Markets: Not A Pond

The ripple effects of US/China trade hopes and UK/EU Brexit deals dominated overnight trading. The mood isn’t great as the splash of tweets last week didn’t follow with a rock from China. The Xi comments from the China International Import Expo suggest the path for a US/China deal isn’t so obvious. He noted China's economy is "a sea, not a pond," so it can weather storms.

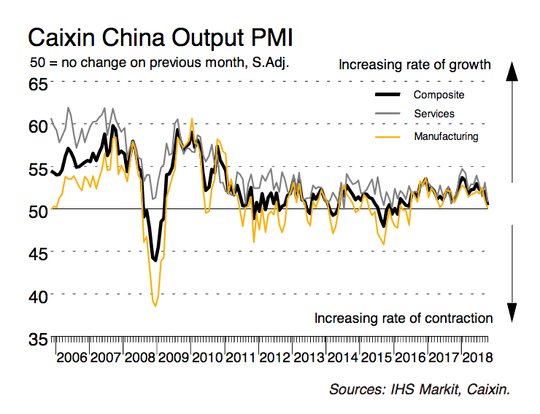

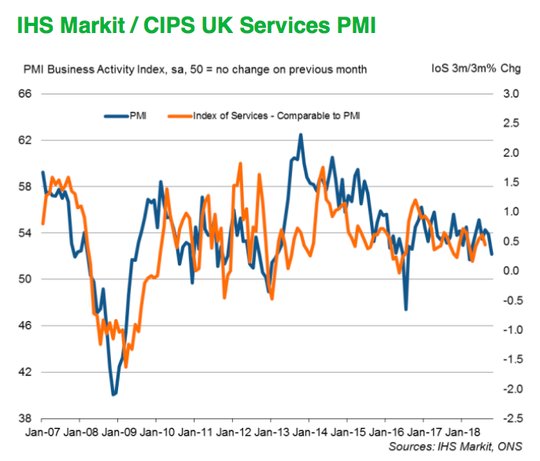

China is willing to quicken the negotiations of investment agreement with the EU and free trade zone with Japan and South Korea. China will continue to be a source of global growth and an active contributor to global governance. So the edge is off the rally in Asia and that means the EU calm may not last as the US markets open and reconsider positions ahead of a heavy week with elections tomorrow, FOMC on Thursday and plenty more economic data to consider.While the playbook for the week was supposed to be the ripple effect of bond yields hampering equity bullishness, this isn’t the wave for today.Instead we are still mired in growth concerns.China Composite Caixin PMI is at 28-month lows, UK Services PMI worst since the March snow storms. The exception and perhaps the most interesting outcome was the bounce in Japan services.

The most interesting story from today’s price action is in safe-haven demand remaining modest in JPY, CHF and Gold despite the pull-back in Asian stocks and EM FX.Markets are looking for a bigger ripple of hope rather than a rogue wave in this pond of modest trading ahead of the ocean of news ahead.The JPY weakness today stands out and confirms the broader uptrend belief – with 112.80 the pivot to watch today.

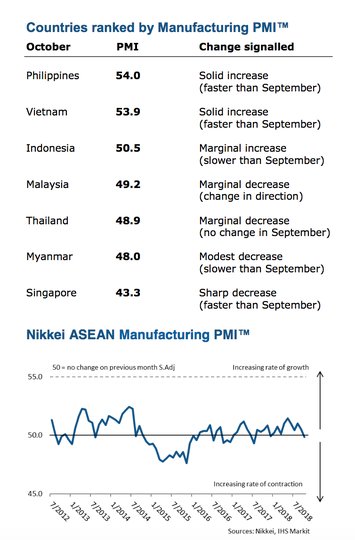

Question for the Day: Is the weakness in Asia manufacturing more than just US/China trade wars? The weakness of the growth data in Asia remains a key problem and the hope of a quick unwinding of that maybe too sanguine a view. The October ASEAN Manufacturing PMI report fell into contraction to 49.8 from 50.5 – first time for 2018 – with new orders falling the most in 2-years but with input inflation at 20-month highs. That is the key point to take away here as markets want to blame geopolitics but have to live with the day-to-day costs of doing business and here is where oil, industrial metals and the like all matter as they need to be countered with pushing this onto the consumer to keep profit margins alive. Expect this theme to remain in the background as the US considers 4Q outlooks and more 3Q earnings today.

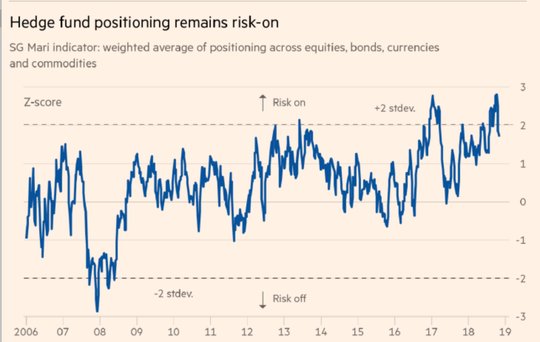

The lack of larger fears in Europe today maybe more about the view that easy money in Japan and Europe will remain and that any true economic weakness will give the FOMC pause in their hiking. We are in a position game now and the chart of the day is about Hedge Fund risk appetites – as SocGen suggests, we aren’t yet in a market that believes in bears.

What Happened?

- Japan October Services PMI jumps to 52.4 from 50.2 –better than 50.5 expected - best gain since April. New business growth rises near 5 1/2 year highs, but output prices lower even as input rises.

- BOJ Kuroda speech: Not a time for “big” policy. "Prices have improved steadily compared with five years ago, when the economy was suffering from deflation. Japan's economic activity and prices are no longer in a situation where decisively implementing large-scale policy to overcome deflation was judged as the most appropriate policy conduct, as was the case before," Kuroda said. However, Kuroda ruled out any imminent policy adjustment to mitigate side-effects, saying, "It has been taking time to achieve the 2% price target." "It has become necessary to persistently continue with powerful monetary easing while considering both the positive effects and side effects of monetary policy in a balanced manner," he added.

- China October Caixin Services PMI 50.8 from 53.1 – weaker than 52.9 expected – 13-month lows. The new orders fell to 50 – the worst in almost 10-years. Many companies noted shrinking demand, with confidence over the future at a three-month lows. The Composite PMI fell to 50.5 from 52.1 – weaker than the 51.9 expected – 28-month lows.

- German September VDMA machine orders 0% y/y with domestic orders +6% y/y but foreign -2% y/y. The 3M rolling average now 3%.

- Spanish October unemployment change 52,194 from 20,400 previously – as expected. Unemployment rose 1.63% m/m but fell 6.12% y/y. / cons confidence 90.6p 92e

- UK October Services PMI 52.2 from 53.9 – weaker than 53.3 expected – weakest since March. The second-lowest growth rate since July 2016 was attributed to "heightened economic uncertainty and a soft patch for new work," according to IHS. Moderate rise in activity and strong input cost inflation continuing noted as well.

Market Recap:

Equities: The S&P500 futures are off 0.1% after losing 0.63% Friday. The Stoxx Europe is up 0.2% while the MSCI Asia Pacific fell 0.9%.

- Japan Nikkei off 1.55% to 21,898.99

- Korea Kospi off 0.91% to 2,076.92

- Hong Kong Hang Seng off 2.08% 25,934.39

- China Shanghai Composite off 41% to 2,666.43

- Australia ASX off 0.52% to 5,904.80

- India NSE50 off 0.27% to 10,524

- UK FTSE so far up 0.25% to 7,110

- German DAX so far up 0.15% to 11,538

- French CAC40 so far up 15% 5,111

- Italian FTSE so far off 0.4% to 19,316

Fixed Income: Quietly bid with risk moderate and US/China trade hopes a bit lower. European bonds are back to watching periphery with Lega beating 5-Star in polls the excuse for Italian selling.German 10-year Bund yields are up 0.5bps to 0.43%, UK Gilts up 3bps to 1.517% and Fenc OATs up 1.2bps to 0.79% while Italy is up 3.5bps to 3.35%, Spain is up 0.5bps to 1.57%, Portugal flat at 1.875% and Greece up 1.5bpst o 4.225%.

- The Netherlands sold E1.53bn of new 6-month Apr 30 DTC at -0.655% with 1.62 cover – previously 0.65% with 1.34 cover.

- US Bonds are bid with eye on equities, US/China hopes – 2Y off 0.8bps to 2.895%, 5Y off 1.2bps to 3.021%, 10Y off 1.1bps to 3.20% and 30 off 0.5bps to 3.449%.

- Japan JGBs stable with eye on equities and BOJ Kuroda – 2Y off 0.2bps to -0.138%, 5Y off 0.1bps to -0.094%, 10Y up 0.4bps to 0.118%, 30Y off 0.1bps to 0.869%. BOJ left 10-25Y buying unchanged at Y180bn with offer to cover 3.16 down from 4.36 while 25Y plus buying also steady at Y50 and offer was 3.51 from 4.59.

- Australian bonds lower despite watching equities, China with US catch up trade and modest 30Y sale. 3Y yields up 2.5bps to 2.075%, 10Y up 5bps to 2.74%. AOFM sold A$500mn of 30Y 3% Mar 2047 TB150 bonds at 3.233% with 2.618 cover.

- China PBOC skips open market operations, but conducts CNY403.5bn in MLF, net leaving liquidity unchanged. Money market rates were mixed with 7-day up 2bps to 2.621% and O/N off 5bps to 2.415%. The 2Y up 2.6bps to 3.03%, 5Y off 1.5bps to 3.335% and 10Y bond yields fell 2bps to 3.52%.

Foreign Exchange: The US dollar index is up 0.1% to 96.60 with range 96.44-96.61 and focus on 97 resistance. In emerging markets, the USD is bid – EMEA: ZAR off 0.45% to 14.358, RUB off 0.3% to 66.38, TRY off 0.5% to 5.4550; ASIA: TWD off 0.3% to 30.75, KRW off 0.15% to 1123.5, INR off 0.95% to 73.13.

- EUR: 1.1370 off 0.15%. Range 1.1366-1.1408 with focus on US/China and policy this week, 1.13-1.15 consolidation.

- JPY: 113.25 up 0.1%. Range 113.11-113.34 with EUR/JPY 128.80 off 0.1% - focus is on BOJ vs. US/China with 112.50-113.80 keys.

- GBP: 1.3005 up 0.25%. Range 1.2970-1.3065 with EUR/GBP .8745 off 0.4% - Brexit deal hopes high driving and counter PMI miss. 1.30 pivot point for 1.2880 or 1.3180.

- AUD: .7190 flat. Range .7182-.7224 with metals lower, China story unwinding a bit, .7250 caps. NZD off 0.1% to 0.6655 with RBNZ key this week.

- CAD: 1.3100 off 0.1%. Range 1.3088-1.3113 with focus on US rates, focus is on 1.3050-1.3150 for momentum today.

- CHF: 1.0060 up 0.25%. Range 1.0013-1.0069 with EUR/CHF 1.1440 up 0.1% - despite BTP pain – focus is on safe-haven unwind still and 1.0080 pivot for 1.02 target.

- CNY: 6.8976 fixed 0.57% stronger from 6.9371, The weekly RMB index fell 0.01% to 92.31 on the week, down 2.68% on the year.

Commodities: Oil lower, Gold lower, Copper lower -0.7% to $2.8310.

- Oil: $62.80 off 0.55%. Range $62.52-$563.12. Watching 200-day at $65.38 against $62.32 June 16 lows and then $60. Brent off 0.25% to $72.66 with focus on 55-day at $78.44 vs. 200-day at $72.43. Iran sanctions start today, headlines about Kurdistan exports weekend fodder.

- Gold: $1232.15 off 0.1%. Range $1231-$1234. Gold watching $1212 Oct 31 lows against $1243.50 Oct 26 highs. Silver up 0.2% to $14.74 with focus on $14.50 as it needs $14.915 Friday highs and $15 to break for momentum.

Economic Calendar:

- 0810 am BOC Poloz speech

- 0945 am US Oct final Services PMI 53.5p 54.7e

- 1000 am US Oct Services ISM 61.6p 59.3e

- 1130 am US 3M and 6M bill auction

- 0100 am US $37bn 3Y note auction

- 0200 am Fed 3Q Senior Loan Officer Survey

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

When your middle class is larger than the entire USA population, you can get by without arrogant North America. There is power in numbers, and that can only mean trouble for nations that trust the USA more than 4.5 billion Asians.