Is Now The Time To Invest In Frontier Markets?

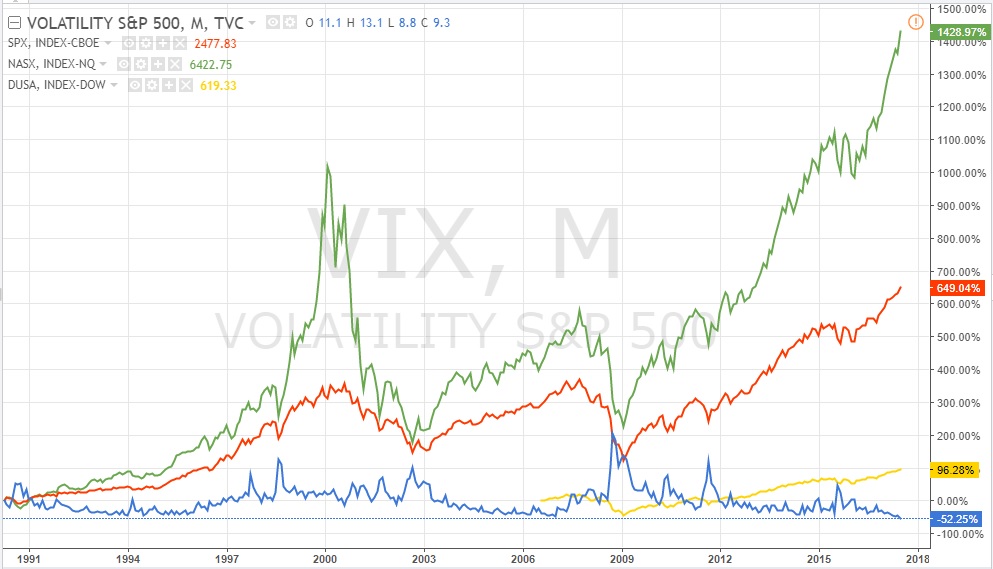

The Volatility S&P 500 Index (VIX) dropped to the lowest level in history to trade at just under $9.50 this month. Low volatility is viewed as a positive sign when it comes to long-term investing as this simply implies low investment risk.

As such, investors find it more secure to take long-term positions thereby increasing activity in the market. Simply put, this is the time that also attracts new investors to the market whereas, there are few departures.

However, during such a period, stocks tend to be overpriced because more investors assume that due to market stability, stock prices will continue to go up. In addition, low volatility also increases the uptake of credit in the lending market. This is because lending institutions also tend to have more confidence in the ability of their borrowers to settle their debts.

This results in more money in the market, which in turn continues to push stock prices up. The US stock market indexes are all at all-time highs, so where are the opportunities?

As such, when volatility is low investments are unlikely to genuinely undervalued stocks since the market is either fairly-priced or overpriced. This also aligns well with the analogy that high-risk investment opportunities result in high returns and vice versa.

So, where exactly do you find value when market volatility in developed countries is low? The answer is simple. Emerging markets provide a good option. However, investing in frontier markets is likely to provide the right balance to investments in low-risk assets.

Frontier markets are slightly behind emerging markets in terms of development, however, there are a few that stand out for investment. To identify these unique markets, investors can do so by analyzing a range of factors that drive growth and opportunity in an economy.

These include countries and regions with rising levels of urbanization, stable geopolitical environment, and high population growth rates. All these factors are good catalysts for investment opportunities in frontier markets but they must also be accompanied by good health statistics and limited obstacles to investment.

With urbanization, opportunities are ripe in real estate investments, the renewable energy market, and the construction industry while rising population creates a market for goods and services, cheap labor and opportunities in the education sector.

However, while such opportunities may appeal to investors from all walks of life, some countries make it very difficult for foreign investors to capitalize. Some have very strict foreign investor policies that give priority to local industries while others are geopolitically unstable. This is why such markets are viewed to have a high investment risk and with it, high returns.

Furthermore, market information is not readily accessible while trading activity is not as vibrant as in the developed countries. This increases liquidity risk and the potential for market manipulation. Therefore, buying equities in the frontier markets possesses a unique challenge of its own. Nonetheless, there are other avenues which are more viable for foreign investors.

One of the most common investment vehicles in the frontier markets is buying real estate. Given the increasing rate of urbanization in these markets, property prices are rising rapidly and this could provide a moderate risk investment opportunity with a potential for high returns.

Alternatively, since some of these markets are growing at incredible rates, locally based businesses are bound to benefit in the foreseeable future. As such, investors can also benefit by investing in locally-based businesses, either through venture capitalism or private equity ownership.

One of the main reasons why the frontier markets look exciting for investment is that due to globalization and the advances in technology, they are taking a shorter period to catch up with the developed world. It used to take decades to move up a level in the development rankings, over the last few decades this has been cut down to just a few years with the likes of Singapore, Malaysia, and Indonesia being perfect examples.

While a majority of African, South American, and Asian countries are yet to be ranked among the emerging markets, most are perfectly placed for frontier market investing. Some of them have double digit economic growth rates with a huge chunk of their populations aged between late-teens to mid-20s. In addition, urbanization is also peaking with more cities cropping up while major cities continue to grow. It is the perfect environment for a continuous economic growth and this creates unmeasurable opportunities for aggressive investors.

Conclusion

In summary, risk is a critical element when it comes to investing for capital gains. Based on the latest VIX data, it seems to be currently pegged at a historical low, which means that the market is less likely to present any good opportunities for aggressive investors. To this end, some analysts are already speculating that quant funds may be forced to pull out some of their investments due to lack of volatility in the market.

US stock market indexes are all at historical highs and analysts are already worried that there might be a market correction soon. These further limits opportunities in the market and this suggests that it might be the right time to explore opportunities in the emerging markets and the frontier markets.

And the weird fact is that when stock prices seem to be continuously rising, that’s when most first-time investors tend to join—in the belief that the rally will continue. On the contrary, wise investors do the opposite by pulling out some of their investments and seeking value in other markets with growth opportunities.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more