No Boom Without A Bust

By Steve Blumenthal

Last week’s mention of the great Art Cashin sent a number of emails my way. The one that touched me most was from Richard who worked for Paine Webber from 1974 to 1987. Back then every broker had a small speaker on his or her desk. We in the industry know it as the “squawk” box.

That early technology made Art available to all the reps all day, every day. Richard wrote me that Art would close each day saying,

“You know the rules, take care of yourself, put some joy into your life and all those around you that you think deserve it, and never, NEVER pass up a chance to kiss someone you love!”

Richard added, “I look forward to his wisdom being accessible once again.” Pretty great.

I had dinner with Art several years ago, along with my good friend John Mauldin. Art is as humble and likeable as you see him on TV. I wonder if he has any idea how many people he has touched. Shoot me an email if you’d like me to forward your name and email address to Art.

The big news this week is Mario Draghi and the ECB. Let’s look at that, but first let’s see if we can take a 30,000 foot view at the problem and how the markets might behave going forward.

Collectively, the number one global problem is DEBT. Can we grow our collective incomes in a healthy way that we are able to cover our debts? For long periods of time, debt helps to fuel growth but at some point it becomes too big. Think in terms of what you earn and what you have to spend after you pay your bills. When you have too much debt and more of your income goes to pay off your debt, you have less to spend on other things. Your economy slows.

On a larger scale, this is what is happening to economies most everywhere – Japan, U.S., Europe and China. So, in steps the central banks to goose the system. Step one, central banks lower rates. However, when rates go to zero, central banks have lost the power so they move to step two. Step two is quantitative easing “QE”, also known as large scale asset purchases. The Fed did this in the last recession and again recently. The ECB is doing it now and Japan on and off since 1991.

Step two causes asset prices to rise, but they then reach a point when valuations grow too rich and forward return potential is low. Steps one and two hope to activate our collective animal spending spirits.We feel wealthier so we spend…so the theory goes. After you’ve done step two several times, subsequent moves are less powerful. As Ray Dailo says in a recent Bloomberg interview (link below), and I mentioned several months ago, the central banks reach a point where they are “pushing on a string”.

So what comes next? We are likely moving to step 3, or “helicopter money”. This amounts to direct government spending to stimulate the economy. The idea is to force spending since the private sector isn’t doing enough.Who does that spending? The government. Print and spend.

I share some bullet point notes from the Dalio interview. Cutting to the chase, like me, he sees a low return environment (see Stick With the Drill and Expect More Money Printing), slow growth, low inflation and choppier markets for a period of time. He also talks about step 3. But check out the interview and/or my notes (links below).

Steps 1, 2 and 3: The point is that there are a few “bazookas” yet to be fired. It was all about the European Central Bank this week. Janet Yellen and the Fed step to center stage next week. One giveth and one taketh away? We’ll see. How it plays out remains uncertain though I have my thoughts.

Front of mind is that debt on top of too much debt won’t work. Zero to negative interest rates destroy price discovery and it hurts retiree income (further slows the economy). If 75% of the investable assets are going to be in the hands of pre-retirees and retirees (per Blackrock) by 2020, I just don’t think they are looking to spend more. Animal spirits? Right. Their income is being squeezed. Pensions, significantly underfunded, need 7% to 8%. No chance unless they meaningfully overweight to non-constrained alternative strategies (and they are not).

Let’s recognize that we are in a long-term debt cycle. Be aware that this is different than anything you and I have experienced thus far in our lives.

Ok – grab a coffee and let’s dive in. This week’s piece is a quick read.

Included in this week’s On My Radar:

- The Draghi Bazooka

- Reaction to ECB Announcement

- Ray Dalio – Bloomberg Radio Interview

- Red Ink Rising – China Cannot Escape The Economic Reckoning That A Debt Binge Brings

- Trade Signals – Investor Sentiment Neutral, Bullish on Bonds and Gold

Draghi’s Bazooka

It was all about the European Central Bank this week. Mario Draghi and his ECB lowered rates to -0.40% from -0.30%, increased QE (asset purchases) to €80 billion euros worth of bond purchases each month, which is an increase from the €60 billion euros presently, extended the stimulus until at least March 2017 and announced they will also be buying corporate debt. Negative interest rates, additional QE and for an extended time period. The markets loved it… until they didn’t… until they did.

“Rates will stay low, very low, for a long period of time and well past the horizon of our purchases,” Draghi declared. Kaboom – markets are higher today.

Reaction to ECB Rate Cut

As one blogger put it: This is not capitalism, or a functioning market: this is the end-game of legalized looting and financialization. What’s the value of real estate? If interest rates are pushed negative, then that gooses housing demand, as the cost of interest on a mortgage declines to near-zero in real terms.

What would the value be at 5% mortgage rates? What would the interest rate be in a truly private mortgage market, one that wasn’t dominated by government agencies and central banks? Nobody knows.

Once you lower interest to zero, the market can no longer price the difference between a mal-investment and a sound investment. Price and risk discovery are dead.

Prop up asset bubbles with direct asset purchases, and markets abandon valuations in favor of following the manipulation. Price discovery is dead.

Ray Dalio, Bridgewater Associates – Bloomberg Radio Interview

Thinking back to the squawk box days vs. what we have at our finger tips today is reason to be really grateful. You and I have instant access to some of the brightest minds amongst us. A few key strokes and send.

Bridgewater stewards the world’s largest hedge fund (roughly $155 billion). I’ve always preferred to listen to investors with real money on the line over research providers. There were several things that stood out to me in the interview and I bullet point them for you:

- Over a period of time, productivity matters the most – what you earn and what you have to spend.

- There is a long-term debt cycle.

- When you have too much debt and you can’t service it anymore and when rates go to zero, we have run out of monetary policy #1 and we have to go to #2 (QE) –this happened in recession and again recently.

- QE causes the assets to rise in price and future returns are then low. Now when you’ve done that, the next move is less powerful… pushing on a string.

- Japan was in this spot first (pushing on a string)… rates at zero. Going nowhere and still trying to get 2% inflation.

- Europe is there… rates are slightly positive to negative. So there too interest rates are not going to work… we are pushing on a string in Europe.

- S. – we are close to pushing on a string.

- Forward equity returns of about 4%. Some returns, but not much.

- So risk reward is not asymmetric – the bigger risk is on the downside vs. reward on upside.

- We are moving to monetary policy or step #3 (“MP3”) or “helicopter money”. It will not be QE – QE was asset purchases that helped financial institutions but stays in the financial community.

- Going to move to a policy that puts money directly in the hands of spenders. Print and lend directly to spenders… helicopter money.

- The central bank has capacity, legally, to put directly in the hands of spenders. There are a range of ways it can be done.

- These long-term debt cycles come once a lifetime, but in history they have regularly happened.

- May see the Fed raise the Fed Funds Rate up 25 bps or so, but the very next big move is down… we are heading to MP3.

- He believes the Fed is not paying enough attention to the LT debt cycle

- Asset prices correct to a point where the risk premiums come back (SB here: that is when we want to get aggressive on equities).

- Let me be clear, I am not bearish on the stock market. Investors make a choice in investing, cash (0% return), bonds (2%) or stocks (4%).

- When stocks go down, it has a negative wealth effect which has a negative effect on the economy. Problem is the Fed, at zero, doesn’t have the ability to ease. They have to do something else.

- There was a great dialog near the end of the interview. Dalio added, “Are you going to create a good strategic asset allocation portfolio meaning you are not going to go to the betting table and bet against active investors like me? It is not easy to win in the markets. In fact, it is more difficult to win in the markets than competing in the Olympics.”

- Long-term debt cycle is what we need to look at – the Fed is not looking at it.

- Japan is more likely of what our outcome will be – unless we restructure our debt somehow.

- Overall debt is too large. We are at limits of debt relative to the income we produce. Look at individuals and corporations as a country, then as each separate country, then collectively as a world. There is a limitation to how much debt.We can’t borrow more to grow our way out of this. We can’t borrow more that will help us out of the slow growth, low inflation problem.

- We have a low return environment, slow growth, low inflation. Increased difficulty of monetary policy (central banks) working.

- Not expecting anything like 2008. That was a debt crisis. Debts couldn’t get paid. Don’t see a big bang crisis.

- Going to see low returns, relative stagnation.

- Choppier markets for a period of time.

- See more currency volatility.

- Globally there is a tightening of economic activity.

- No one knows exactly what the market range is.

“The way that we succeed is by having thoughtful disagreement” – I liked that quote…“try to find people who are smart and who disagree with your point of view – need independent thinkers. If you can work your way through to get at the right answer…” – amen brother.

Finally, I found this to be highly on point: Dalio doesn’t think it is more difficult for him (Bridgewater) to invest today. The reason is that he doesn’t make systematic investments (i.e., equities for the long-term where a market crash can cause great loss. They have the opportunity to go either way (bet both up and down).

A few days ago marked the 7th anniversary of the bull market. Now in its 84th month, it’s the third longest bull market on record. It’s aged, over-priced and central bank activity is pushing on that string. More that can be done? Sure. We are in the midst of an economic experiment that is, as my father used to say, “not for the faint of heart.”

Put your head phones in and head out for a walk – it’s 20 minutes well spent.Here is the link again: Bloomberg Radio Interview

Red Ink Rising – China Cannot Escape The Economic Reckoning That A Debt Binge Brings

While all eyes are on Mario, the PBOC pulled its own surprise this week. They are changing the way the banks will account for non-performing loans. This may free up billions for new lending.

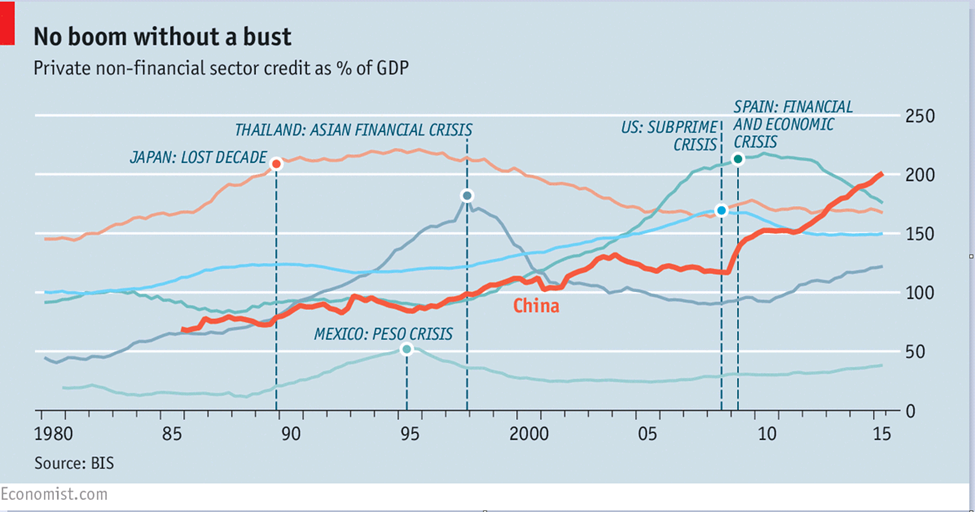

Get those quant goober goggles back out as you look at the next chart. Specifically, the dark orange China line which represents private non-financial sector credit as a % of GDP.Note Japan in 1989 (light orange line) and the U.S. in 2008 (blue line). Income can only grow so fast. Income can only cover so much debt. Is it any wonder we are seeing a global slowdown?

From the piece:

“HOW worrying are China’s debts? They are certainly enormous. At the end of 2015, the country’s total debt reached about 240% of GDP. Private debt, at 200% of GDP, is only slightly lower than it was in Japan at the onset of its lost decades, in 1991, and well above the level in America on the eve of the financial crisis of 2007-08 (see chart). Sooner or later China will have to reduce this pile of debt.

History suggests that the process of deleveraging will be painful, and not just for the Chinese.”

If you want to get a better sense for the headwinds that excess debt creates, this piece from The Economist does a great job. Here.

Trade Signals – Investor Sentiment Neutral, Bullish on Bonds and Gold

S&P 500® Index 1985

Included in this week’s Trade Signals:

Equity Trade Signals:

- CMG Ned Davis Research (NDR) Large Cap Momentum Index: Sell Signal – Bearish for Equities

- Long-term Trend (13/34-Week EMA) on the S&P 500®Index: Sell Signal – Bearish for Equities

- Volume Demand is greater than Volume Supply: Sell Signal – Bearish for Equities

- NDR Big Mo: See note below (active signal: buy signal on 3-4-16 at 1999.99).

Investor Sentiment Indicators:

- NDR Crowd Sentiment Poll: Neutral reading (short-term Bullish for Equities)

- Daily Trading Sentiment Composite: Neutral reading (short-term Neutral for Equities)

Fixed Income Trade Signals:

- Zweig Bond Model: Buy Signal

- High-Yield Model: Buy Signal

Economic Indicators:

- Don’t Fight the Tape or the Fed: Indicator Reading = +1 (Bullish for Equities)

- Global Recession Watch Indicator – High Global Recession Risk

- S. Recession Watch Indicator – Low U.S. Recession Risk

(S&P 500® Index monthly declines of -4.8% or greater below its five-month smoothing (MA) signaled recession 79% of the time: 1948 – Present). Data is updated each month end.)

Gold:

- 13-week vs. 34-week exponential moving average: Buy Signal – Bullish for Gold

Tactical — CMG Opportunistic All Asset Strategy (update):

- Relative Strength Leadership Trends: Utilities, Gold, Fixed Income, Muni Bonds and Telecom are showing strong relative strength. We’ve seen an increase in equity exposure with a trade this week out of Fixed Income and into Telecom (approximate 9% weighting).

Personal Note

“Downside hurts much more than upside might give benefit…clients get this.” – Neil Rue, CFA, Managing Director, Pension Consulting Alliance, LLC.

I’m not sure enough investors get this, though I’m sure you do.

To this end, motivated largely by a conversation I had with my Susan, I wrote an educational piece titled, The Merciless Math of Loss. Some time ago she asked me, “If there was one thing you should teach me about investing, what would that be?” I answered that the most important thing every investor should learn is how money compounds over time.

I then asked her, “If your investment account goes down 50% in value, how much do you have to earn to get back to even?” 50%, she answered. I told her that is what most people think. I said look at it this way, “if your account was worth $1,000,000 and you lost 50%, what is it worth?”$500,000, she answered. Then, after that decline, if you gain 50%, what would it be worth? She did the quick math then stopped and simply said, “oh” and added, “you have to tell everyone this”.

Susan is an extremely bright, Cornell University educated, human being. And beautiful! My point is we in the industry may get this, but it can be confusing to our clients who, like me with my electrician, really don’t get this business and further may have desire to know only so much. But they know if they made money over any period of time.

So I wrote the mathematics piece. Lose 20%, you need a 25% gain to get back to even. Lose 50%, one needs 100% to get back to even. Lose 75%, you need a 300% gain. Again, here is the link to the piece. Please feel free to use the charts that show how devastating loss can be. And we need to teach this stuff to our kids. Ok – I’ll stop.

Disclosure:

Past Performance is Not Necessarily Indicative of Future Results

“The Managed Futures Blog ...

more

"Once you lower interest to zero, the market can no longer price the difference between a mal-investment and a sound investment. Price and risk discovery are dead.", you are correct in this and it is pathetic that the Fed realizes this is occurring even at zirp. The issue is most of the mal-investment is banks getting zirp and less the rest of the market that still must pay some amount for the right to borrow. Even so, there are huge distortions in the market as a direct consequence of artificially low rates. Risk is also not being correctly weighted. The risk in most investments due to asset price increases, lower rates of return, and less financially stable players is frightening.

To all. Lower your debt and deleverage after 6 years into any cycle. Especially one which the Federal Reserve has almost no ability to lower rates if the market cracks.

If more people realized how far they have to climb back up after a financial crisis, I bet the number of people sitting on the sidelines right now would be much greater. After seven full years of a bull market, I'm more than happy to sit in mostly cash. I know how difficult it is to get back to even after a loss of 50%. This being the third longest bull market in history, my guess is that it is pretty exhausted now. Cash may prove to be as good as gold if the market starts to unravel this year.