Tech Talk: Giant

(Click on image to enlarge)

In a recent post, I illustrated that natural gas was showing signs of life, and referenced concern that this is particularly the case in the United States. Canada is of the world’s 39 natural gas exporting countries, Canada is number three – after Russia and the Arab League. All the gas we export goes to America.

The chart above illustrates my latest acquisition, AltaGas, which I bought yesterday when the price was low. As a piece in the Globe and Mail explains, yesterday the TSE-based company made a big move into the American market by acquiring WGL Holdings Inc. for about $4.5-billion, and assumed about C$2.4 billion in debt.

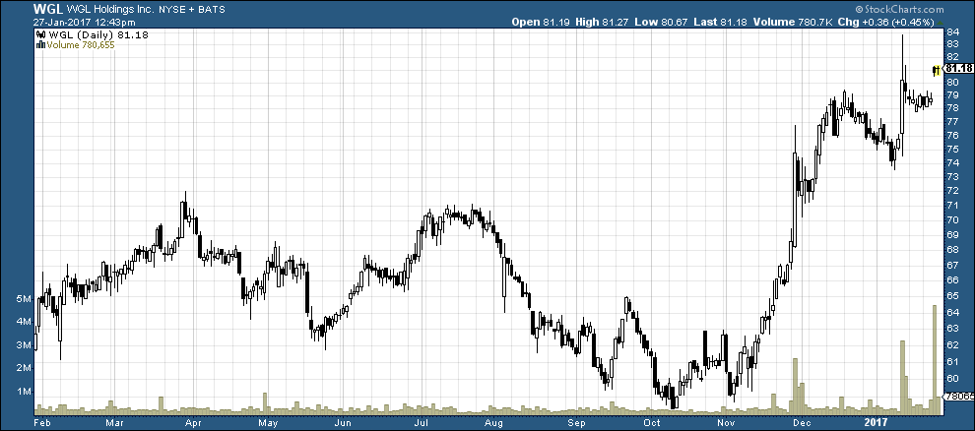

As the chart below shows, WGL shareholders did well on the deal, which has been some time in the making.

(Click on image to enlarge)

At least short-term, AltaGas shareholders took it on the chin. The sharp drop in prices reflected the vast number of shares in trade. On the chart, I use arrows to illustrate the correspondence between the two.

I saw that as an opportunity to move in. I picked up some shares, and had made a few bucks before the market closed. Today, the rally continues. As a major acquisition of an energy infrastructure company by a Canadian rival, this deal will put AltaGas in the big leagues. My speculation is that share prices will rise to the red-green auto resistance line on the ALA.To chart.

Disclaimer: The analysis and ideas presented here should never be seen as a buy or sell recommendation. I am an active trader, but I discuss stocks for informational purposes only. By reading my ...

more