The Bank Of Canada’s "Unsurprising" July Interest Rate Hike

“The Bank of Canada is raising its target for the overnight rate to 3/4 per cent. The Bank Rate is correspondingly 1 per cent and the deposit rate is 1/2 per cent. Recent data have bolstered the Bank’s confidence in its outlook for above-potential growth and the absorption of excess capacity in the economy. The Bank acknowledges recent softness in inflation but judges this to be temporary.” (Bank of Canada Press Release, July 12,2017)

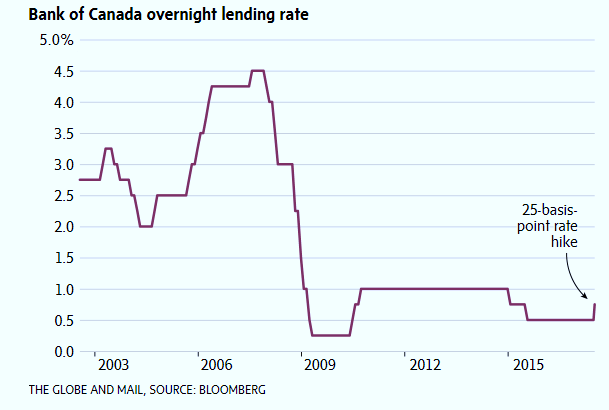

The Bank of Canada has not been hawkish on interest rates. Indeed, as the following chart indicates, the Bank had held its policy rate at 0.5% over the past two years. But as of late, with the Canadian economic recovery much more firmly rooted, the Bank realized that it was time to start raising rates. Thus, the Bank’s overnight policy lending rate was raised to 0.75% from 0.5% on July 12th. The financial markets were not at all surprised by the July rate hike.

The Bank had been hinting for some time that because of the strengthening economy that it would soon start normalizing interest rates in Canada. Much like the Fed in the U.S., the Bank sketched out a rationale for interest rate normalizing, based on the conclusion that the economy was more firmly anchored in a growth direction than several years ago.

Back in 2015 conditions were very different and the Bank felt an urgency to cut interest rates 50 bps to cushion the economy against the negative effects of the huge drop in world oil prices.

While the positive effects of these extra low interest rates cuts may have been slow in coming, Canadian production and employment in manufacturing ultimately increased, and there have also been some positive signs of increased activity in the oil producing regions of Western Canada. In other words, starting to remove some of the extra monetary stimulus seems quite sensible.

In addition, the Bank also stressed in its July statement that Canada’s output gap was shrinking faster than originally expected. On an output gap basis, the Bank concluded that Canada’s economy would be virtually at full capacity by the end of this year. Of course, despite warnings of a rapidly shrinking output gap, price inflation in Canada is no where in sight.

In May, the Canadian CPI increased only 1.3% relative to a year earlier, easing somewhat from a 1.6% rise in each of the previous two months. While the CPI is very sensitive to volatile gasoline price changes, nonetheless as in the U.S., Canada’s inflation concerns are also exaggerated.

Disclosure: None.