Is The Australian Property Market Due A Correction?

The global property market has experienced a booming period over the last few years with some regions approaching the levels reached in the period before the financial crises 2008/2009. The same trend has continued since the turn of the year, albeit a few signs here and there that have indicated the possibility of a meltdown in various parts of the world. Among them, is Australia, which many analysts suggest that a market correction could be on the horizon in various cities.

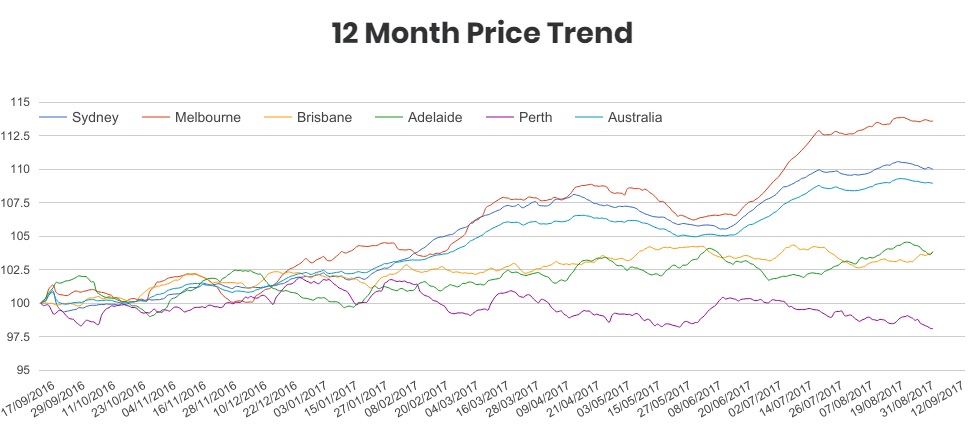

In the 12-month period ended February 2017, Australian property prices surged 12% on average while Sydney witnessed an increase of 18.9%. This triggered fear of a potential property bubble, but some analysts have allayed those fears saying that the most realistic thing that could happen in the Australian property market in the coming quarters is a correction. The prices slowed during May and June, but since then, they appear to have clawed their way back to new highs as shown on the chart below. Data courtesy of CoreLogic.

(Click on image to enlarge)

Melbourne and Sydney experienced the highest spikes in property prices during the month of July while Brisbane, Adelaide, and Perth remained generally subdued. In August, things cooled off across the board and analysts expect this trend to continue to the end of the year. However, some players in the market are a little more bullish. According to Bricks and Agent, an Australian-based online portal used to compare real estate agents and vendors, there is still an insatiable demand in the property market and there is no guarantee that a correction could come within the next few quarters as predicted by most analysts.

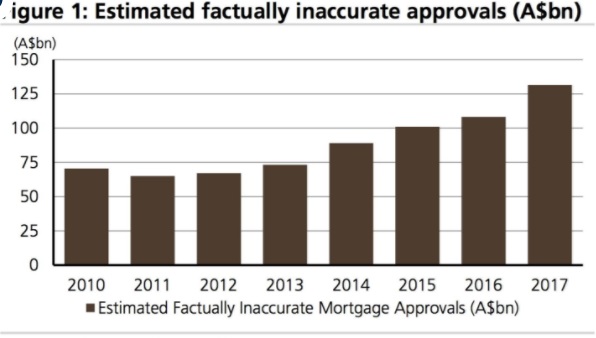

This claim has, however, been overshadowed by a recent report published by UBS. According to the UBS banking report, the Australian Housing market is built on $500 million worth of factually inaccurate mortgage approvals and this could spell a disaster if not checked within the next few months.

One of the reasons behind this is the extremely low lending rates, which are set to rise when the Reserve Bank of Australia hikes the base interest rate (cash rate).

In a note in July, UBS Economist George Tharenou said any rush to raise interest rates by the RBA could trigger a crash in the property market.

As demonstrated in the chart above from the UBS report, there has been a sharp rise in the value of inaccurate mortgage approvals this year when compared with the average increment in the preceding years since 2014. This, coupled with the inevitable hike in interest rates, poses a huge threat to the credit market and consequently, the housing market in the foreseeable future.

"We still see rates on hold in the coming year, amid macro-prudential tightening on credit growth and interest only loans. Hence, we still see a correction [in the property market], but not a collapse, but if the RBA hikes too early or too much [as hinted in its minutes], it risks triggering a crash," Tharenou warned.

Now, since UBS released this report, the Australian housing market has experienced subdued period as investors and mortgage borrowers take note. Speculation about a rate hike in the coming quarters has also cooled off, which means the most likely direction for the housing market is now a correction rather than a crash.

Conclusion

In summary, Australia’s top cities Melbourne and Sydney are among the world’s most expensive places to live in right now in terms of housing. These two cities and several others across the world could be harboring potential property bubbles. When these bubbles burst is still the big unknown in the market, but analysts are optimistic that the most likely up-shots in the coming quarters could be a correction, rather than a burst.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more