Sensex & Nifty Hold Gains; FMCG Stocks Buck The Trend

The Indian share markets continue to maintain the upbeat trend during the noon trading session amid positive global markets. Barring FMCG, consumer durables and auto stocks, all sectoral indices are trading on a positive note with realty, oil & gas stocks leading the pack of gainers.

The BSE Sensex is trading higher by 104 points while the NSE Nifty is trading higher by 32 points. The BSE Mid Cap index and BSE Small Cap index both are trading up by 0.7%. Gold prices, per 10 grams, are trading at Rs 27,975 levels. Silver price, per kilogram is trading at Rs 41,195 levels. Crude oil is trading at Rs 3,496 per barrel. The rupee is trading at 68.17 to the US$.

According to an article in The Economic Times, demonetization has had an impact on FMCG business with primary sales declining significantly. However, Dabur India is of the opinion that the demonetization of high value currency notes would have beneficial impact on organized players in the long run. On account of scarcity of cash available with customers and trade, Dabur is foreseeing near term pressures on the its business.

Dabur India said that the impact varies across channels and geographies. Moreover, the stress is highest for wholesalers and small town grocery shops, who are facing a severe liquidity crisis and are destocking. The impact is likely to be positive on modern trade outlets and plastic money enabled retailers who are likely to benefit from this change.

In the meanwhile, the company is focusing more on modern retail, e-commerce and institutional sales. It is also encouraging general trade retailers to adopt cashless payment systems. This will help in mitigating the overall impact of demonetisation and pave the way for normalization in the next few months.

However, to mitigate the issues of credit risk and defaults from the trade partners, Dabur is giving credit extensions in a calibrated manner. One the liquidity front, Dabur said that it is already seeing signs of liquidity improving in the Southern region compared to North and the East region.

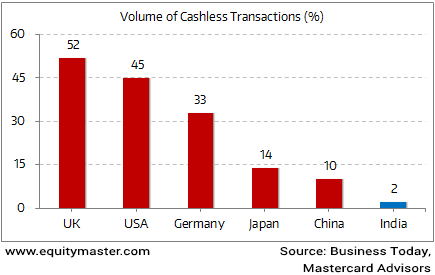

Speaking about Modi's push towards a cashless, digital economy, we have compared the quantum of cashless transactions in some of the major economies of the world. The chart shows how far India has to go to become a cashless economy. Just about 2% of the volume of economic transactions in India are cashless.

Is India Ready to Go Digital?

Poor penetration of banks in villages and lack of access to financial services might be left behind. According to the World Bank, there are only 18 ATMs per 100,000 citizens in India compared to 129 in Brazil. Additionally, just 22% of Indians use the Internet "at least occasionally" and only 17% have a smartphone.

Therefore, unless the whole financial system is made more secure and fool proof, the shift towards a cashless economy can prove to be a financial nightmare for the common man.

Dabur's share price was trading down by 1% while writing.

Moving on to the news from stocks in auto sector. As per an article in Livemint, Mahindra Agri Solutions Ltd (MASL), a wholly-owned subsidiary of Mahindra & Mahindra(MAHMF), has inked a definitive agreement to acquire up to 60% of the equity share capital of OFD Holding BV. OFD Holding BV is Netherlands-based fruit distribution company.

Reportedly, the acquisition is made for a consideration not exceeding 5 million euro (about Rs 360 million) subject to customary adjustments on closing.

Moreover, OFD Holding owns Origin Fruit Direct, Origin Direct Asia and Origin Fruit Services South America, which are based out of the Netherlands, China and Chile, respectively. This deal will give Mahindra an opportunity to tap new markets in Europe and China and strengthen its existing customer base. Besides this, the pact also takes M&M closer to becoming a significant global player in grapes. The move is also in line with Mahindra's long term vision of Delivering FarmTech prosperity.

Meanwhile, M&M's board has recently approved the demerger of Mahindra Two Wheelers Ltd.'s two-wheeler undertaking, which manufactures and sells two wheelers.

Reportedly, M&M approved a scheme of arrangement which envisages demerger of the two wheeler undertaking of its step down subsidiary Mahindra Two Wheelers (MTWL) and transfer and vesting thereof as a going concern into the company. All assets and liabilities of Mahindra Two Wheelers Ltd (MTWL) pertaining to the two wheeler undertaking would be transferred to M&M. The proposed demerger is in line with M&M's strategy of focusing on niche premium two-wheeler segment.

Mahindra & Mahindra's share price was trading down by 0.3% while writing.

more