in the past decade. TD has grown earnings-per-share at an average rate of 11% in the past ten years, including growth in every year since 2009. Looking ahead, we expect annual earnings growth of 7%.

Growth will come from revenue growth, as a result of loan portfolio expansion. Some margin expansion is also on the horizon from higher loan balances, but TD is already very profitable and its PCL ratio is stable, meaning that lower losses on loans is unlikely to be a source of margin growth in the near future. Still, given TD’s track record of growth, we believe 7% is a reasonable expectation.

TD’s dividend was recently raised almost 12% as the bank continues to prove that returning capital to shareholders is a priority. In terms of valuation, the stock has a price-to-earnings ratio of 12.6. This is near our fair value estimate of 12.5, meaning that TD is fairly valued today. A minor 0.2% headwind to total returns may result from the valuation coming down slightly over time, but TD looks fairly valued.

We expect 10.3% in annual returns over the next five years, consisting of the company’s 3.5% dividend yield, 7% earnings-per-share growth, and a modest 0.2% headwind from the price-to-earnings ratio. TD is therefore a strong choice for investors looking for a high current yield or earnings-per-share growth.

Canadian Bank Stock #2: The Royal Bank of Canada

The Royal Bank of Canada offers a wide variety of financial services to its customers, primarily in the U.S. and Canada. RY traces its history back to the 1860s when it was founded. Today, it is present in 50 countries around the world. It has a market cap of $111B.

The bank’s recent Q2 earnings showed diluted earnings-per-share growth of 11%. RY’s terrific credit quality continued with provisions for credit losses remaining very low. Return on equity was up to 18.1% and its capital levels expanded during Q2 as well. Overall, it was a very strong report.

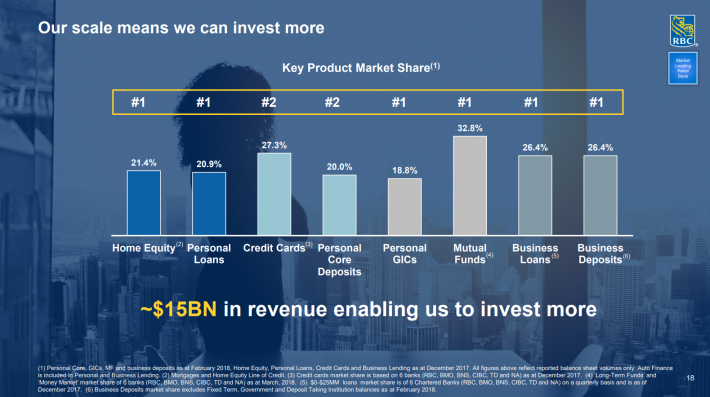

Source: Investor Day Presentation, page 18

This slide from a recent investor presentation shows RY’s dominant position in the markets it serves, which we see as a meaningful competitive advantage. RY’s market share in the eight products listed above is first or second for all of them, allowing the bank to continually strengthen its brand and improve margins over time.

RY has grown its earnings-per-share at a rate of 9% since 2008. We are forecasting growth a bit lower than that – 8% annually – moving forward. RY’s growth will continue to come from its expansion into the U.S., which it accelerated with the acquisition of City National Corporation in California in 2015. RY is still a small player in the U.S. market and as a result, we see this as its primary growth driver moving forward. RY will almost certainly continue to grow organically in its home market as well.

The current 3.9% dividend yield is on-par with the other large Canadian banks. We see the payout continuing to rise in the coming years, and dividend growth should roughly keep pace with earnings growth moving forward.

RY’s long term fair value estimate is a price-to-earnings ratio of 12.6, but today the stock has a price-to-earnings ratio of just 11.3. This implies a 2.2% boost to total returns over the next five years.

RY offers investors very strong prospective total returns looking ahead. We forecast 14.1% annual total returns, the product of the 3.9% yield, 8% earnings-per-share growth, and 2.2% returns from a rising valuation.

Canadian Bank Stock #1: The Bank of Nova Scotia

The Bank of Nova Scotia is Canada’s third-largest bank with a market capitalization of $70B. It traces its roots back to 1832 and since that time, has become a truly global bank.

The company’s recently reported Q2 earnings showed diluted earnings-per-share growth of 5% on revenue growth of 7%. Strength was seen in equity trading and investment income as well as loan volume growth, but margins suffered. Its tax rate was higher in Q2, which crimped net income growth, but provisions for credit losses fell markedly against the same quarter last year.

Source: Investor Day Presentation, page 12

As we can see from this slide, a key differentiator for BNS from some of the other large Canadian banks is its global presence. BNS gets only half of its revenue from Canada and according to guidance, that number should continue to shrink going forward. This reduces BNS’ reliance upon a strong Canadian economy, but does expose it to currency risk, as well as some geopolitical risk as well. However, on balance we see BNS’ diversification as a positive and a differentiator from the others in this group.

BNS has grown its earnings-per-share at 8.7% annually in the past decade. We think BNS can continue this robust growth, and are therefore forecasting 8% annual growth in earnings going forward. This is roughly in-line with the company’s long term guidance.

We see BNS producing growth through loan volume generation, both at home and outside of Canada, as well as expanding operating margins via lower expenses. In addition to that, BNS isn’t afraid to acquire growth and we see this as helping to fuel the next leg of earnings growth as well. BNS’ exposure to economies like Colombia, Chile and Mexico should provide both volume and margin growth in the coming years in excess of what BNS can produce from its more developed markets. Overall, BNS’ future looks very bright.

Recent weakness in the stock has the dividend yield up to a robust 4.5%, firmly planting BNS in the category of income stocks. We see the valuation rising over time, which should see the share price rise in excess of dividend growth. In the next five years, the yield should remain above 4%, providing investors with a strong source of income for the long term.

BNS’ long term average price-to-earnings ratio is near 12, which is what we see as fair value. The stock trades for just 10.2 times earnings today, implying there could be a meaningful 3.3% tailwind for annual total returns from the rising valuation. Indeed, we see BNS as undervalued today given its valuation and track record of growth.

Overall, BNS’ outlook for total returns is very strong. We see total returns of 15.8% annually for the next five years, consisting of the 4.5% yield, 8% earnings-per-share growth and a 3.3% tailwind from a rising price-to-earnings ratio. BNS provides investors with a unique blend of a high current yield, strong growth and a favorable valuation, meaning it has something for just about any type of investor.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more

Thanks for your insight on Canadian banks. I personally like TD and its exposure to the US economy which has been performing better than Canada.