Short Best Inc. Before Lockup Expires

March 19, 2018, concludes the 180-day lockup period on Best Incorporated (NYSE: BSTI).

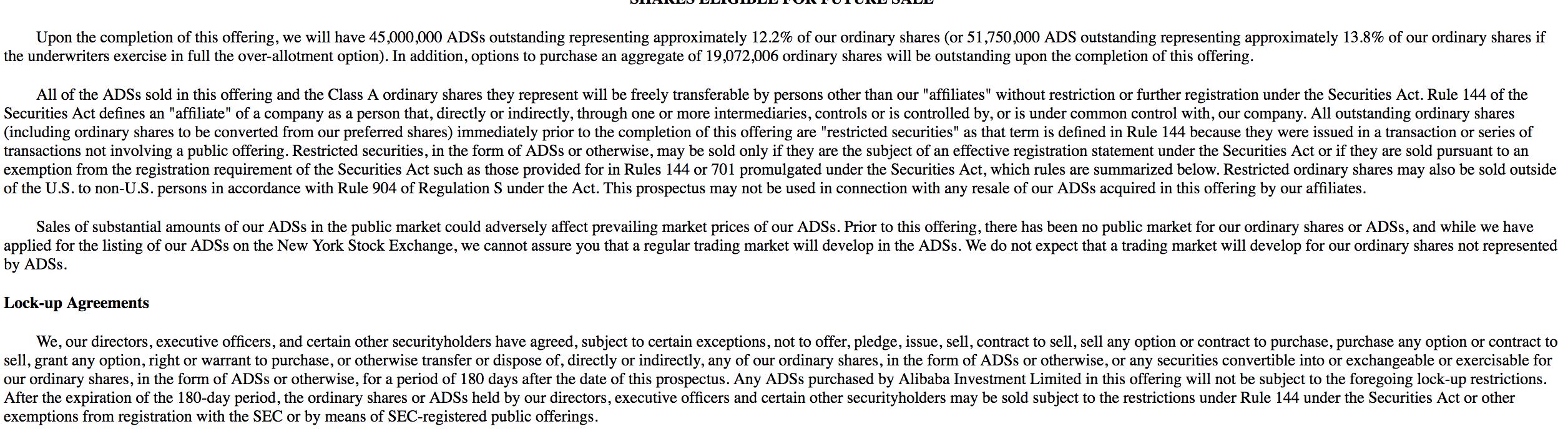

When the lockup period ends for Best Inc., its pre-IPO shareholders and insiders will finally have the chance to sell large blocks of previously-restricted stock. Just 12.2 of shares outstanding are currently freely transferable.

(Click on image to enlarge)

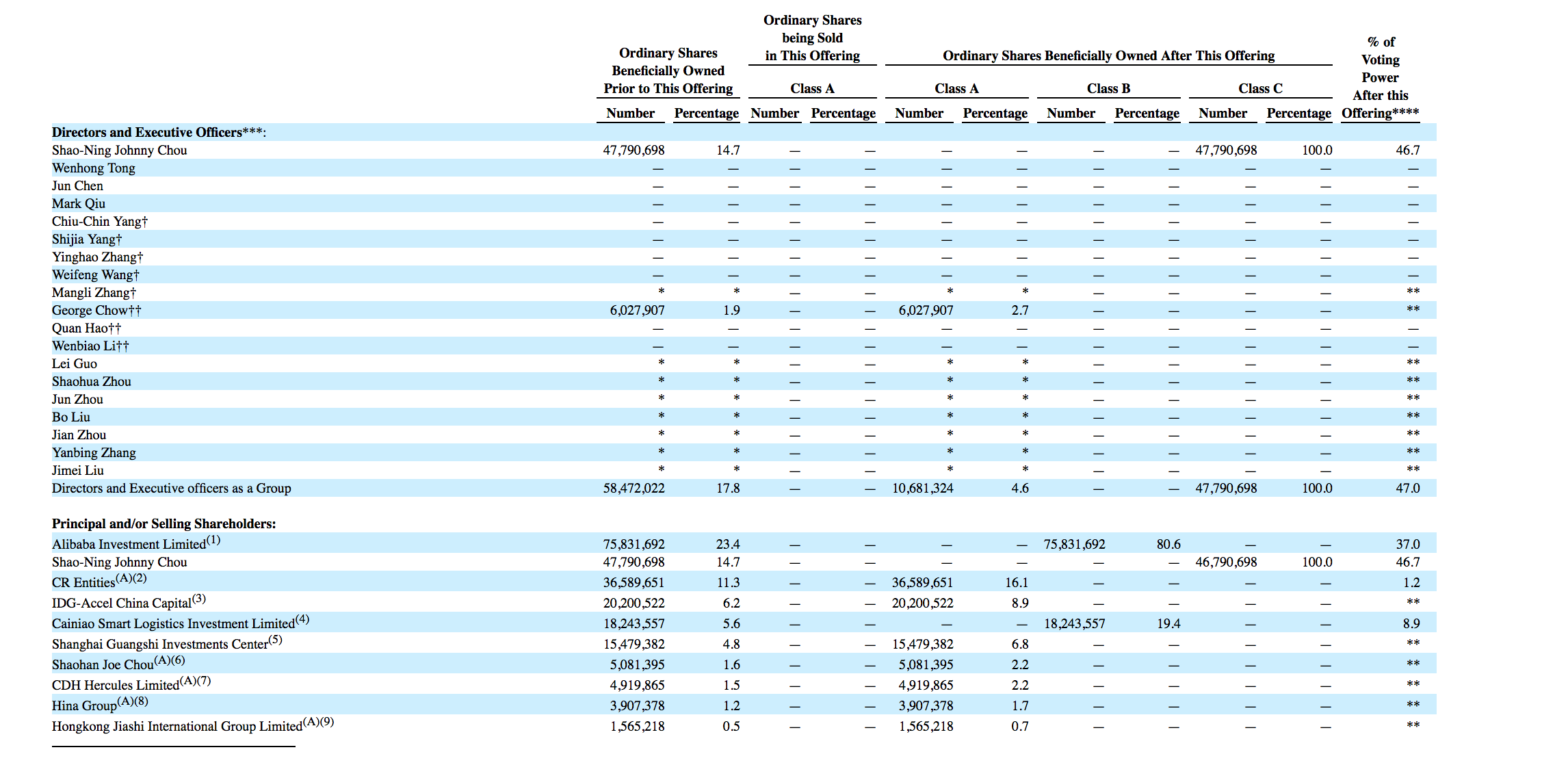

A sudden increase in shares traded on the secondary market will likely negatively impact the stock price of Best Inc. in the short term. This group of pre-IPO shareholders and insiders is comprised of numerous individuals and 10 corporate entities.

(Click on image to enlarge)

Currently BSTI trades in the $10.50 to $11 range, slightly higher than its IPO price of $10. However, this price is down significantly from its high of $12.05 on September 25, just five days after the release of the IPO.

Business Overview: Smart Supply Chain Service Provider in China

Best Inc. operates as a smart supply chain service provider in the People’s Republic of China. The company’s proprietary technology platform gives its ecosystem users the ability to operate their business with a variety of SaaS-based applications. Its applications include store management, smart warehouses, sorting line automation, swap bodies, and network and route optimization. The company also offers door-to-door integrated cross-border supply chain services such as international express, less-than-truckload, reverse logistics, fulfillment, and freight forwarding via its network, and warehouse and transportation partners. Best Inc. also operates a real-time bidding platform for sourcing truckload capacity from independent transportation providers and agents, and it offers store management services for convenience stores and last-mile B2C services like bill payment, laundry services, and parcel delivery and pick-up. Another business area includes a variety of value-added services, including customized financial services, such as equipment and fleet finance leases.

Best Inc. defines its ecosystem to include merchants, franchisee partners, consumers, and transportation service providers

The company was founded in 2007 and is headquartered in Hangzhou, the People’s Republic of China.

Financial Highlights

Best Inc. reported the following financial highlights for the third quarter ended September 30, 2017:

- Total revenue was RMB5,354.4 million (US$804.8 million), an increase of 133.9% year-over-year.

- Supply Chain Management Service revenue increased by 28.3% for the same period to RMB386.2 million (US$58.1 million).

- Express Service revenue increased by 147.6% to RMB3,265.7 million (US$490.8 million).

- Freight Service revenue increased by 100.0% to RMB874.4 million (US$131.4 million).

- Gross profit was RMB201.7 million (US$30.3 million.

- Net loss was RMB466.6 million (US$70.1 million), compared to RMB321.3 million in the same period of 2016.

Management Team

Founder Mr. Shao-Ning Johnny Chou has served as chairman and CEO since 2007. His previous experience includes senior positions in Greater China for Google, UTStarcom China, and AT&T Bell Labs. Mr. Chou studied computer science at Fudan University. He earned a bachelor’s degree in science with a specialty in electrical engineering from City College of New York, a master’s degree in engineering science from Princeton and an MBA from Rutgers University.

Ms. Wenhong Tong has served as a director at Best Inc. since 2014. Ms. Tong also has been chief people officer at Alibaba (NYSE:BABA) since January 2017. She previously served as COO, President and CEO of Cainiao Network. She earned her bachelor’s degree from Zhejiang University.

Competition:

In its SEC filing, Best Inc. notes that it faces competition from other supply chain solution providers including JD Logistics (JD) and SF Holdings. Its other business lines face competition from P.G. Logistics, Annto Logistics, Zhongshang Huimin, ANE Logistics, DEPPON Logistics, YUNDA, STO Express, YTO Express, and ZTO Express (ZTO).

Early Market Performance:

Best Inc.’s IPO priced at $10 per share, significantly lower than its original expected price range of $13 to $15. The expected price range was subsequently lowered to $10 to $11. The stock closed its first day at $10.52 for an increase of 5%. The stock quickly reached a high of $12.05 on September 25, but then began a steady decline to a low of $8.24 on February 9, 2018. Currently, the stock trades around $9 to $10.

Conclusion:

When the BSTI IPO lockup expires on March 19th, the company's large group of pre-IPO shareholders and insiders will be allowed to sell their previously restricted shares for the first time. Just 12.2% of shares outstanding currently trading.

We believe that it's likely that these numerous individuals and 10 corporate entities will want to take at least some of their capital off the table. Any significant sales will likely result in a flood of shares into the marketplace and a sharp, short-term downturn in BSTI's stock price.

To take advantage of the likely short-term downturn, risk-tolerant investors should short shares of BSTI ahead of the company's March 19th lockup expiration. We suggest that interested investors cover their short positions during the March 20th and March 21st trading sessions.

Disclosure: I am/we are short BSTI.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more