The Bank Of Canada Abruptly Changes Direction

Early this year the Bank of Canada was unsure about the future path of Canadian economy; accordingly, it announced no change in its rate policy all winter and spring. Suddenly, in August the Bank announced a rate hike of ¼% and followed up with a similar hike in September. This abrupt shift in outlook and policy caught many market participants off guard. Did the Bank see something that most observers missed? Why the sudden shift in gears?

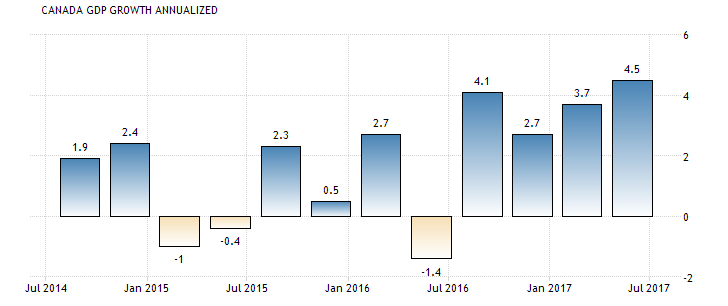

What the Bank saw was evident to everyone; it was just how the Bank interpreted the economic data that is open to question. The first half of 2017 the economy grew at annualized rate of 4% (Figure 1). But this growth spurt came after some very weak results in 2016, a year that recorded one negative quarter and three-quarters that were under 2%. In other words, 2017 looks better only in comparison to the dismal performance in 2016.

Figure 1

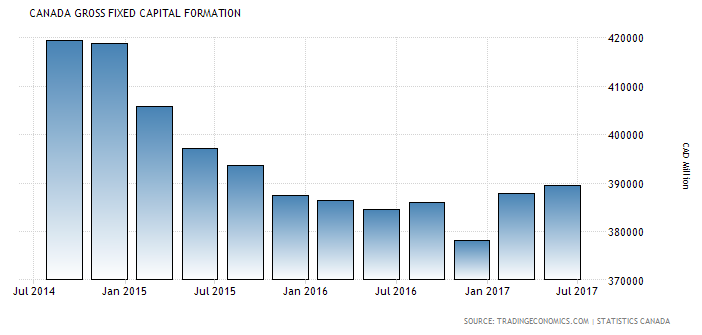

The Bank also took heart from the improved performance in business investment (Figure 2). Here again, the data show a nice bounce in gross fixed investment, compared with nearly three straight years of declining investment. While the uptick in business spending is very welcome, it continues to remain relatively weak compared to prior years. It is much too early to declare that business investment is on a sustained upward path.

Figure 2

In addition, the Bank noted that the export sector picked up momentum early in the year. Canada earns nearly 25% of its income from exports, so a steady rise in exports is welcome indeed. However, the latest figures on exports show some slowing ---- June exports were actually down by 4%--- as the high flying Canadian dollar starts to take its toll. Today the currency is trading at 1.21 (USD/CDN) compared to 1.33 in April. Exporters now face a considerable headwind and are concerned that any further currency appreciation will hurt business.

Oddly enough, the Bank’s own economic forecasts call for a considerable slowdown. GDP for 2018 -2019 will level off to just under 2%, according to Bank officials and private forecasters. Finally, the inflation rate and average wage gains continue to be very muted and the Bank does not anticipate any significant upturn in either data series.

In the Bank’s defense, it maintains that it was necessary to remove the “insurance” created by the two rate cuts in 2015 in response to the collapse of oil prices. It is one thing to restore rates to a prior level, but quite another thing to accept the view that these two hikes are just start of a continual path to higher short-term rates.

Benjamin Tal of the CIBC rightly argues that, “the Bank of Canada is facing a softening trajectory of economic growth, no real inflation fears, a US Fed that is unlikely to move and a currency that has appreciated dramatically. If the Bank chooses to divorce itself from the Fed, the currency will go even higher. We doubt that the Bank will welcome such a development”.[1]

According to Tal, the market may have mispriced the 2-yr bond whose yield has shot up 75 bps since June. As the same time, the loonie has powered ahead gaining 8 %. Both developments have introduced a considerable amount of monetary tightening that will likely slow future growth.

Did the Bank of Canada get too far ahead of the curve?

[1] Economic Update, September 11,2017

Disclosure: None.