Sensex Opens Marginally Higher; FMCG & Automobile Stocks Lead

Majority of Asian stock indices are higher today as Japanese and Hong Kong shares show gains. The Nikkei 225 is up 0.02%, while the Hang Seng is up 0.44%. While, the Shanghai Composite is trading down by 0.37%. US stocks displayed muted performance on Tuesday; the Dow logged gains for the third day in a row, while the Nasdaq and S&P 500 ending flat with negative bias.

Back home, share markets in India have opened the day on a positive note. The BSE Sensex is trading higher by 67 points while the NSE Nifty is trading higher by 25 points. The BSE Mid Cap and BSE Small Cap index both opened the day up by 0.8% & 0.7% respectively.

Barring capital goods stocks and bank stocks, all sectoral indices have opened the day in the green with FMCG stocksand automobile stocks leading the pack of gainers. The rupee is trading at 64.03 to the US$.

Mining stocks opened the day on a mixed note with Gujarat NRE Coke and MMTC Ltd witnessing maximum buying interest. Coal India share price opened the day on a negative note after it posted a 23% decline in its net profit at Rs 23.5 billion for the quarter ended 30 June 2017.

The net profit of the company in the corresponding quarter of the last financial year stood at Rs 30.7 billion.

However, CIL's consolidated income during April-June quarter was at Rs 217.7 billion, registering an increase of 4.5%. The firm's consolidated expenses increased to Rs 178.4 billion in April-June this year, over Rs 162 billion in the year-ago period.

The production of the country's largest coal miner was at 118.8 million tonnes (MT) in the first quarter of FY2017-18 against 125.6 MT in the same quarter of previous fiscal.

Further, the company's off take for the April-June quarter was at 137.4 MT, over 133.2MT in the same quarter of previous fiscal.

Moving on to the news from pharma sector. As per an article in Livemint, Aurobindo Pharma and Intas Pharmaceuticals are in a race to acquire part of the European assets of Teva Pharma.

The assets include the oncology, pain management and women's health divisions of the company.

One must note that, this will be the second time in less than a year that Aurobindo and Intas are vying for Teva's assets. Last year, Aurobindo unsuccessfully bid for Teva's Actavis UK Ltd and Actavis Ireland Ltd units and was pipped at the post by Intas.

The transaction was part of the European Commission's antitrust divestiture requirement arising from Teva's acquisition of Actavis. In July last year, Cipla Ltd acquired a portfolio of three products from Teva in the US. While in November, Aurobindo Pharma acquired a few products from Teva in France.

Interestingly, if either Aurobindo or Intas acquire the assets, it will be the largest outbound pharma deal by an Indian company. The largest so far is Lupin Ltd's acquisition of Gavis Pharmaceuticals Llc. and Novel Laboratories Inc. for US$880 million in 2015.

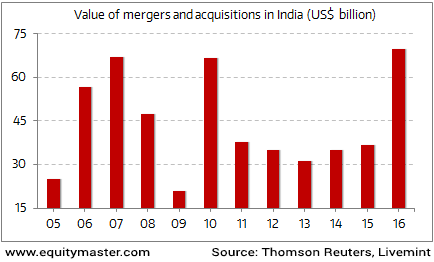

The Indian pharma majors have been on an acquisition spree over the past few years. The value of M&As that took place in 2016 was at US$ 69.75 billion. This even beats the previous record of US$ 66.96 billion set in 2007.

Indian M&A activity in the Past Few Years

Especially, the M&A activity in the Indian pharma space has been on the rise in recent times. At the end of the day, whether the company is able to derive value from the acquisitions and augment the overall performance will be the key thing to watch out for.

Aurobindo Pharma share price opened the day down by 0.7%.

Disclaimer: Equitymaster Agora Research Private Limited (hereinafter referred as 'Equitymaster') is an independent equity research Company. Equitymaster is not an Investment Adviser. ...

more