The Bank Of Canada Raises Its Rate But Continues To Offer Lots Of Accommodation

When the Bank of Canada announced a 1/4pt increase in its policy rate today, few were caught by surprise. Yet the Bank did so with some reservations about the future as highlighted in the last line of its press release:

Governing Council will remain cautious in considering future policy adjustments, guided by incoming data in assessing the economy’s sensitivity to interest rates, the evolution of economic capacity, and the dynamics of both wage growth and inflation, Bank of Canada, January 18, 2017.

The BoC measures actual output against an estimation of potential output. That is, just how close is the economy operating to full capacity. More importantly, it continues to evaluate whether employers are undertaking new investment and new hires in response to tightening capacity. This is a key component influencing interest rate decisions. Although the BoC publishes an estimate of potential growth--- currently set at 1.8-2.0 %, it is, nevertheless, a moving target and one that is inferred rather than measured with a good degree of accuracy.

Canadian potential output has slipped considerably since the 2008 crisis and further weakened with the collapse of oil prices in 2014-15. Recent expansion in business investment and some recovery in oil prices have given an uptick to potential, so the BoC sees that as giving the economy more room in which to expand without creating inflation.

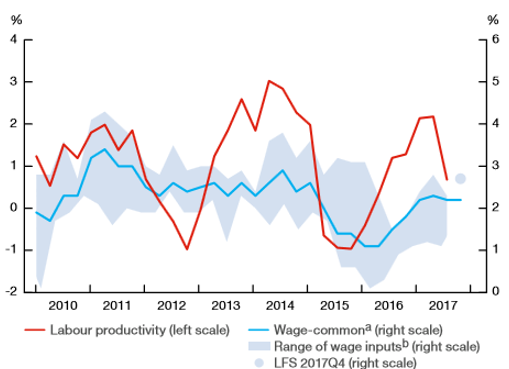

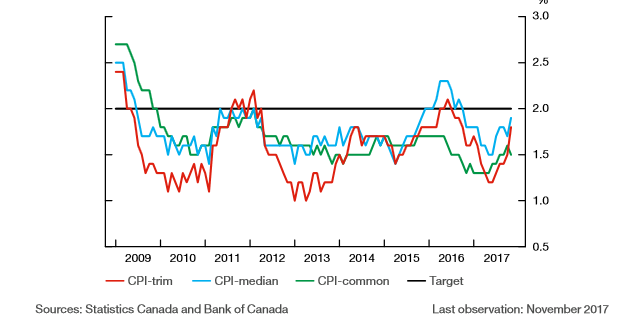

Wage growth continues to hold inflation in check. While the national unemployment rate has fallen to historic low levels, the underlying wage pressures remain subdued (Figure 1). Workers lack any real bargaining power, despite some selected shortages in specific industries. Recent hikes in the minimum wage will result in a one-time spike in the wage bill in many low-skilled industries, but it remains to be seen if there is any follow through in future wage gains. On this point, the BoC estimates that some 60,000 jobs will be lost due to the increase in the minimum wage, further clouding the outlook for employment growth. Wages are not a source of inflationary pressure to date. All measures used to track consumer prices have remained below the 2% target. (Figure 2).

Canada has one of the highest ratio of debt -to- household income in the advanced economies. The BoC is very weary of how sensitive households are to increases in borrowing costs, especially as it affects housing demand. Tougher guidelines affecting mortgage underwriting are an additional factor that will also affect house prices, especially in the Toronto and Vancouver markets. Now, that there have been three policy rate increases since mid-2017, we can expect further strain on household borrowing.

Figure 1 Wage Growth Remains Contained

Figure 2 Various Measures of Inflation

In the press conference, the elephant in the room was NAFTA negotiations. Governor Poloz made it clear that this a huge unknown factor in terms of both the outcome and how business will react to a new agreement. It is impossible for bank officials to know how to fashion a policy position under such ambiguous conditions. In the same vein, the Governor was quick to point out that Canada has lost some of its international competitiveness.

In sum, monetary policy continues to be very accommodative, according to the Governor. He pointed out that the real rate of interest remains negative. In his view, the neutral rate of interest is in the 2.5-3.5% range, so monetary policy is still very stimulative. He did not seem in any hurry to get to the neutral rate. The BoC remains very data dependent.