Raise The Yuan! Implications For The Treasury Spread

Some back-of-the-envelope calculations: If we get what President Elect Trump says he wants — no depreciation of the yuan — what happens to the Treasury 10 year-3 month spread?

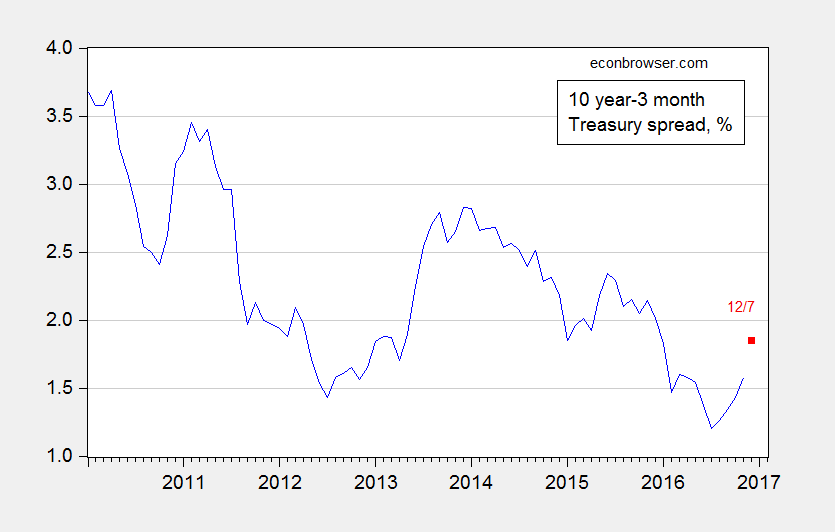

Figure 1: Ten year minus three month Treasury spread, % (blue), and 12/7 observation for December (red square). Source: Federal Reserve, Bloomberg.

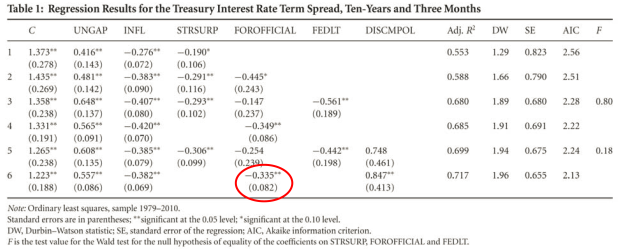

Brad Setser estimates China’s October reserve decumulation at $40 billion — which annualized amounts to about $500 billion/year. And even then, the yuan depreciated 0.9% against the dollar in October! Keep this up for a year, and we can see the implication for the Treasury spread by appealing to estimates in Kitchen and Chinn (2012). Table 1 presents estimates from a regression of ten year yields on the cyclically adjusted budget surplus, Fed purchases and foreign purchases (plus activity variables).

Source: Kitchen and Chinn (2012)

Constraining the slope coefficient on these three variables to be equal (after sign switches), we obtained a point estimate of 0.335 (circled in red).

Potential GDP according to CBO in mid-2017 averaged $19462 billion (SAAR). Suppose about 2/3 of the $500 billion in reserve sales is in Treasurys; then $333 billion amounts to about 1.7 percentage points of potential GDP. Using our estimate of 0.335, I get an elevated ten year yield of 0.6 percentage points relative to what otherwise would have occurred.

Now, recall, the yuan depreciated 0.9% against the USD from October to November (log terms), or 10.8% annualized, even with $40 billion of reserve decumulation. So to stabilize the yuan against the US dollar (holding all else constant) means even more sales of US Treasurys, and commensurately larger spread increases.

Disclosure: None