Promising Canadian Aristocrat Companies

It is quite interesting to see how the Canadian stock market has recovered a very good part of its latest drop:

Source: ycharts

We keep reading pessimistic news, but the reality is otherwise. While the stock market plummeted by more than 20% compared to its previous peak, the “big hole” left by the oil price drop is now just a bump in the road.

To be honest, I don’t really mind if the market is up or down by 20% for the past 12 months. In fact, I rather like focusing on what is coming month after month in my cash account: dividend income.

If you are looking to start your Canadian dividend growth portfolio, you should know that there is a special list of “elite” companies that have proved to their shareholders that they will reward them on a consistent basis. As the US stock market has its aristocrat companies, so do Canadians!

Canadian do have aristocrats, but they are just not as impressive

Considering the US stock market, a company must successfully increase its dividend payout for 25 years consecutively. As it is not enough to distribute their cash flow, they must increase it year after year and show an impressive consistency.

If we would apply the same rule in Canada, I’m not even sure we would have a single company on the aristocrats list. This is why the stock market came up with another set of rules :

- The company’s security is a common stock or income trust listed on the Toronto Stock Exchange and a constituent of the S&P Canada BMI.

- The security has increased ordinary cash dividends every year for five years, but can maintain the same dividend for a maximum of two consecutive years within that five year period.

-

The float-adjusted market capitalization of the security, at the time of the review, must be at least C$ 300 million.

-

For index additions, the company must have increased dividend in the first year of the prior five years of review for dividend growth. This rule does not apply for current index constituents.

Without being the model of constant dividend increases as we have in the States, these rules help determine the most dividend friendly stocks in the Canadian market. I’ve handpicked a list of my favorite companies from this list (note, I’ve left the Canadian Banks off of the list, you all know them anyway ;).

Those companies were picked based on the 7 principles of dividend growth investing.

Agrium (AGU)

Source: ycharts

The company’s business model is not solely limited to potash production. While being the third largest potash producer in North America, Agrium is also the largest agricultural retail operator in the USA with more than 750 farm stores across the country. In addition to potash, the company sells other fertilizers such as nitrogen and offers farms a wide variety of solutions to improve their crops (chemicals, seeds plus weather, soil and pest information).

Agrium also benefits from a highly fragmented market to make acquisitions and grow from both internal and external sources. Agrium continues to increase its dividend payout since 2012. In fact, I guess management decided to start paying dividends back in 2012 to keep investors interested in their stocks as the market for potash was collapsing. While the company’s cash payout ratio is over 100%, AGU is posting solid earnings and the fact that Uralkali & Belaruskali have made amends is helping to restore the potash oligopoly market. This should eventually help AGU’s cash flow.

BCE (BCE.TO)

Source: ycharts

BCE is part of the ever high yield payers in the Canadian dividend landscape. As opposed to REITs and oil industry dividend paying stocks, BCE seems to be alone with a very low volatility profile. While the TSX went up and down over the past 18 months, BCE hasn’t touched negative return territory if you include its generous dividend (while the TSX almost hit -20% at one point).

BCE is a diversified media company that is not afraid to use its cash flow to invest in other businesses. They recently acquired Manitoba Telecom (MBT) for the sum of $3.9 billion paid in cash and stock. This goes well with BCE’s strategy of improving its presence in the wireless business in Manitoba. On the other hand, I’m not sure it’s a super deal since MBT hasn’t been a skyrocketing business over the past few years. Not to mention that BCE will most likely have to sell a part of MBT’s postpaid wireless customers to Telus in order to gain regulatory approval.

Canadian National Railway (CNI)

Source: ycharts

I’ve written a lot about CNI recently as I can’t stress enough about the quality of this company. In my introduction, I wrote that industrials follow cyclical trends creating buying opportunities. I believe this is the case right now for railroads companies. The stock lost about 7% since it has reported its latest earnings. While the company deserves various businesses segments, most of them are greatly affected by a global slowdown.

However, the company continues to aggressively increase its dividend payout supported by the best operating ratio of its industry. Management has been doing an amazing job in generating higher margins than its competitors and they have decided to share their success mainly with shareholders.

An investment in CNI today is definitely for the long haul. Don’t expect the clouds to go away this year, but if you buy now, you will be enjoying a fast increasing dividend before seeing the stock price going back up once the cycle starts again.

Emera (EMA.TO)

The future looks bright for EMA as it shows several projects for the next decade. Both revenues and EPS have grown steadily over the past five years and the dividends have followed accordingly. EMA is definitely a strong utility to hold. EMA reported clockwork results on November 13th for its Q3. Earnings are up $0.04 EPS compared to last year. Management expects the TECO acquisition should boost EPS by 5% in 2017 and growing to more than 10% by the third full year of operation (2019). EMA restated its dividend growth target of 8% through 2019 and expects to keep this pace past 2019. EMA continues to be a strong holding for any Canadian dividend growth investor.

An investment in EMA is also an investment in a relatively high dividend yielding stock. At the moment, there are a few very interesting high yield (over 4%) stocks on the Canadian market. It is also a gauge of stability. While the Canadian stock market was dropping faster than the 20 inches of snow that fell on our heads last night, EMA posted a solid and steady return coming from both its dividend payment and stock value appreciation.

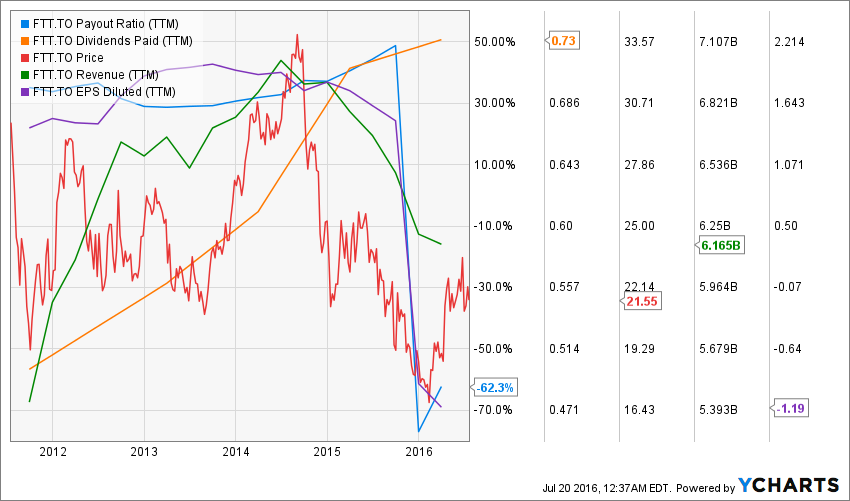

Finning International (FINGF)

Source: ycharts

Finning had a terrible year in 2015. Being the official Caterpillar (CAT) product reseller in Canada has its advantages as you offer a world class product to your client, but it’s another story when both the mining and the oil industry is collapsing at the same time. Finning International had it rough in 2015 and provided a great buying opportunity back then. Since the beginning of the year, this is a complete new story as the stock price is already up by 22% since January.

Unfortunately, the window for buying Finning International at a cheap price seems over already. The company will continue to drag behind with virtually no growth vector to work with. The mining industry is not getting any better while oil is simply “better than it was”. Think about it, can the oil industry could get any worse?

The company is strong and sells a great product, this is not the problem. However, you can sell the best car in town, if nobody needs it, it will stay in your garage.

Magna International (MGA)

Source: ycharts

Magna is not only an international automobile part supplier, it also designs, develops, manufactures, assembles and engineers automobile parts. Magna sells to OEMs (original equipment manufacturers) across 26 countries. It offers a wide variety of 86 products that go from seating to roofing systems. Magna is a leader in the auto parts industry and this serves it well as many manufacturers now tend to concentrate their processes with fewer suppliers with wider product offering. This is exactly where Magna stands in the market. While Magna relies on Detroit automakers for about 50% of its sales, the overall automobile business is looking brighter in the near future. Low oil prices have helped new cars sales which leads to more sales for Magna. Finally, there is a high switching cost for automakers to change manufacturers such as Magna. This makes their niche a highly repetitive and stable market. The stock price dropped by 17% over the past 12 months and this makes Magna highly interesting.

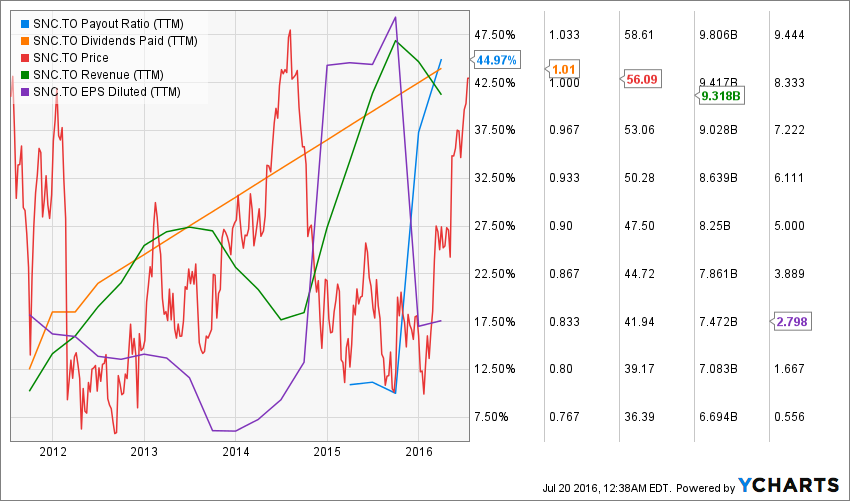

SNC Lavalin (SNCAF)

Source: ycharts

Not too long ago, this engineering firm was treated like the ugly duckling by financial analysts. I must admit SNC looked for all the hate it received as the company is under review by the Canadian Government for corruption allegations. If the company was to be found guilty, they would be kicked-out for any Government related project for 10 years. For an engineering firm, this is possibly the greatest penalty.

However, the clouds seem to be fading away as it has become less likely there will be a trial and eventually a judgement in this case. I have a feeling there will be an out of court ruling. In the meantime, the company has restructured itself, got rid of the bad element in the company and shown some strong potential. This is how the stock price rose 30% since the beginning of the year. At the moment, many analysts now see the stock over $60 and now it is trading around $53. Better oil perspectives are also helping the company who bought important stakes in oil related businesses right before the oil crash in 2014.

Many readers were surprised when I announced this purchase back in 2014, now, this holding is over +35% in my portfolio.

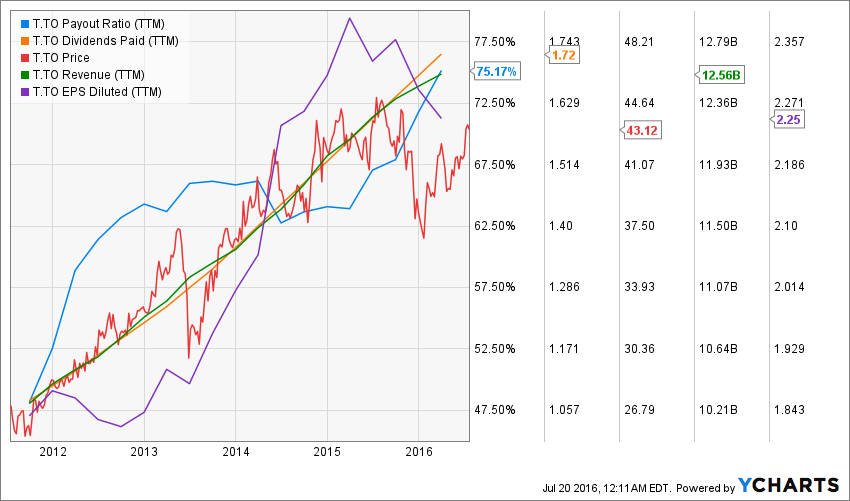

Telus (TU)

Source: ycharts

Telus is one of my favorite Canadian dividend paying stocks. The company is known for its solid customer service and a wide network offering. The company had announced several investments to continue improving its communication infrastructure. The bread and butter of this company comes from a solid network and great customer service. This is why they announced investments of $4.5 billion through 2019 in BC, $1 billion through 2019 in Ontario and a $500M investment to bring wireless service to highway 37A and the community of Stewart.

At the beginning of May, Telus announced another 10% dividend increase. It wasn’t a surprise, and it surely was good news. What is even better is that management expects to keep raising its payout by 7% to 10% per year from 2017 to 2019. There aren’t many companies this transparent with investors when it comes to discussing dividend distributions. While BCE and Rogers invested in Broadcasting, Telus is stealing Shaw Communications cable clients and investing in the highly profitable mobile industry

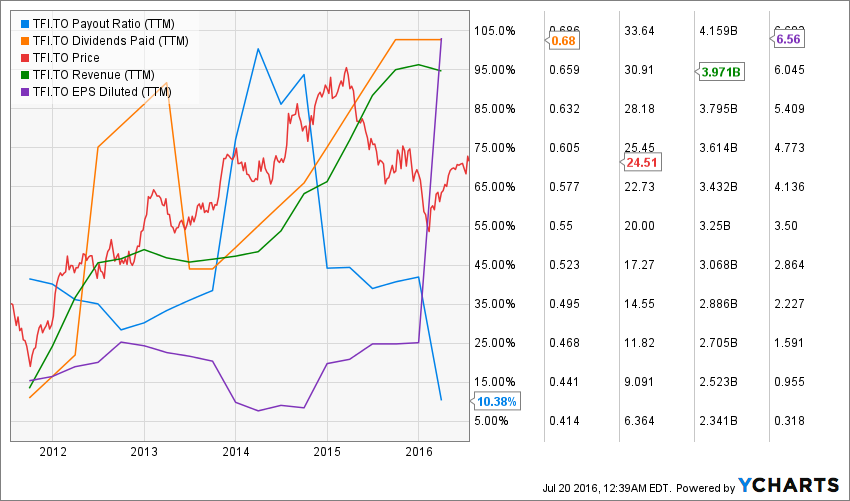

Transforce (TFIFF)

Source: Ycharts

Transforce is Canadian largest trucking company and the 9th largest for-hire trucking company in North America. While its stock is getting beaten down by the Street due to the weak Canadian economic outlook, Transforce is generating serious cash flow and is ready to capitalize on this situation. The company’s payout ratio stands at 10.38% while its cash payout ratio is at 27.94%. These are amazing numbers that will lead to one thing; more dividend payout increases in the future.

While there are concerns around the Canadian economy, Transforce benefits from a stronger market through its US division. The rise of ecommerce brought another growth vector in Canada as more and more people are ordering online that require trucks for the goods to be transported.

With lots of cash in its hand and a weaker economic outlook, many analysts anticipate a merger or acquisitions from Transforce to make it even stronger when the economy bounces back. The stock is down 9% for the past 12 months and keeps dragging behind the TSX since the beginning of the year, this could represent a great buying opportunity.

There is more to the list, what is your favorite Canadian Aristocrats?

I didn’t want to pull out the whole list and this is why I stop here. I’m curious to know which dividend aristocrats you have in your portfolio?

Disclosure: Each month, we do a review of a specific industry at our membership website; Dividend Stocks Rock. In addition to have full access ...

more