Sensex Finishes Firm; Realty Stocks Rise

Indian share markets finished the trading day on a firm note as the country moved a step closer to implementing a nationwide goods and services tax (GST) from July. At the closing bell, the BSE Sensex closed higher by 116 points, whereas the NSE Nifty finished higher by 30 points. The S&P BSE Midcap and the S&P BSE Small Cap Index both ended up by 0.4%.

Sectoral indices ended on a mixed note with consumer durables sector and realty sectors witnessing maximum buying interest. While losses were largely seen in the metal sector and information technology sector

Asian equity markets finished lower today with shares in China leading the region. The Shanghai Composite is down 0.96% while Japan's Nikkei 225 is off 0.80% and Hong Kong's Hang Seng is lower by 0.37%. European markets are mixed. The DAX is higher by 0.11%, while the FTSE 100 is leading the CAC 40 lower. They are down 0.04% and 0.03% respectively.

Meanwhile, the rupee was trading at Rs 64.93 against the US$ in the afternoon session. Oil prices were trading at US$49.41 at the time of writing.

Pharma stocks were trading on a mixed note with Elder Pharma and Alembic Pharma leading the gains. According to a leading financial daily, Aurobindo Pharma has bagged final approval from the US Food & Drug Administration (USFDA) to manufacture Abacavir Sulfate and Lamivudine tablets. Abacavir Sulfate and Lamivudine tablets are the AB rated generic equivalent of VIIV Healthcare Company's Epzicom tablets.

The tablets are the AB rated generic equivalent of VIIV Healthcare Company's Epzicom tablets. The product is being launched immediately. The tablets are indicated in combination with other anti-retroviral agents for the treatment of HIV-1 infection.

The approved product has an estimated market size of US$ 388 million for the twelve months ending December 2016 according to IMS.

This is the 108th ANDA (including 20 tentative approvals) approved out of Unit VII formulation facility in Hyderabad, India used for manufacturing oral products. Aurobindo Pharma has a total of 314 ANDA approvals (276 final approvals including 16 from Aurolife Pharma LLC and 38 tentative approvals) from USFDA.

Meanwhile, in an edition of The 5 Minute WrapUp, we wrote about the USFDA crackdowns faced by the Indian Pharma in recent times and how they have been constantly investing towards R&D. We believe pharma companies that are upgrading and keeping facilities compliant, and have niche product pipelines in place will see sustained revenue growth going forward.

Reportedly, domestic pharmaceutical industry is likely to register moderate growth largely owing to increased regulatory scrutiny as well as consolidation of supply chain in the US market.

According to rating agency ICRA, India pharma companies' revenue from the US during from 2011-15 period, rose at an average 33%. This plunged to 15% in 2015-16 and 12% in the first nine months of the current fiscal.

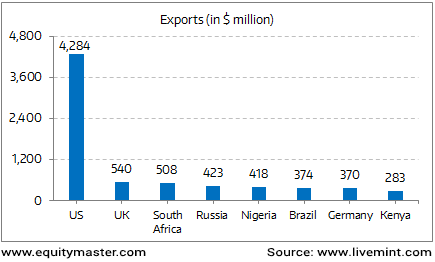

Surging Exports to the US

The revenue growth for Indian pharma industry remains moderate with base business in US continuing to face high single digit price erosion, regulatory overhang for select companies and temporary demonetisation effects in India.

Aurobindo pharma share price ended the day up by 0.4%.

In another development, as per a report in The Economic Times, come July 1, leasing of land, renting of buildings as well as EMIs paid for purchase of under-construction houses may start attracting the Goods and Services Tax (GST).

The sale of land and buildings will, however, be kept out of the purview of GST. Such transactions will continue to attract the stamp duty, according to the legislations Finance Minister Arun Jaitley introduced in the Lok Sabha for approval.

Service tax is currently levied on payments made for under-construction residential houses after providing abatement, which brings down the effective rate from 18% to around 6%.

However, the real estate sector is worried about the percentage of tax to be levied, which they fear would be kept at a minimum of 12%. At present, while service tax is levied on commercial space renting, for under-construction houses, service tax and value added tax (VAT) are both charged at around 9%.

There are also fears that an increase in taxes on EMIs might further impact the residential sector. However, experts expect some changes in the new tax regime during the March 31 GST Council meeting.

Speaking of GST, while some minor details remain to be ironed out, Rahul Shah, Co-head of Research doesn't foresee any problems in the roll-out now. Here's an excerpt of what he wrote in The 5Minute Wrapup recently:

- "What is more important is the implementation of this landmark legislation. Now, this doesn't mean that investors should get carried away and buy 'GST stocks'. Your broker will no doubt try to sell you some. We see no reason why investors should change their strategy when GST becomes a law."

For some perspective on this issue, we also recommend the 4 August 2016 edition of The 5 Minute WrapUp - GST Approved: Time to Buy Stocks by the Fistful?

Also, to get a detailed view on the Goods and Services Tax (GST), you can read Vivek Kaul's report, GST & You: What the Media DID NOT TELL YOU about the GST.

And here's a note from Profit Hunter:

Yesterday we saw Asian Paints generate a massive 1,643% returns for its investors in seven years. Today we highlight another company that has been extremely generous to its investors - MRF Ltd. MRF has generated even better returns than Asian Paints during the same time span. The stock has rallied nearly 4,000% from the low of 2009 to hit a life-high of Rs 60,300 just a day before.

Recently, the stock rallied vertically from the low of Rs 30,101 to hit a 52-week high of Rs 54,650. It then consolidated for a while in a form of symmetrical triangle pattern, after which it resumed its uptrend. And now the stock is trading near its life high.

The RSI indicator is bouncing from the 40 level, which typically acts as a support level during the uptrend.

The stock is trending extremely powerfully. But is the current uptrend support by robust fundamentals? Our colleague Rohan Pinto, research analyst, recently met with an ace stock picker to find out the fundamental prospects of stocks they hold - including MRF, Asian Paints, and more. You can find the complete interview in the 5 Minute WrapUp here.

MRF Near Life High

Disclosure: None.