Ontario: The Borderland Economy

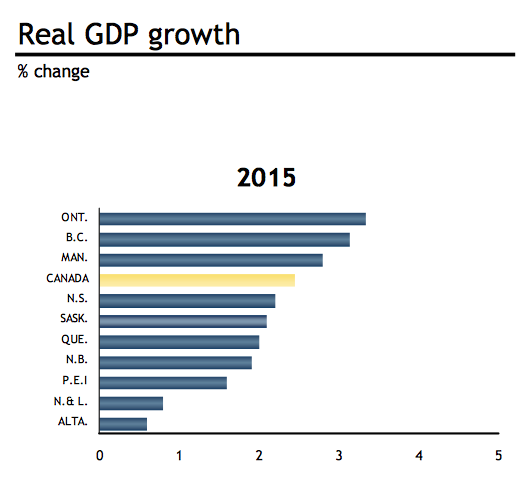

Source: Royal Bank of Canada, predictions of provincial economic growth for 2015, published March 2015

With western Canada hit disproportionately hard by the fall in oil and other commodity prices, Ontario, Canada's largest province, has begun to account for quite a large share of the country's economic growth. Many Canadian economists (most of whom live in Ontario, as I do) assume this economic resilience is the result of Ontario' economic diversity and size. Ontario's population is much larger than that of any other Canadian province (see graph below), and its economy is mixed between services (in Toronto), industry (southwestern Ontario), government (Ottawa), and commodities (northern Ontario). Ontario's economy is also more oriented toward the auto sector and suburban commuting than other provinces are, so it may be benefiting more from the fall in oil prices.

Ontario accounts for around 38 percent of Canada's population, compared to 23 percent for Quebec and 13 percent for British Columbia

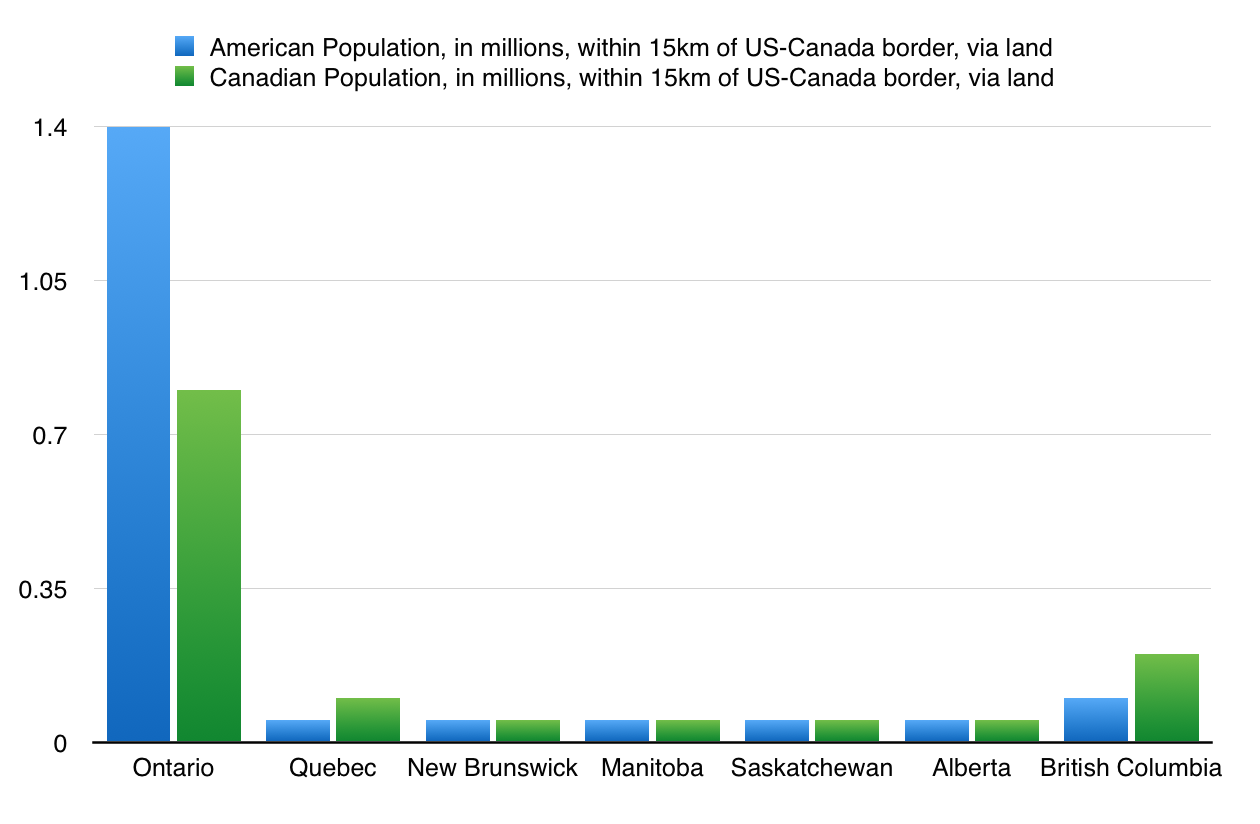

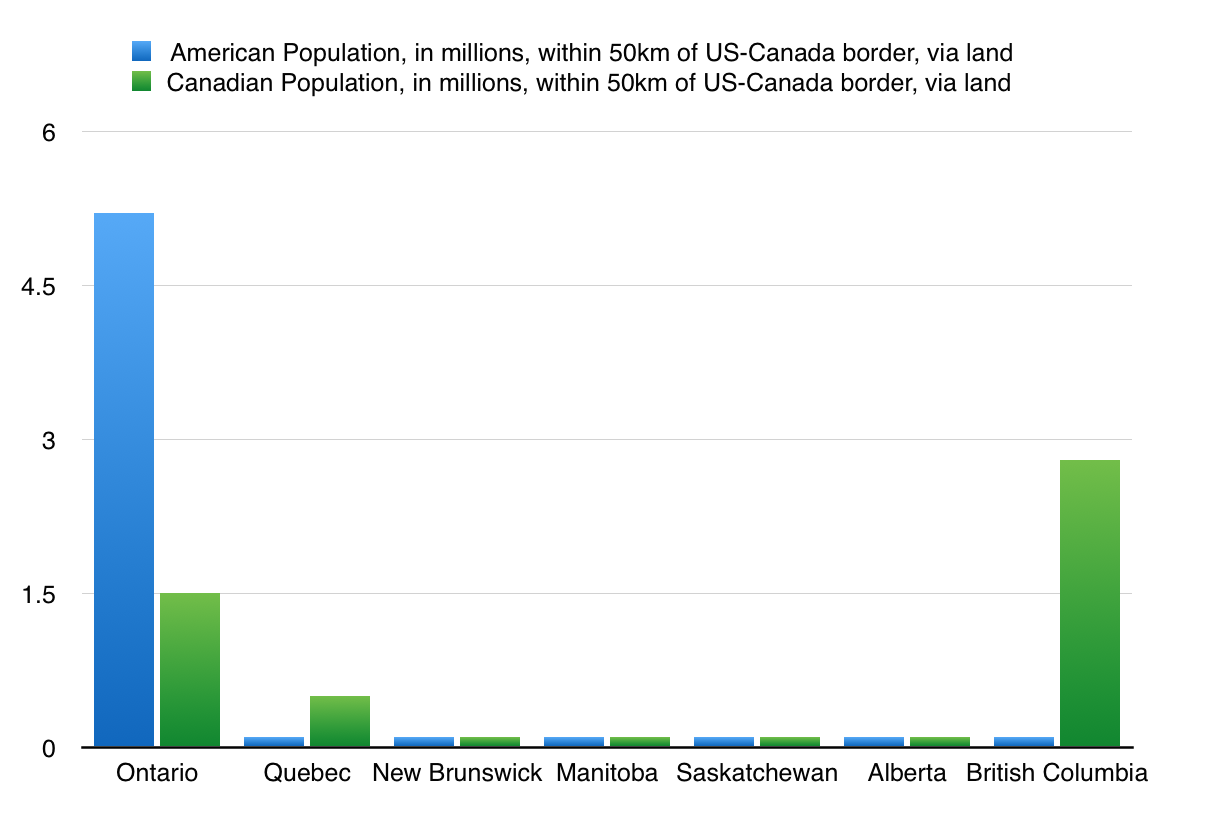

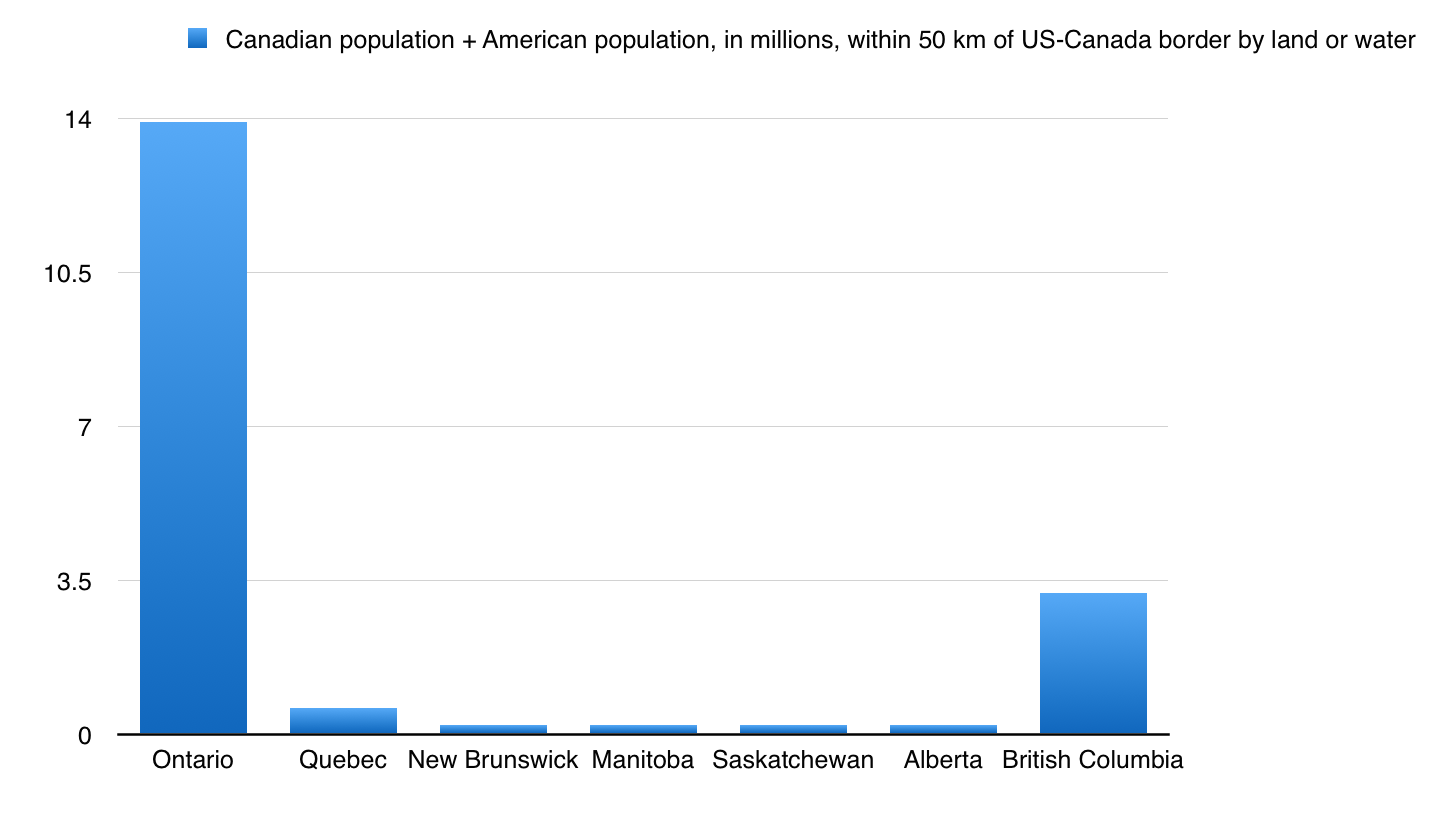

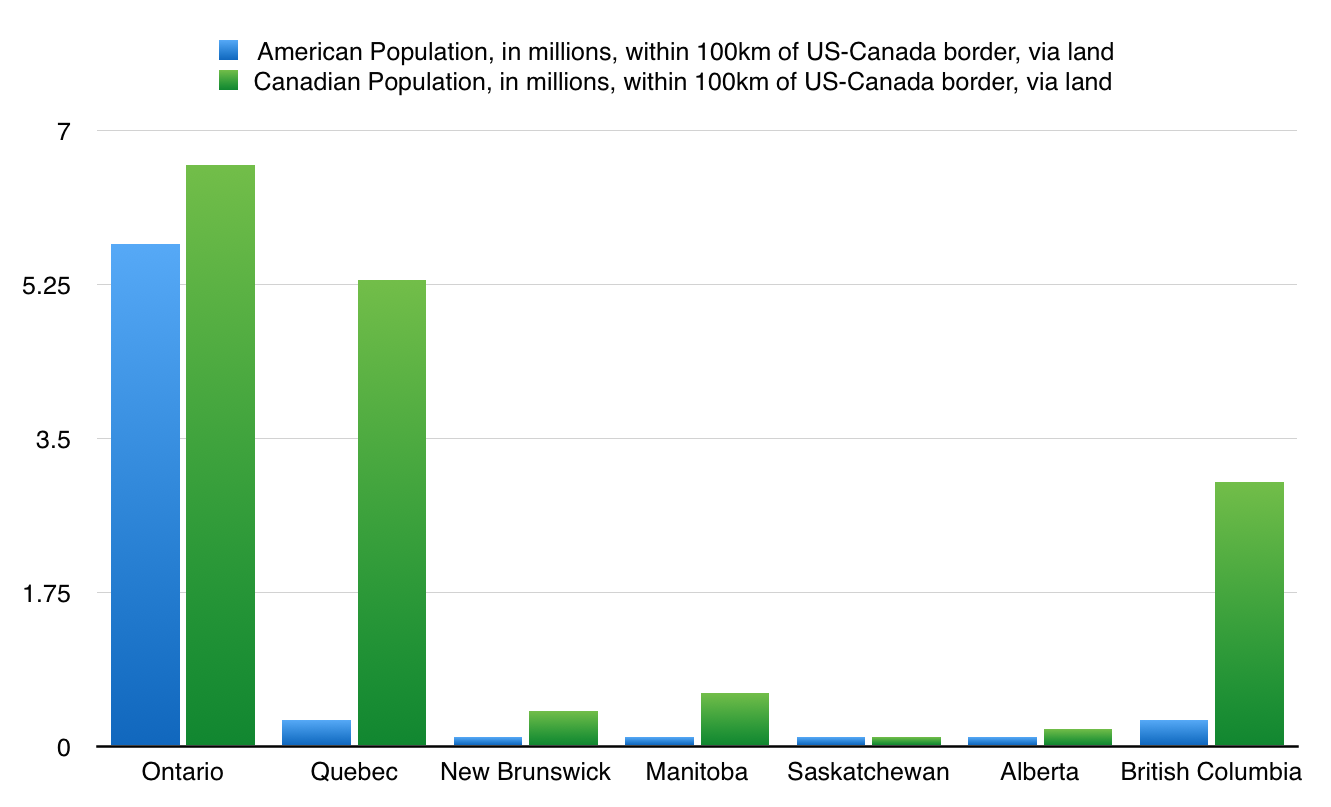

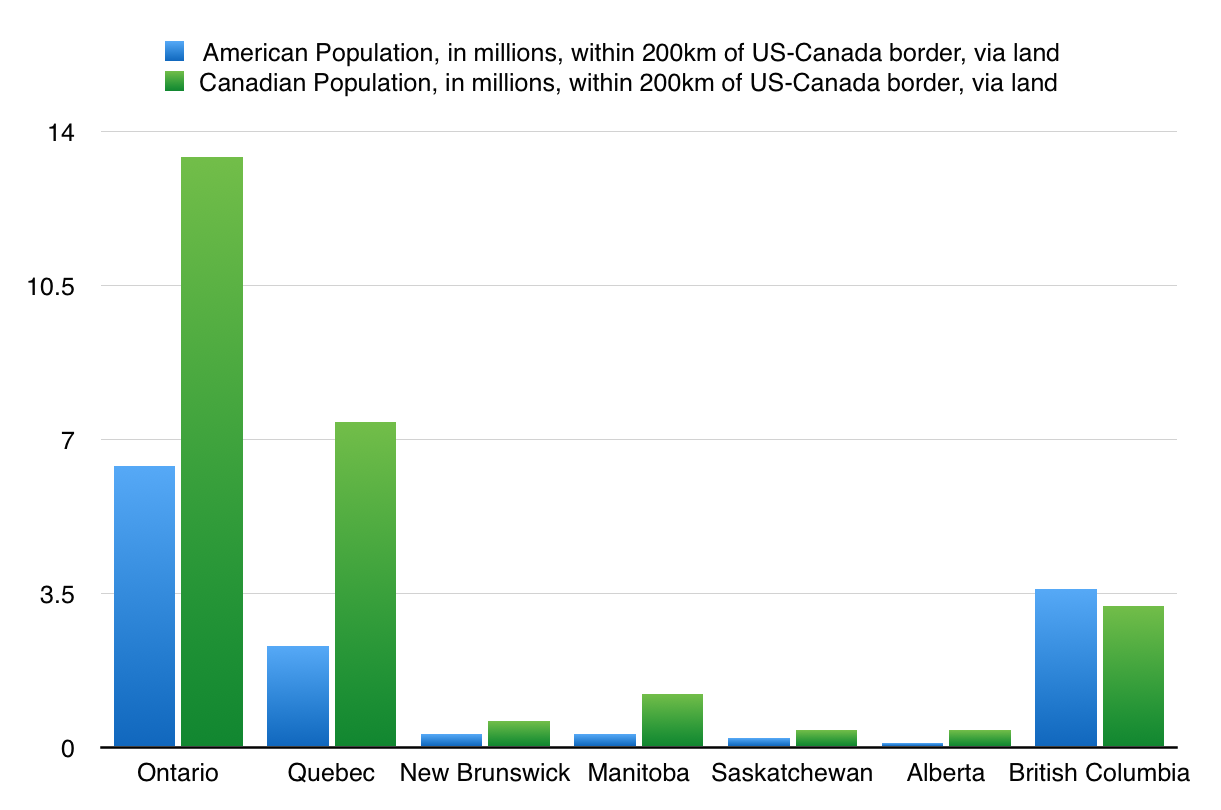

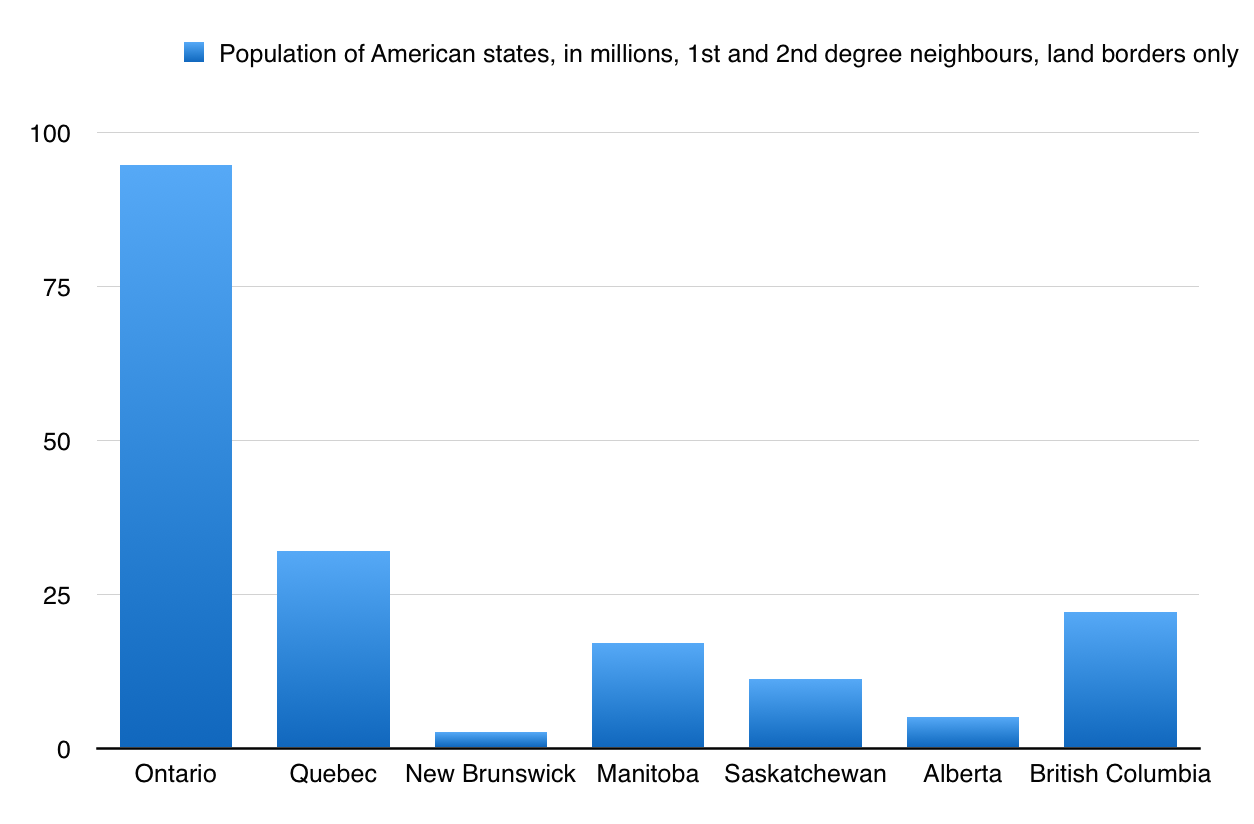

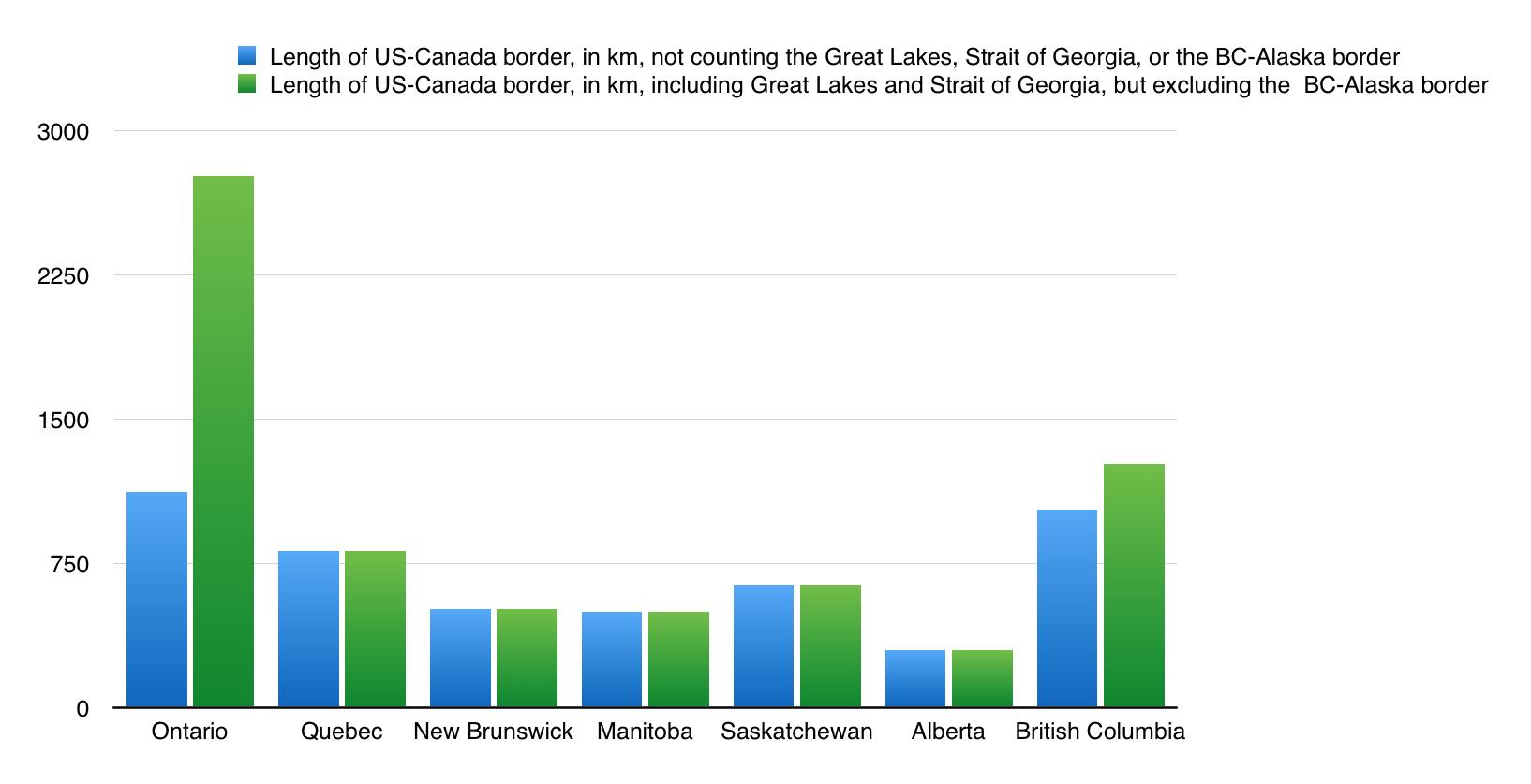

Still, this may be missing the point to a certain extent. What really sets Ontario aside from other Canadian provinces is the proximity of large population centres in Ontario to large population centres in the United States. This is unique among Canadian provinces - particularly if you ignore British Columbia (which, perhaps not incidentally, is the other major province that has decent economic growth right now, in spite of the fact that it is a significant commodity exporter and has close ties to oil-rich Alberta) and Quebec (which is separated from US populations by a linguistic barrier). Since the US economy, unlike those of Europe, East Asia, the developing world, or Canada, has remained strong, Ontario's ties to the US may be what is driving Ontario's economic growth. This should make Ontario concerned; the US economy has not had a recession for almost eight years now, so, in a certain sense at least, it is due for one soon.

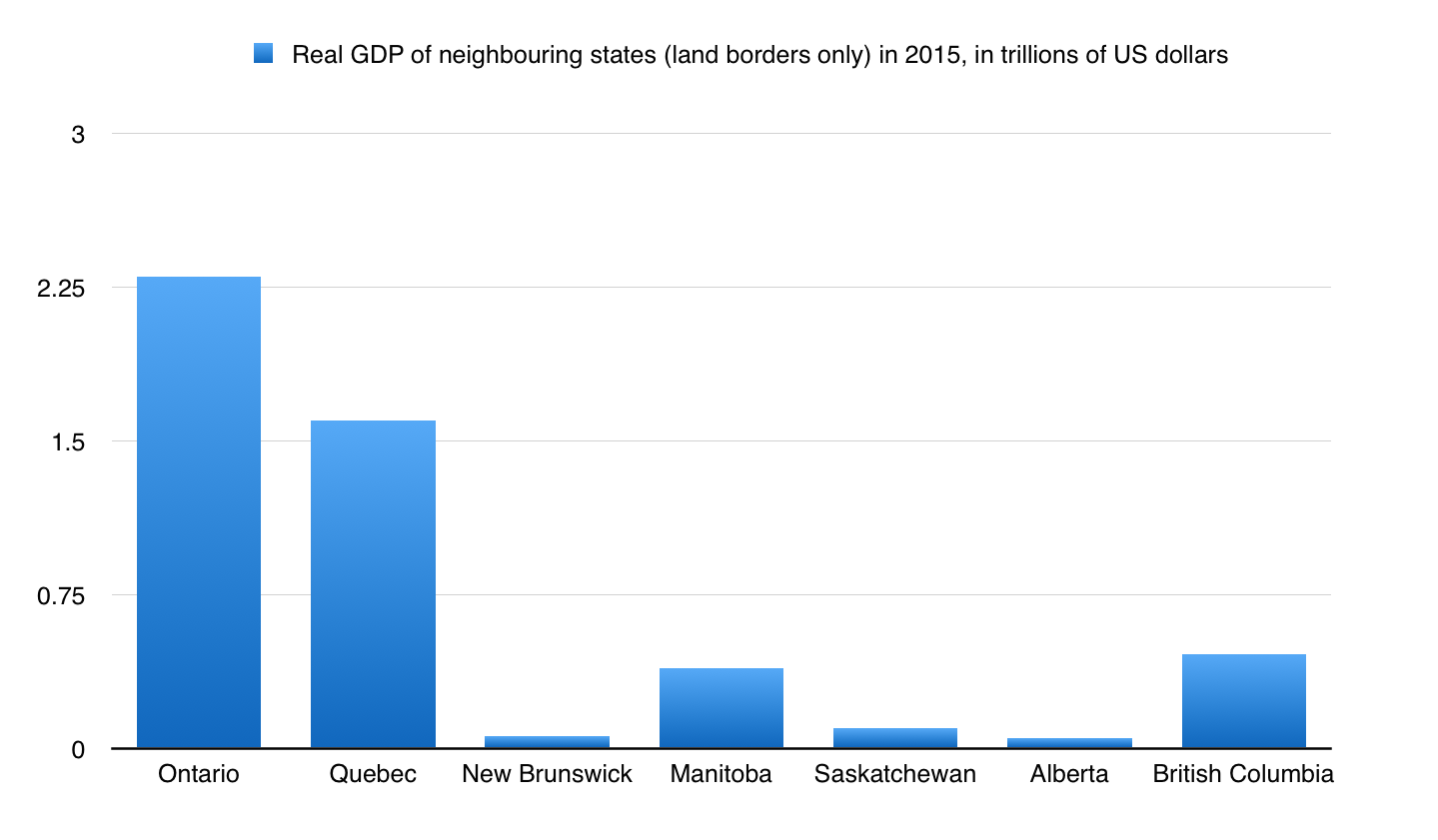

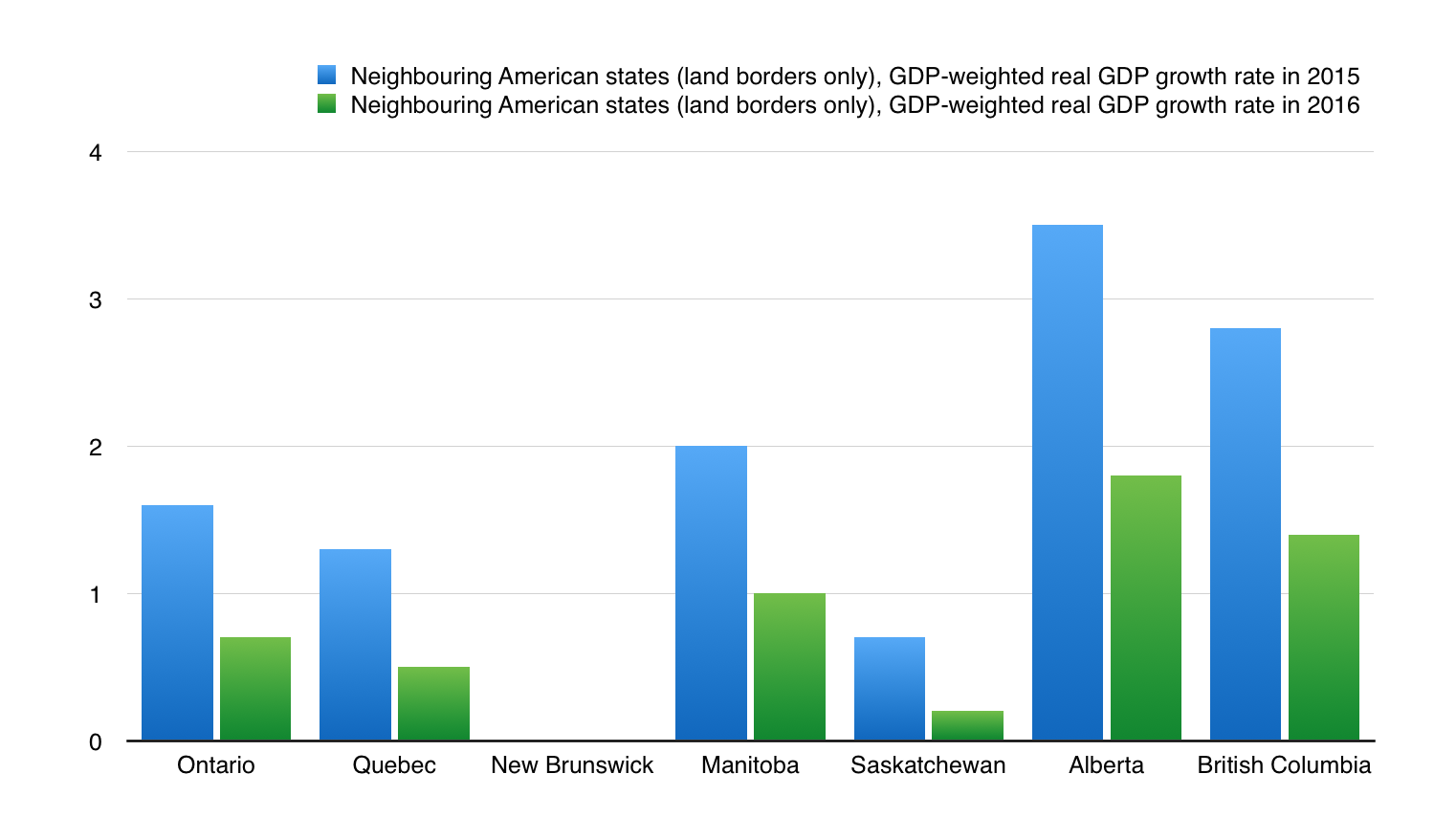

Below, I have tried to show the extent of Ontario's unique ties to the US. I've gathered all the data myself using Google Earth and recent Canadian and American censuses, so if you think you've found any errors in it please let me know.

New Brunswick had zero in these categories because Maine's economy has been neither growing nor shrinking in the past year or so. Alberta and BC are high in this category because of the growth of Washington state and Montana, respectively. (Washington state is growing so fast partly for the same reason as BC is growing: capital flight from China, which may not be sustainable for much longer). Saskatchewan and Manitoba were doing great in this category before the oil crash caused their shared neighbour North Dakota to go from the fastest-growing US state into a serious recession. Ontario and Quebec are roughly equal in this category because of the huge size of New York state, which they both border. However if you were to ignore New York state, then Ontario's border states, namely Michigan and Minnesota, are growing much faster than Quebec's border states, namely Maine, Vermont, and New Hampshire. Minnesota's growth, meanwhile, is also why Manitoba is relatively high in this category in spite of North Dakota's recession -- as Minnesota's GDP is nearly seven times higher than North Dakota's

Ontario's ties to the US have also meant that it is less dependent on inter-provincial trade of goods than other parts of Canada are: in recent years Ontario has conducted 2.5 times more trade with other countries -- overwhelmingly, the United States -- than it does with other provinces. This is compared to just 1-1.5 times more for Quebec, Alberta, and British Colombia.

Economists and financial journalists in Ontario need to be more careful than they have been in the recent past. During the 2007-2009 economic crises they ascribed the success of Canada's financial system (which is centred in Toronto, Ontario), relative to those of the US or Europe, to the fact that Canadian bankers and regulators were more prudent and conscientious than their peers in other countries, rather than to the fact that Canada was flush with capital at the time as a result of the sky-high commodity prices that existed just before and just after that period, and as a result of the fact that its Baby Boomers (Canada, unlike the younger US or older Japan, is dominated by the Baby Boomer generation) were then in the prime of their financial lives.

But instead of acknowledge these obvious facts, the Canadian media decided to help create a cult of personality around people like Bank of Canada leader Mark Carney -- a cult of personality they have since exported to Britain, where Carney has become a figure of great importance (especially since Brexit and the resignation of Prime Minister David Cameron) and the first non-Briton to ever become the central banker over the British financial system, a system that is far larger, far more worldly, and far less dependent on commodity sectors than the Canadian financial system is. Similarly, Ontario's economic resilience is now being described (by some people) as if it was an inherent condition of the Ontario economy, rather than a result, at least in part, of Ontario's dependence on the growing US economy.

Don't get me wrong: I am not saying that Ontario is not a resilient place or that bankers and regulators in Toronto and Ottawa are not prudent and wise. And certainly I would like Ontario to continue growing, since it is my home. Still, believing either one of these stereotypes about Ontario too much could be a dangerous mistake for investors or governments to continue to make.

Disclosure: None.