Sensex Stays Flat; Capital Goods Stocks Witness Selling Pressure

After opening the day on a flat note, the Indian share markets have continued to remain flat and are and are trading just above the dotted line. All the sectoral indices with the exception of Healthcare sector and Capital Goods sector are trading in the green, with stocks in the Consumer durables Sector leading the gains.

The BSE Sensex is trading up 30 points (up 0.1%) and the NSE Nifty is trading up 13 points (up 0.2%). Meanwhile, the BSE Mid Cap index is trading up by 0.6%, while the BSE Small Cap index is trading up by 0.7%. The rupee is trading at 68.12 to the US$.

India's largest bourse, National Stock Exchange (NSE) has filed draft papers with the market regulator Securities Exchange Board of India (SEBI) for its much awaited initial public offering (IPO).

The IPO will be an offer for sale (OFS) of 111.4 million equity shares, that is 22.5% of the exchange's post offer paid-up equity capital amounting to Rs 100 billion. This would put the NSE's expected valuation at Rs 400-450 billion, the issue size would the highest since the Coal India IPO of Rs 150 billion in 2010.

The exchange, which had been lobbying the regulator to self-list, will list on rival BSE. NSE had decided to go public at a board meeting on 23 June, after continued pressure by its shareholders, some of whom have been invested for more than a decade. NSE shareholders are hopeful of a listing by March next year.

The OFS will give existing shareholders a chance to exit. Major shareholders are Life Insurance Corporation (LIC) with a 12.5% stake, and Gagil FDI, Aranda Investments and SAIF II SE Investments each holding 5%. Most shareholders have opted for a partial exit. Major domestic shareholders doing so are SBI, SBI Capital, IFCI, Bajaj Holdings and Bank of Baroda. Tiger Global Five Holdings, which has 3% stake, is offering all its shares, opting for a complete exit. While, LIC is not parting with any.

NSE has appointed Citigroup Global Markets, JM Financial Institutional Securities, Kotak Mahindra Capital and Morgan Stanley India as joint global coordinators to manage its IPO. Cyril Amarchand Mangaldas will be legal advisor. HDFC Bank, ICICI Securities, IDFC Bank and IIFL Holdings are the lead managers.

NSE becomes the third financial market infrastructure entity to announce an IPO. Securities depository firm Central Depository Services Ltd (CDSL) on Tuesday filed its draft prospectus for an estimated Rs 4.5 billion IPO. BSE, Asia's oldest stock exchange, filed its proposal for an IPO worth Rs 1.5 billion in September.

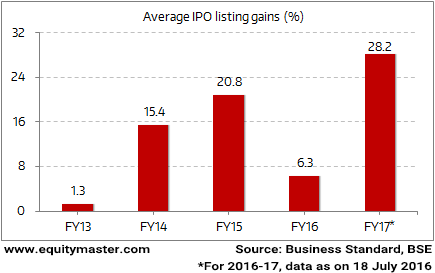

NSE's listing is expected to be one of the most high profile in 2017. Indian companies raised more than Rs 250 billion from IPOs this year. Many investors have been able to reap handsome returns from investing in IPO's

Time to Get Rich Investing in IPOs?

IPOs are often tricky to understand, but there is no denying the fact that they are exciting. It is possible to make big money from IPOs. But only with the right company. At the right price. To help you approach them as an enterprising investor would, we have prepared a special handbook for IPO investing.

Moving on to news from stocks in the auto sector. According to a leading financial daily, India's domestic two-wheeler sales are set to crash to their lowest in six years in December, with industry executives citing demonetisation and the resultant cash shortage as the major reason for the decline.

Sales in December are estimated to drop more than 35% to below 1 million units, compared with the average monthly sales of 1.57 million registered in the domestic market during April-November.

Local sales have never missed the 1 million mark since November 2010, when they totalled 9,28,660. Two-wheeler sales in the domestic market grew 16% to 11.34 million units during April-October, before falling 6% to 1.24 million in November.

Demonetisation has had a telling effect on India's prolific two-wheeler industry, with new dispatches from factories to dealers and sub-dealers reducing drastically in December. A big chunk of two-wheeler sales happen in rural India, with a large number of the transactions in cash. With demonetisation causing a cash crunch, potential buyers either scrapped or postponed their decision, hurting demand.

Demand remains subdued in the current term, however in our view, the effects of demonetisation would only be prominent in the short term. Demand is expected to pick up in the next two quarters as in the long run individuals will buy two wheelers regardless of demonetisation.

If anything, the current slump in auto stocks have brought their valuations to reasonable levels. Capitalizing on the correction in auto stocks, our Hidden Treasure team has recommended a stock from the auto ancillary sector.