Sell These 3 Popular Dividend Stocks

The terrorist attacks in Paris are already affecting tourism and many popular American stocks with enticing dividends will lose money as travelers cancel trips and rethink their plans. Now is the time to sell these popular dividend stocks before they fall.

The terrorist attack in Paris earlier this month was a tragedy.

And while the mantra has historically been, “Buy when there’s blood in the streets,” now is not the time to be a hero.

In particular, it might be too early to buy European stocks that sold off for cheap. And more importantly, you should rethink your “flight to safety” trade, which likely includes owning dividend stocks amidst the uncertainty.

Travel in Europe will be under pressure for some time and Americans were urged to be careful when traveling over Thanksgiving. Just this week the U.S. State Department issued a travel warning for the entire planet. Sure, some countries like Iraq, Somalia, and Haiti are pretty much always on the list, but I can’t even recall the last time the State Department issued a worldwide travel warning.

The French President has already issued a three-month State of Emergency for France. And, French intelligence has said their data suggests we could see more terror attacks in the country or other parts of Europe. Bookings for Europe during the Christmas period are already lagging last year by a healthy percentage and cancellations are spiking. Reuters reports that in the seven days after the November 13th Paris attack new flight bookings to Paris fell 27 percent compared to the same period a year ago.

The takeaway is that the tragedy in Paris and threat of future terrorist attacks will put pressure on a number of companies operating in Europe, in particular, anything travel related.

And while dividends are generally a flight to safety trade, even seemingly healthy dividends won’t ease the pain of a falling stock price.

With that, here are three classes of dividends to sell now:

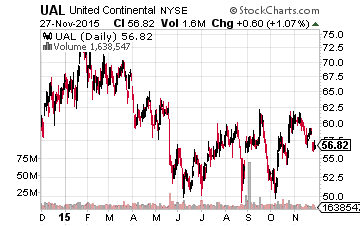

Dividends to Sell Now No. 1: Airlines

The big three airlines in the U.S. will feel the pain from the France fallout, including: United Continental (NYSE: UAL), American Airlines (NYSE: AAL), and Delta Air Lines (NYSE: DAL).

Delta Air Lines is the biggest name to watch. It happens to be one of the few major U.S. airlines paying a dividend, coming in at 1.1%. The big issue is that Delta has a joint venture with Air France for offering transatlantic flights to the country and the two have a revenue share agreement. France has historically been the most visited country in the world.

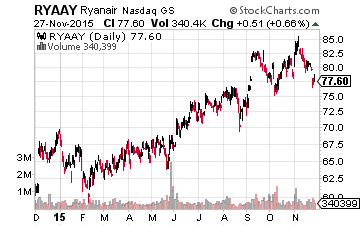

Then there’s the European budget airline, Ryanair (NASDAQ: RYAAY)

The airline serves close to 200 airports across Europe and generates all its revenues from the region. It offers a seemingly juicy 4.3% dividend yield, but will be one of the big names caught up in a decline of travel within Europe.

Along the same lines of airlines, there’s also cruise line operators that will feel the pressure. The name to avoid here is Carnival (NYSE: CCL) which, while paying a solid 2.4% dividend, generates 35% of revenues from Europe.

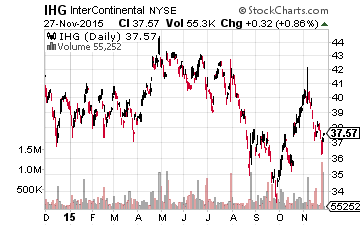

Dividends to Sell Now No. 2: Hotels

The major hotelier operating in Europe is InterContinental Hotels (NYSE: IHG), which generates 20% of revenues from Europe. It pays a 1.5% dividend yield.

However, the other big name(s) to avoid is Marriott (NYSE: MAR) and Starwood Hotels (NYSE: HOT). Recall that Marriott is buying Starwood, but both have a lot of exposure to Europe. Their respective dividend yields are roughly 1.5%.

In terms of European exposure, Marriott generates 7% of its profits from Europe. Meanwhile, Starwood generates over 25% of its leased and owned property revenue from Europe and 13% of its management fees from the region.

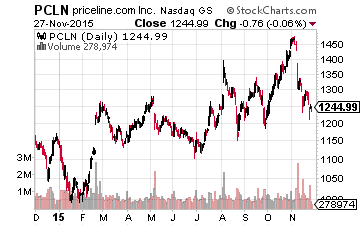

In that same vein, some of the major online travel site stocks will also feel the pain. These guys sell both travel and air services, the double-whammy if you will.

Priceline (NASDAQ: PCLN) has been the big name to watch when it comes to online travel sites, generating 65% of its revenues from Europe. However, the dividend name to avoid in the space is Expedia (NASDAQ: EXPE), which pays a 0.8% dividend yield.

Dividends to Sell Now No. 3: Consumer goods

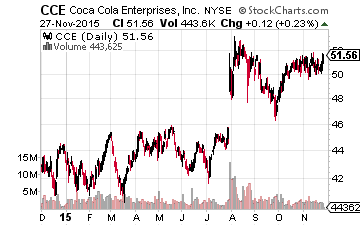

With tourism and travel down, there will be fewer people to “consume” products in Europe. So the list of names to avoid starts with the Coca-Cola bottling company, Coca-Cola Enterprises (NYSE: CCE).

The company generates all its revenues from Europe, with a couple of its key markets being Belgium and France. It pays a 2.2% dividend yield.

Then there’s Mondelez (NASDAQ: MDLZ), the maker of snack foods like Oreos and Cadbury. Its dividend yield is 1.6%, but it generates over 40% of revenues from Europe.

One of the biggest names in fast food industry also generates a lot of revenues from Europe; McDonald’s (NYSE: MCD) pays a juicy 3.1% dividend yield and gets 40% of revenues from the region.

Other dividend payers with major exposure to Europe include: VF Corp (NYSE: VFC), generating 38% of revenues from Europe and paying a 2.2% dividend yield; Baxter (NYSE: BAX), generating 30% of revenues from Europe and paying a 1.2% dividend yield; and Twenty-First Century Fox (NASDAQ: FOXA), generating 30% of revenues from Europe and paying a 1% dividend yield.

In the end, while the demand impact from the recent turmoil in Europe might not last long-term, there will be near-term issues felt by many of the companies exposed to the travel and leisure industry. Protect yourself and avoid the “enticing” dividends tied to European travel and anything travel-related for now.

But, there are still plenty of high-quality dividend stocks available to purchase that will have zero exposure to the fallout from the attacks in Paris.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more