Sensex Opens Firm Tracking Positive Asian Stock Markets

Asian stock indices are higher today as Japanese and Hong Kong shares show gains. The Nikkei 225 is up 1.38%, while the Hang Seng is up 0.92%. The Shanghai Composite is trading up by 0.23%. The US equity benchmarks ended the last trading session of the week lower amid concerns about the economic impact of Hurricane Irma.

Back home, share markets in India have opened the day on a positive note tracking positive signals from Asian markets. The BSE Sensex is trading higher by 172 points while the NSE Nifty is trading higher by 47 points. The BSE Mid Cap and BSE Small Cap index opened the day up by 0.5% & 0.4% respectively.

All sectoral indices have opened the day in the green with stocks from capital goods sector and energy sector leading the pack of gainers. The rupee is trading at 64.87 to the US$.

Tata stocks opened the day on a mixed note with Tata Coffee & Tata Global Beverages witnessing maximum buying interest. As per an article in Business Standard, Tata Sons will pare the stakes that group companies have in Tata Chemicals and Tata Power, and the holding firm will buy shares in each case and consolidate its ownership.

Besides the unlisted Tata Teleservices, the equity value of the two companies' listed investments is around Rs 55 billion. This sale of investments to parent Tata Sons will help both companies raise funds to repay their debt and finance capital expenditure.

Tata Sons had raised Rs 33 billion by private placement of debentures, which closed on 21 August.

Further, the market value of Tata Sons' investments in listed companies was Rs 4538.9 billion as of March this year.

Apart from buying back the stake, Tata Sons will have to put funds into Tata Teleservices so that it can repay its debt and improve its financial metrics. This follows Tata Sons' investment of Rs 20 billion into Tata Teleservices in the financial year 2016-17.

Notably, a reduction in cross holdings within the Tata Group will result in unlocking of value for listed entities. Further, these entities will benefit from such a move as it could lead to lower debt and interest expenses.

Notably, reducing cross-holdings among the Tata group companies has been one of the top priorities for N Chandrasekaran since he took charge as chairman on 21 February. As we recently pointed out in one of the editions of The 5 Minute WrapUp:

- "The Tata Group too has some legacy business operations that are struggling. These businesses operate in a hyper-competitive environment and have generated sub-par returns for all stakeholders. Mr Chandrasekaran clearly has some tough calls to take on these operations."

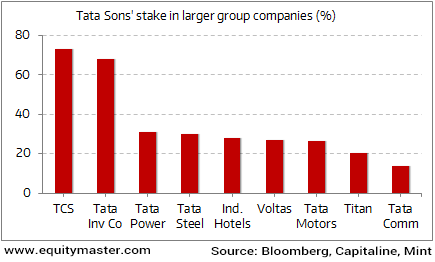

One must note that, apart from Tata Consultancy Services and Tata Investment Corp., Tata Sons seems to be very low on direct equity stake holdings. Its stake in most seems to be in the 20% range, which is quite a low number.

Tatas High on Control, Low on Equity Stake

Through its low holdings and large cross holdings, the group has for long relied on being high on control but low on actual equity stake.

However, the Tata Group too has some legacy business operations that are struggling. These businesses operate in a hyper-competitive environment and have generated sub-par returns for all stakeholders.

Moving on to the news from IPO space. It's raining IPOs these days. After two successful IPOs of Dixon Technologies and Bharat Road Network during the last week, three more public offerings are slated to hit D-Street this week.

They are Matrimony.com, Capacit'e Infraprojects and ICICI Lombard. Together, these companies will raise Rs 66 billion.

Reportedly, Matrimony.com is expected to raise over Rs 5 billion, which opens from today. The company has raised nearly Rs 2.3 billion from anchor investors ahead of its initial share sale.

Meanwhile, Capacit'e Infraprojects' Rs 4 billion IPO will be launched on 13 September. ICICI Lombard has set Rs 651-661 as the price band for its IPO, which will make it a Rs 57 billion issue opening from 15 September.

Disclaimer: Equitymaster Agora Research Private Limited (hereinafter referred as 'Equitymaster') is an independent equity research Company. Equitymaster is not an Investment Adviser. ...

more