Low U.K. Unemployment Rate Not A Signal For Rate Hike

The Bank of England announced U.K.’s lowest unemployment rate of 4.5% in 45 years thereby triggering comments across the media channels that a rate hike could be next on the cards. However, when you look at the entire basket of numbers released on the most recent jobs report, it could be unwise to jump into hiking the base interest rate, especially given the fact that inflation slowed last month contrary to predictions.

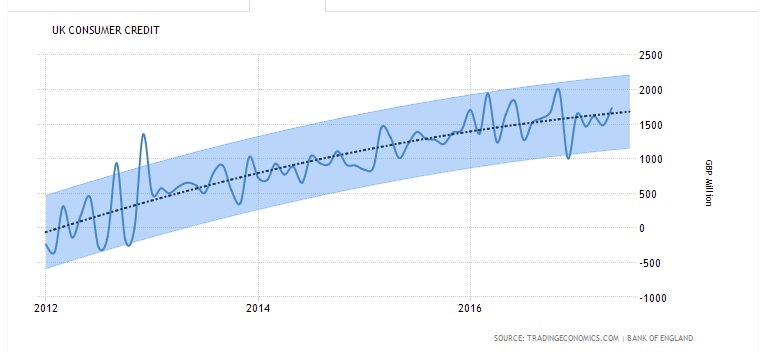

This is because, despite the impressive unemployment rate posted, wages remain low while the U.K. Household Debt to GDP ratio continues to rise. While it is correct to assume that a majority of this debt is tied to the mainstream lending sector, an increase in the unemployment rate could push some of the borrowers to source for loans in the alternative lending markets that include lenders that offer loans to unemployed people. And while the overall consumer credit numbers indicate an upward trending movement, it hasn’t been smooth at all. So, it is hard to predict where it’s actually going next.

As for the wages, the most recent numbers based on research done by the Office for National Statistics (ONS) indicate that the total pay for employees in the U.K., including bonuses, fell by 0.7% in real terms between March-May 2016 and March-May 2017.

While it has been reported that some of the Bank of England committee members voted for a rate hike during a meeting held in Scotland a few weeks ago, there are those who believe that the economy is yet to reach a level that calls for a rate hike. The U.K. unemployment rate has been falling over the last 12 months dropping by 0.4 percentage points since August last year to 4.5% in May 2017.

Based on the current forecasts, the rate is expected to remain at this level for the next few months, but if the Bank of England hikes rates, this could change. A higher base interest rate would trigger a rise in lending rates. This is not always a good thing for an economy especially when it’s on a recovery trail.

In a situation where the economic recovery is overblown, then raising interest rates could easily put more people out of jobs, in turn, increasing the unemployment rate. The low-interest rates experienced over the last few years have helped to boost consumer lending/borrowing and this is evident by the way household debt has increased over the last two years.

Illustratively, U.K. Household Debt to GDP has increased from about 85.7% in July 2015, to about 88.2% in October last year before dropping slightly to 87.6 in January this year. While the movement in percentage terms may appear to be small, when you convert the 2.5 percentage movement to monetary terms the figure is significantly huge.

And even despite the slight slowdown posted early this year, forecasts seem to point towards a continuation of the current trend of a rising U.K. Household Debt to GDP.

In November last year, the U.K. consumer credit jumped to about GBP 2 billion, the highest level in over 10 years. In the following month, it dropped to just over GBP 1 billion. This could be related to seasonality. However, when you look at the following few months, the movement has been equally choppy oscillating between GBP 1.6 billion and GBP 1.4 billion from one month to the next through April this year before jumping again to 1.732 billion in May.

Consumer credit is one of the main indicators that economists use to measure consumer confidence levels in an economy, and when the curve rises smoothly, then that indicates high confidence levels. The current picture is far from smooth and this indicates elevated levels of uncertainty in the status of the economy. Therefore, rising interest rates could hurt the economy, which could affect various markets including the credit market.

Conclusion

In summary, the current levels of the U.K. unemployment are encouraging. Some analysts believe that it’s about time the Bank of England raised rates to keep up with the likes of the U.S. but this may require caution given the fact some key economic indicators are not as impressive the unemployment rate.

Therefore, it might take some time before the Bank of England raises rates contrary to the current market opinion, but a surprise cannot be ruled out either.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more