Slower Growth Is Coming. Will There Be A Soft Landing In 2019 Or 2020?

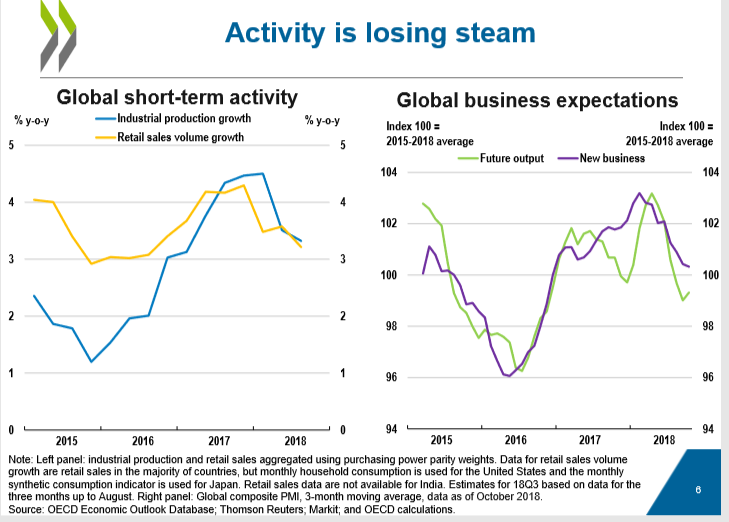

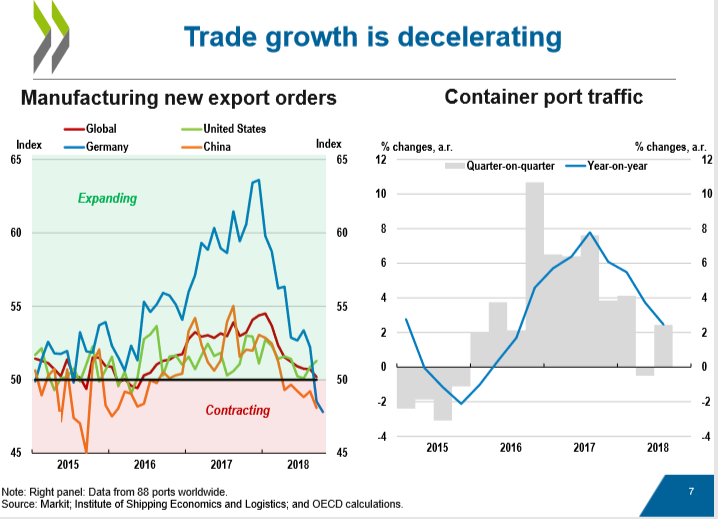

The global economy is slowing. There is strong evidence to support this assertion. Moreover, the synchronization of growth, which was so evident between 2014 and 2017, is also fading.

The emerging market economies are having serious problems, while the advanced economies continue to grow, boosted by unusually robust US economy, which is still benefiting from the outrageously expensive fiscal boost less than a year ago. In many of the advanced economies, unemployment is low and businesses complain of labor shortages.

It is hard to argue with the conclusion that global growth has peaked and that risks have increased. Consequently, engineering a soft landing from the recent peak phase of growth will be challenging.

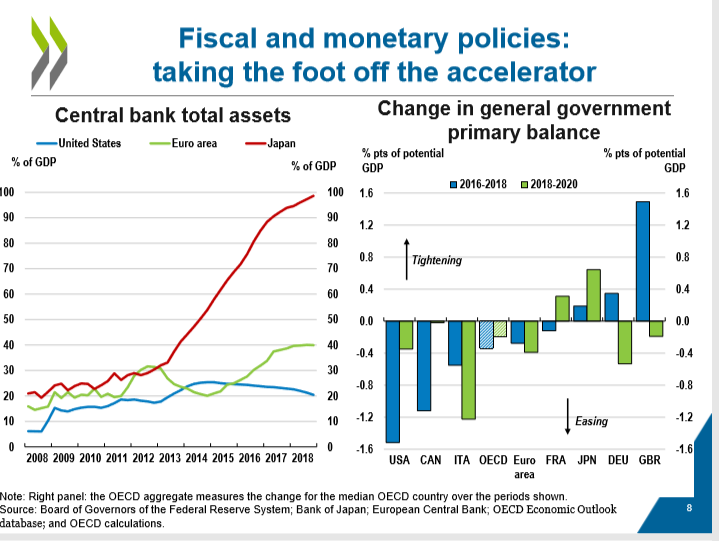

The range of economic risks in the current environment is well known. At a global level, trade and capital investment are slackening, partly in response to the tariff hikes. Some large emerging market economies (Turkey, Argentina and Brazil) are experiencing capital outflows and a weakening of their currencies because of the higher interest rates and the appreciation of the US dollar. The three largest central banks, the Federal Reserve, the European Central Bank and the Bank of Japan, have all been withdrawing monetary stimulus. Moreover, fiscal stimulus is also progressively being removed in many of the larger economies.

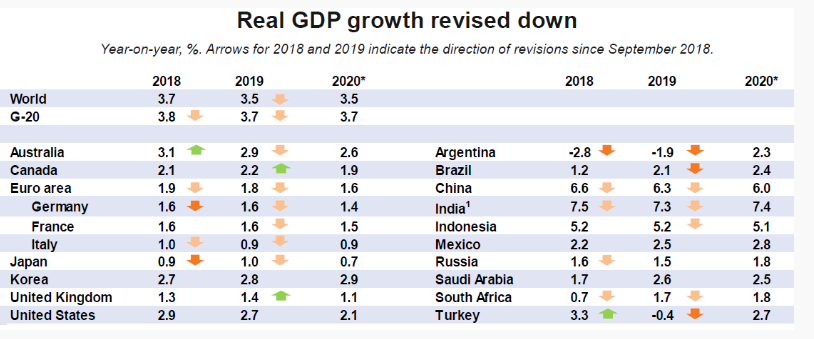

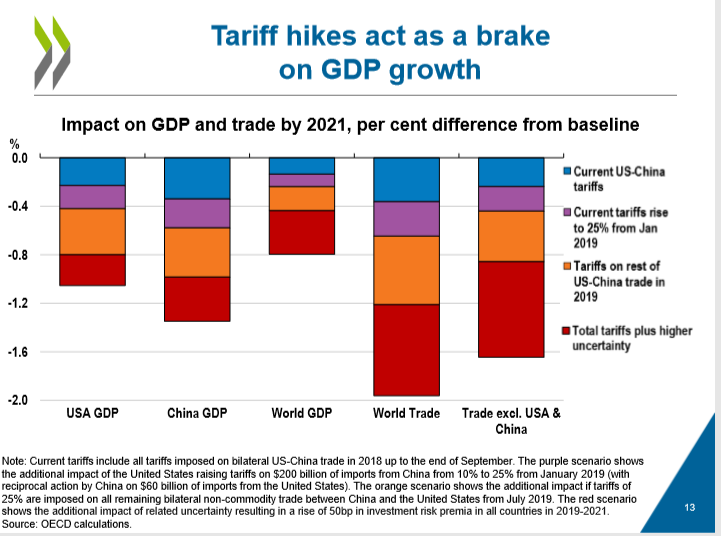

The OECD’s latest forecast is that global growth will slow from 3.7% this year to 3.5% in 2019 and 2020. However, a full-blown trade war could worsen this picture and would reduce global GDP by 2021 by 0.5%. For example, an escalation in the US-China tariff war could trim about 1% of China’s GDP and 0.8% off US GDP.

Nonetheless, the US economy is well situated to ride out this period of uncertainty. US growth is projected to be 2.9% this year and 2.7% in 2019, and then to sharply slow to 2% in 2020.

(Click on image to enlarge)

Source: OECD, November 2018

Growth in the Euro Area economies is projected to moderate only slightly in this environment, from 1.9% in 2018 to 1.8% and 1.7% growth in the following two years.

Japan’s economy is also projected to remain in a relatively low and stable growth range over the next couple of year, recording 1% growth in 2019 and 0.7% growth in 2020.

Because of Brexit uncertainties, the British economy is projected to remain in a slow growth trap (much lower than the Euro block) of 1.4% in 2019 and 1.1% in 2020.

Canada’s economy, though reasonably tight in terms of its job market, is expected to significantly underperform US growth. Canada’s real GDP is projected to expand 2.2% in 2019 and 1.9% in 2020.

The two largest emerging market economies, India and China, are expected to continue to grow faster than the G7 countries.

India is projected to expand by 7.3% in 2019 and 7.4% in 2020, while China’s growth is projected to gradually slow from 6.65 this year to 6% by 2020.

Economic Policies Have Been Gradually Removing Stimulus

Disclosure: None.