Political Angle Driving Oil Higher

As Turkey, alongside Saudi Arabia and Qatar see the balance of power in the Syrian proxy war effectively shift back towards the Assad regime, recent trial balloons and troop buildups could be a game changer in the ongoing conflict. The rising probability of a wider conflict unfolding in the region means that Syria could be the spark that lights an even larger fire. So far oil prices have responded in similar fashion to “buy the rumor” and “sell the news”. The rapid rally higher comes on the heels of data from OPEC and other global output centers showing in many cases production is continuing to rise. Now that peace talks in Switzerland have stalled between the parties, a growing offensive from pro-regime forces in Aleppo may finally tip the scales in the conflict, setting the stage for a regional war and a greater risk premium for crude.

Stakes Are High

After persistent efforts to unseat Bashar al-Assad have resulted in repeated failures following expanded foreign intervention from the regime’s supporters, long-time backers of the rebels are now reassessing the situation. With the rebels increasingly encircled in Aleppo, should the city fall, it would mark a turning point in civil war. Now that the momentum has shifted in favor of the Russian led operation to rout out rebels and IS, Turkey is reportedly growing its military presence opposite the Syrian border, amassing for a possible invasion and potentially dragging in NATO. This has set off tensions across the region with Russia’s defense ministry warning about ongoing preparations.

Saudi Arabia has also offered to join the fray, issuing a trial balloon last week about the possibility of sending ground troops to fight IS alongside the coalition in Syria. The message that ensued from Syrian Foreign Minister Walid al-Moallem pledged several times that foreign troops entering the nation without permission would “return home in wooden coffins”. This multi-angular nature of the conflict dictates that in spite of fighting an ongoing civil war, the Assad regime now faces the threat of invasion. This would likely provoke a strong reaction from the Russians and Iranians, dragging the region even closer to chaos. A regional war could ignite a conflict of global magnitude, adding to the growing risk premium in oil prices.

The War Impact

Relative to storage and production levels, most indications are for a degree of overpricing in the crude oil market as the prevailing imbalance remains intact. US crude oil stockpiles continue to rise at a tremendous pace, now standing at levels last seen during the Great Depression. Production from Russia continues to grow as Iran eagerly pounces on the opportunity to expand its own market share and fill state coffers with much needed capital. However, the growing military dimension to ongoing regional conflict threaten to spur potential supply disruptions throughout the Gulf States. A closure of the Strait of Hormuz for instance could potentially mean an additional $10.00-15.00 points worth of risk premium added to already elevated prices.

Until denials of a ground invasion are delivered and tensions are calmed, oil prices will likely remain elevated, trending above $31.00 per barrel with downward pressure sensitive to evolving supply and demand conditions. However, it needs be said that without another trigger or catalyst that leads towards increased hostility, a substantial rebound in oil prices is unlikely. If the downturn in international trade persists, driving demand growth for crude lower amid burgeoning supplies, it could elicit additional jawboning and posturing from certain members of the conflict to propel price momentum higher. Right now, however, the Saudi’s campaign to inflict maximum possible damage on producers has shown little signs of ebbing despite the damage it has done to energy sector dynamics globally.

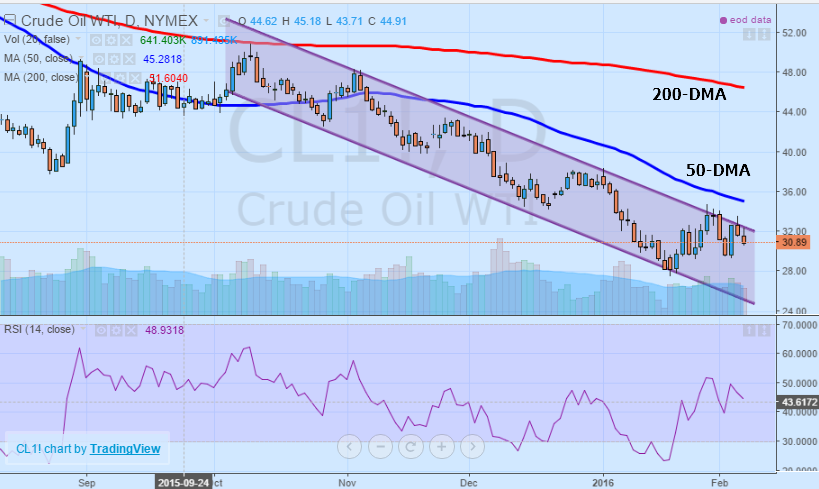

Technically Speaking

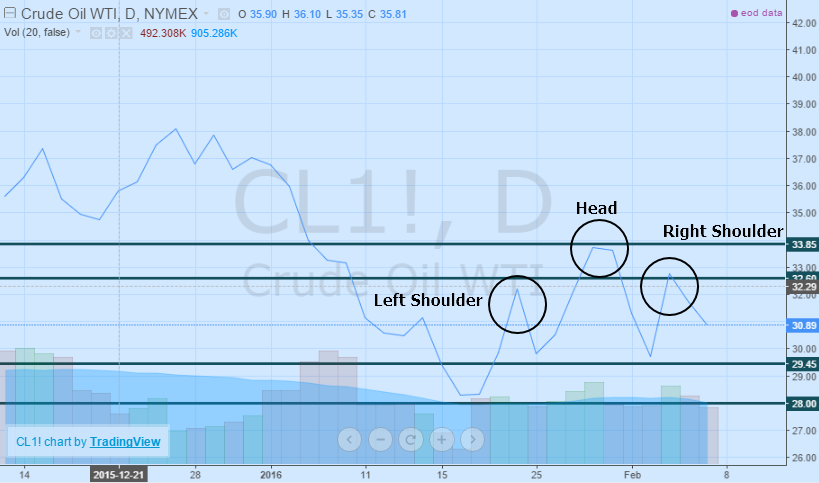

Even though the technical indications are playing second fiddle to the potential for dramatic fundamental changes, the bias remains bearish over the near-term, with the more medium-term channel still intact and a possible head and shoulders pattern setting up. Moreover, even the moving averages suggest further downside in oil following the recent rally higher. Although not far from resistance, WTI prices are currently trading just below the upper channel line of the prevailing downward trending equidistant channel. Traders looking to establish short positions for prices taking another run at the $30.00 psychological level would be keen to do so near $32.00. Adding to the bias are both the 50 and 200-day moving averages trending lower, continuing to act as resistance towards any sustained upward momentum.

The relative strength index in the middle of the range implies that prices might trend sideways over the coming session or even see a slightly rebound following Friday’s selloff late in the session. However, aside from the moving averages is the ominous head and shoulder’s bearish pattern gradually setting up with shoulder resistance at $32.60 before the head at $33.85. On the downside, the major support is the neckline at $29.45, with any breach and candlestick close below the critical level paving the way for a breakout lower. The first level targeted after support is $28.00 for short positions before pursuing a run at $25.00 per barrel and below. A break back above $32.60 indicates that WTI could be in for a further rebound to the upside, and possible correction targeting $38.00.

Conflicting Signals

Even though the technical indicators give a firm reading of further downside in store for crude oil prices, the fundamental situation remains slightly more delicate. Although supply and demand forces remain supportive of a bearish bias, the unfolding political drama might be more relevant. An unwelcome foreign military intervention in Syria would see tensions around the Arabian Peninsula rise to levels that could threaten both oil production and transit. If initiated under the pretense of eradicating terrorism, the forces defending Damascus could view the move as aggression that would activate a wider conflict dragging in other regional power brokers. In this scenario, prices could reverse from near multi-year lows, working back towards the high $30.00’s. However, if cooler heads prevail, 52-week lows are in play for savvy traders.

Disclosure: None.

Globalist regime change of any sovereign nation's leaders is not only immoral, but it is also illegal. Regime change comes from sources like Oded Yinon, written years ago but adopted by the neocons. But now maybe it is just about the money.