The Bank Of Canada’s Elusive Goal: Closing The Output Gap

In his recent testimony to the House of Commons in Ottawa, Governor Stephen Poloz stated that “ our best plan right now, we think, is to wait for the next 18 months or so”. Immediately, investors interpreted this to mean that the Bank of Canada (BoC) would not make any decision to cut the bank rate prior to 2018. Upon clarification, the Governor said this waiting period was in reference to the time frame needed to close the output gap, not in reference to monetary policy changes. The confusion stems from a recent statement by the Governor that the BoC “actively” considered a rate cut in its October meeting , but decided to hold the key interest rate unchanged at 0.5 per cent.

However, the output gap and monetary policy are inextricably connected, even though the Governor did not mean to connect the two in his statements.

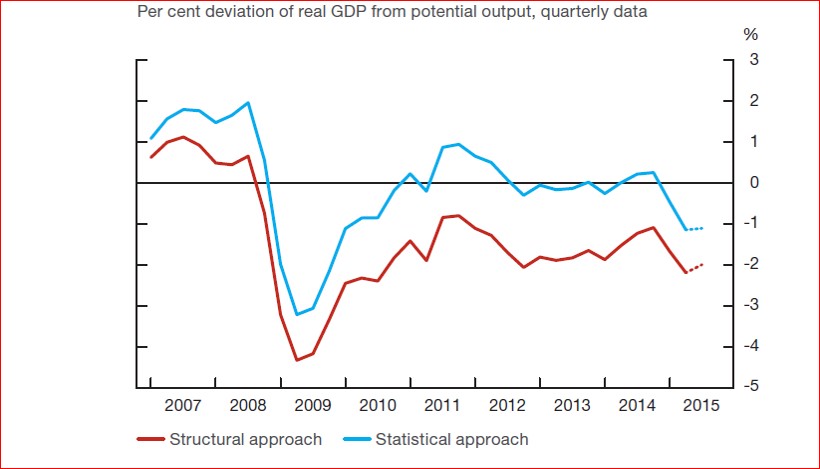

The output gap is a measure of excess productive capacity, a measure the BoC watches very closely to guide its policy deliberations. As Chart 1 demonstrates, the BoC uses two measures to calibrate capacity utilization. Although the measures are technically different, they tend to move in tandem and in the same direction .Canada ‘s output gap is in the range of 1.5-2.0 percent .

Chart 1 Estimates of Capacity Utilization

Source: Bank of Canada, October 2016 MPR

This gap is sizable, especially in view of recent history. The Canadian economy has been operating at much less than full capacity--- in terms of labour and capital utilization --- for all the period since the 2008 financial crash. Moreover, successive years of underperformance results in a weaker economy as all resources continue to be underutilized.This has actually reduced the nation’s potential for growth. Each year that we underperform results in lower investment and employment growth in future years which, in turn, lowers potential growth.

As the BoC put it in its recent Monthly Policy Report (MPR) “declines in investment ....imply that, in the near term, potential output growth is more likely to be in the lower range of estimates” compared to prior years’ calculations. The decline in the growth rates can be traced to the decline in investment , principally, in the natural resource sector .However, the non-energy sector has failed to pick up that slack and, as a result, export growth has been missing in action.

Closing the output gap seems to be an elusive goal. In its October 2015 MPR the BoC anticipated that the output gap would be closed by 2017. Its October, 2016 MPR the target date has been moved out further to 2018, hence the Governor’s statement that we need to “ wait for next 18 months or so”. This re-assessment begs the question : should the BoC provide more monetary stimulus now? We seem to be waiting for growth without any change in policy, as if everything is in place and ,in good time, we will be on track again.

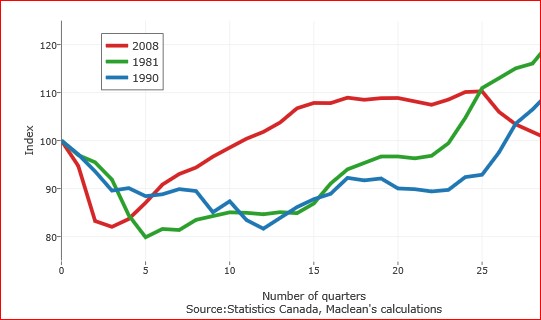

Growth is best achieved through an expansion of business investment. However, since 2008 the recovery in investment has been one of the weakest on record ( Chart 2).This late in the recovery period we would expect that business investment would growing at a robust rate, as in the past. The post- 2008 recovery , initially, was quite strong, in large measure due to the run up in oil price encouraging expansion in the energy sector. But, business investment just lost all its steam since the slump in oil prices and now investment has reverted to its level prior to the recession.

Chart 2 Growth in Business Investment Post Recession

Many factors go into decisions affecting business capital expansion. Above all, a lower cost of capital would contribute to a more positive attitude towards expansion. The BoC has indicated in the past that the effective lower bound[1] for the bank rate is a negative 0.5 per cent. That is, if the bank rate were to be at that level, the economy would grow without overheating and creating unwanted inflation ( not dissimilar to the situation in the EU). Thus, the BoC admits that there is still room to lower interest rates without adverse consequences. The question is when to cut the bank rate .In its latest policy meetings the BoC did come close to cutting . Should business investment continue to be weak and the output gap become even more elusive, the BoC may have no choice but to act.