Sensex Finishes Flat; Airlines Stocks Surge On Weak Oil Prices

Indian share markets continued to trade flat in the afternoon session amid mixed international markets and weak oil prices. At the closing bell, the BSE Sensex stood lower by 14 points, while the NSE Nifty finished down by 20 points. Meanwhile, the S&P BSE Mid Cap finished flat & the S&P BSE Small Cap closed higher by 0.1%. Gains were largely seen in FMCG stocks, power stocks, and realty stocks. Metal stocks and energy stocks witnessed maximum selling pressure.

Oil & gas stocks fell after global oil prices hit seven-month lows, with ONGC share price falling 2.1% and Oil India share price finished down by 2.5%.

Airlines stocks, however, rose on expectations of lower jet fuel prices, with Spicejet Ltd share price and Jet Airways share price up 4% and 3% respectively.

Asian stock markets finished mixed as of the most recent closing prices after MSCI Inc. said it would include Chinese stocks in its emerging-markets index. The Shanghai Composite gained 0.52%, while the Hang Seng & the Nikkei 225 fell 0.57% and 0.45% respectively. European markets are lower today with shares in France off the most. The CAC 40 is down 0.99% while Germany's DAX is off 0.72% and London's FTSE 100 is lower by 0.35%.

The rupee was trading at Rs 64.60 against the US$ in the afternoon session. Oil prices were trading at US$ 43.37 at the time of writing.

In news from economic sector, clearing the air on farm loan waiver, the Union Finance Minister Arun Jaitley has said that the Centre is not considering any proposal for farm loan waiver and it will stick to its fiscal deficit target of 3.2% of gross domestic product (GDP) for 2017-18. He added that states that want to go in for waiver schemes must generate them from their own resources.

Arun Jaitley's statement comes at a time when states like Madhya Pradesh, Rajasthan and Maharashtra witnessed violent farmers' protests over support price and loan waiver. After Uttar Pradesh and Maharashtra, Punjab also announced a loan waiver for farmers but the central government refused to do the same. Despite a bumper crop this rabi season, farmers in many states are in distress because of sharp fall in prices in both domestic and global market.

Farmers in various parts of the country have been agitating, seeking higher support prices for their products as well as waiver of farm loans.

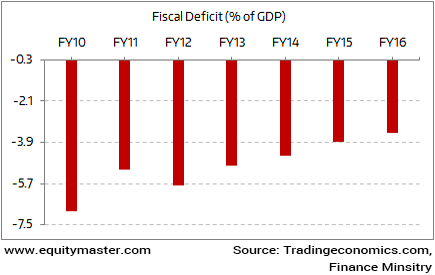

In Union Budget 2017-18, the fiscal deficit has been pegged at 3.2%, lower than 3.5% in the last financial year. The Fiscal Responsibility and Budget Management (FRBM) committee, headed by former revenue secretary NK Singh, has recommended keeping the budgetary deficit at 3% of the GDP in three years to March 2020. It also suggested progressively reducing it to 2.5% by 2022-23.

One of the important yardstick to measure the financial health of an economy is fiscal deficit. It is the difference between the government revenues and expenditure. The difference is generally bridged by debt. The present government is committed to reduce the gap. The long term fiscal deficit target is 3% of the Gross domestic product (GDP). This simply means relatively less expenditure. Hence, less government spending.

In last one decade India is making serious efforts to reduce the fiscal deficit level. Ever since, the new government came in it has been in favor of fiscal consolidation and meet the long term fiscal deficit target of 3% by FY17-18.

Moving on to news from bank stocks. According to a leading financial daily, Yes Bank and FMO (the Development Bank of the Netherlands), along with DEG (the Development Bank of Germany) and Proparco (the Development Bank of France), have organized an investment symposium on 'The Opportunity of Green Finance in India', where the four banks signed a charter to champion green finance in India.

Through the charter, the four banks committed to mobilize green investments, seize opportunities in India's sunrise sectors, and contribute to achieving India's Nationally Determined Contribution and Sustainable Development Goals targets towards combating climate change.

As per the reports, the proceeds of the green bonds issued by Yes Bank have helped fund renewable energy projects across nine states of India, and are estimated to generate 2.35 million MWh of electricity, annually. Additionally, these projects will potentially avoid annual emissions of 2.3 MT of Carbon Dioxide, 19 KT of Sulphur Dioxide, and 5.7 KT of Oxides of Nitrogen.

Yes Bank issued India's first ever Green Infrastructure Bonds in February 2015, raising Rs 10 billion, followed by a second issue of Rs 3.15 billion in August 2015. In September 2016, Yes Bank raised Rs 3.3 billion by issuing a 7-year term green bond to FMO - the Dutch bank's first investment in Green Infrastructure Bond issued by a bank in India.

Yes Bank share price finished the day down by 0.7% on the BSE.

In news from capital goods sector, ABB is reportedly in discussions with Larsen & Toubro (L&T) to acquire its electrical and automation division.

The division that generated revenues of Rs 46.5 billion and operating profit of a little over Rs 7 billion in 2016-17 is expected to be valued at Rs 140-180 billion.

ABB owns 75% in ABB India, its locally listed arm, and the acquisition will help the Zurich-headquartered firm consolidate its position in the country.

In another development, L&T's construction arm, L&T Constructions, has bagged an EPC contract for the development of 50MW Solar Power PV grid connected project. The contract has been awarded by NHPC for an amount of Rs 2.87 billion with its comprehensive O&M for 10 years.

Meanwhile, the government has sold 2.5% of its equity stake in L&T held through its investment arm SUUTI for more than Rs 40 billion.

ABB share price and L&T share price finished the trading day up by 0.7% and 0.2% on the BSE.

And here's a note from Profit Hunter

Hindustan Unilever (HUL) is among the top gainers from the Nifty 50 Index - up 3% and trading at a lifetime high.

After the stock topped out at 975 in March 2013, it traded in a broad range of Rs 765-975. Last month, the stock broke out of this range to hit a lifetime high of Rs 999.

We mentioned in an earlier note that the stock broke out its range with healthy volumes and the RSI indicator trading in bullish territory. After the breakout, the stock rallied sharply and is now trading 15% above the breakout level at Rs 1,123.

It will be interesting to see if the stock continues with its strong upside momentum...

HUL at Lifetime High

Disclaimer: Equitymaster Agora Research Private Limited (hereinafter referred as 'Equitymaster') is an independent equity research Company. Equitymaster is not an Investment Adviser. ...

more

thank