Recent Asset Class Performance Highlights Shift

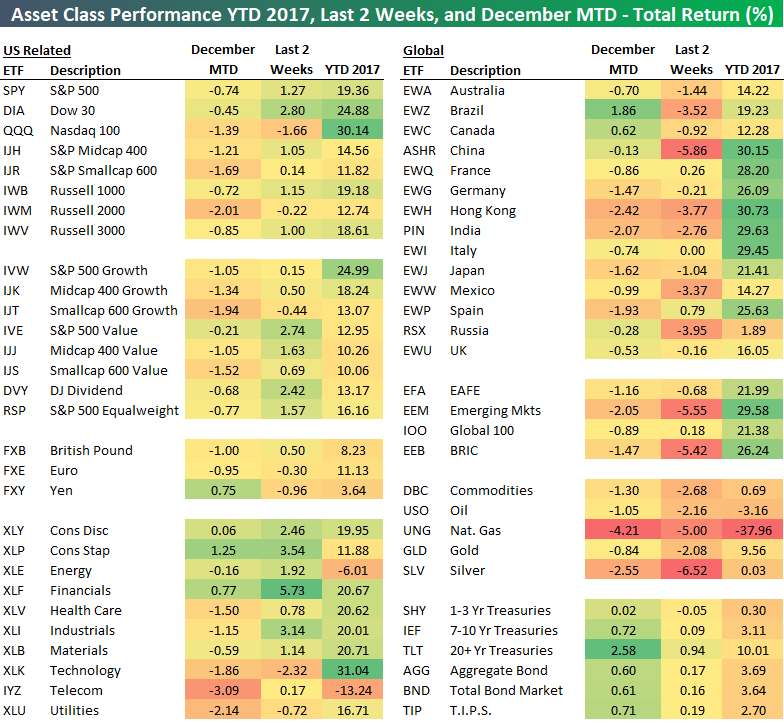

Below is a look at the recent performance of various asset classes using our ETF total return matrix. For each ETF, we highlight its total return month-to-date, over the last two weeks (since 11/22), and year-to-date.

Starting with the US (left side of matrix), we’ve seen the Nasdaq 100 (QQQ) and smallcaps (IJR, IWM) get hit the hardest so far this month.Value has been significantly outperforming growth as well recently.

Looking at sectors, we’ve seen the two consumer sectors, Energy, and Financials perform best of late, while Technology, Telecom, Industrials, Health Care, and Utilities have been underperforming.

Outside of the US, Brazil (EWZ) and Canada (EWC) are the only two countries that are up so far in December.On the flip side, we’ve seen Hong Kong (EWH), India (PIN), Spain (EWP), Germany (EWG), and Japan (EWJ) all fall more than 1%. Over the last two weeks, China (ASHR) has gotten hit the hardest with a drop of 5.86%.

Emerging markets have been especially weak as well recently. While EEM is up 30% year-to-date, it’s down 5.55% over the last two weeks and over 2% already in December.

As “risk on” asset classes have weakened of late, we’ve seen buyers step into the fixed income ETFs. The 20+ Year Treasury ETF (TLT) is already up 2.58% in December, which leaves it up more than 10% year-to-date.

(Click on image to enlarge)

Disclosure: None.