Outlook For Central Puerto (CEPU) When Lockup Expires Aug. 1

The 180-day lockup period for Central Puerto S.A. (CEPU) ends on August 1, 2018. When this six-month period ends, the company's pre-IPO shareholders and insiders will have the opportunity to sell large blocks of currently-restricted shares. The potential for a sudden increase in the volume of shares traded on the secondary market could cause a sudden, short-term downturn in CEPU's stock price when the lockup expires.

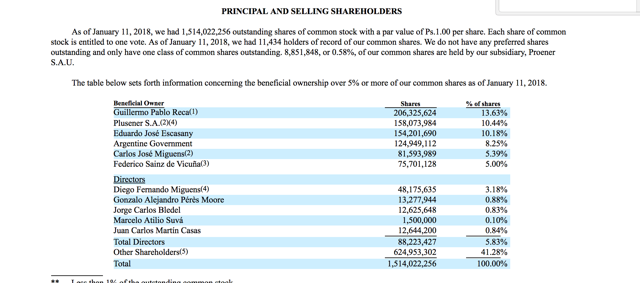

CEPU's group of pre-IPO shareholders and company insiders includes six large beneficial holders and one director with a greater than 1% stake.

(Source)

These individuals own the majority of outstanding shares - 53.29% - and are subject to 180-day lockup agreements.

(Source: F-1/A)

Currently, CEPU trades in the $10.50 to $11, lower than its IPO price of $16.50. Shares of Central Puerto started off well in the secondary market by closing on its first day of trading at $17.70. CEPU has a return from IPO of -36.1%.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this ...

more