More Oil Production And Weakening Gasoline Demand - Oil Market Still In Denial

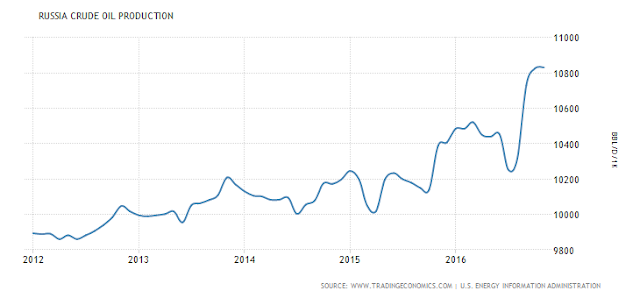

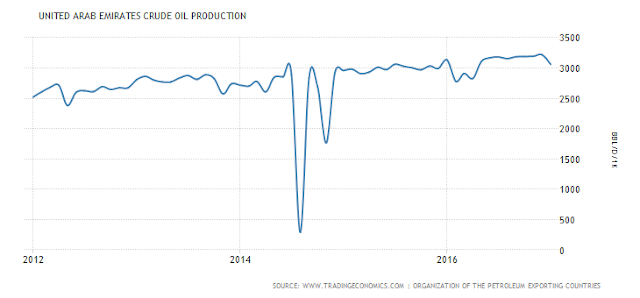

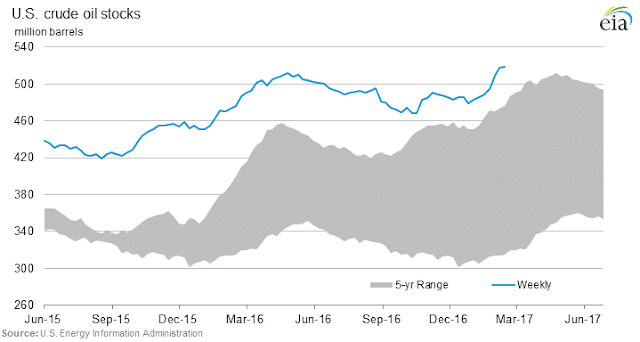

We discuss the oil market in a comprehensive manner in this video, and lay out why the economics of the oil market are not correctly aligned right now. The world oil market was not set up for both the Middle East and the United States to be pumping at record levels.

Conclusion

All we have done is kicked the can down the road a little further just like all the other half measures governments, agencies, industries, companies and financial markets do to avoid facing the nasty, hard reality that ultimately will have to be addressed where people take haircuts, lose money and real pain is felt.

The oil market is not fixed, we have made no progress whatsoever is addressing the poor fundamentals of the oversupply of the product versus the global demand for the product. This is basic economic theory: Oil prices need to go down further and stay there until oil producers stop producing oil and go out of business in the free market producing countries.

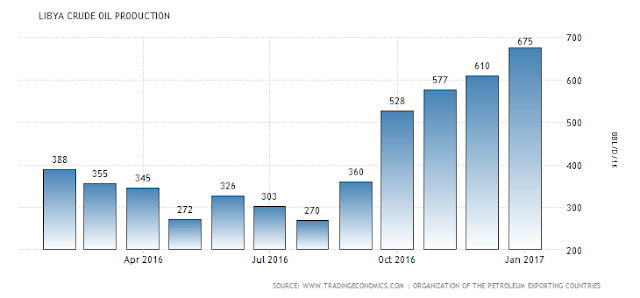

Lifting of US exports and OPEC short term cuts are only delaying the inevitable, because global demand is not going to be robust enough for the world oil producers to all stay in business, and we "grow" into a supply/demand oil market balance scenario. At least not in the next five years. If anything given the temporary measures of governments loading up on unsustainable debt, and central banks artificially lowering interest rates to maximum easy money levels to mitigate against the collapsing credit bubble, this has made demand since the 2008 financial crisis better than it should have been if we didn`t utilize these measures - all more short term measures, now the bill is coming due. The bad consequences of the high debt, deficit spending programs by governments around the world.

Somebody has to pay, you have to face economic reality, you have to have actual supply and demand matches, not monetary tricks that just kick the can down the road. Just like the oil market you can stay in business irrationally, and can load up on debt since 2008 around the world, but there are heavy prices to pay for these "artificial measures".

Well, the bill collector has arrived, the piper is going to be paid, and oil producers and governments are going to start defaulting on their debt obligations and large oil companies are going to go out of business.