Is Japan Falling Back Into Deflation? Only One Monetary Solution Left

One has to ask if Japan is falling back into deflation. Certainly the dollar failed to strengthen as promised, and that would have helped the BoJ. The Fed is probably going to try to raise rates to help Japan. That could cause a devaluation in China, and that would be a shock. The fragility of the world economy is pretty evident right now. Japan needs a stronger dollar and China could use a weaker dollar.

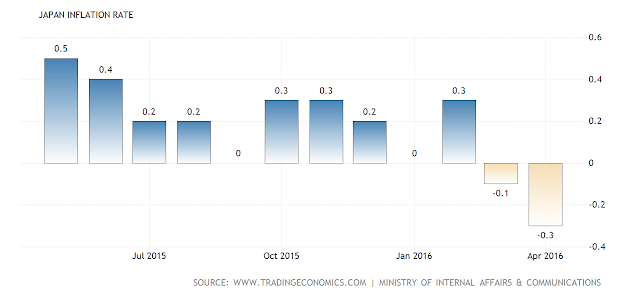

Here is a Japanese inflation chart:

source: tradingeconomics.com

The policy of creating inflation is slipping. Inflation is becoming something longed for, not something clearly attainable. Japanese risky bets are an indication that banks are expecting inflation, taking the inflation side of bets, while investors are still expecting deflation, taking the floating, low rate side of the bets.

Clearly, two months do not indicate a trend, but the higher inflation trend of early 2015 has been crushed. Abenomics is simply not succeeding. In the face of a stronger dollar, it is time for helicopter money in Japan. The population is shrinking, and therefore each citizen needs more money to spend.There is too much debt, so base money that bypasses traditional QE is simply the only sensible tool the BoJ has left. The BoJ has nothing else left except to threaten the world with a Lehman Brothers moment.

But here is what Japan really needs right now:

The helicopter money (HM) debate that he (Eric Lonergan) started was based on the concept made famous by Milton Friedman. Whatever you think about Friedman, or about neoliberalism, or about monetarism in general, put that all aside. HM is different and better and more fair, and could at least slow the divide between rich and poor. Helicopter money has been called QE for the people but that is not quite right...

...It is important to understand that some in central banking appear to be in love with the concepts of negative interest rates and breaking the zero lower bound with nominal rates. If that is the case, then helicopter money, though a far better idea, will never be implemented.

This would be a big mistake for monetary policy. I hope this love affair with negative is not a sinister plan on the part of some in central banking. If it is sinister, we will have to all shout louder in our commitment to helicopter money, but understand clearly what it is and what it does.

Let's put it into an easy to understand concept. You are a kid and you are with your buddies playing Monopoly. It is 100 degrees outside and you want to stay indoors. You want to keep the game going, but some players are washing out. The banker simply gives them more money to continue the game, with a one time gift to everyone equally, and in the real world it would be the central banker who controls base money. The Monopoly game continues on until sunset when everyone can go outside.

The only limits of the Monopoly game is that the creators of the game do not make a large enough bank. Maybe that is why I liked the Easy Money game better. More liquidity.

Central bankers have big enough banks, unless you are trapped in the Eurozone. But most often these bankers would rather push everyone outside when it is hot, and then wonder why their policies are not working. They are like the monopoly creators, and don't create enough money for people who will spend it. The only thing different from Monopoly that I can see in my analogy, is that Helicopter Money money will go equally to the renters of those little green houses on the Monopoly board, not just to the investors playing the game! (There really are not any renters because those houses are just too tiny! But if there were they would have received Monopoly HM.)

I don't feel sorry for Japan, in a way. Here is a nation that has a slow birth rate, and an aging population, ripe for deflationary pressures. Yet the government has allowed the nation to engage 40 percent of the entire population in temporary work and in contract work. Wages in those jobs are 60 percent below regular, full time wages. Equal pay for equal work has gone by the wayside in the USA, as home workers are paid less than their regularly employed counterparts. But Japan has taken this temp work to the extreme. Some of that can be fixed.

And it would not hurt for the safety net to be expanded for legal residents. Japanese often look down upon foreign workers. For a nation slowly declining in population that is just crazy.

Expanding the money supply is key to Japanese prosperity. There is plenty of money at the top for investment. There is not enough money for main street. Sounds like the USA, only worse.

Mitsumari Kumagai has written a piece in the Japan Times detailing problems and solutions for Japan as he sees them. He complains that government policy has allowed the hollowing out of industry by not pursuing growth in industry. Many industries thus moved offshore.

But then, Abenomics corrected some of the issues, and got the economy and job creation going again. But alas, Mr Kumagai says that fiscal policy must now take over from monetary policy. But then he says fiscal responsibility must temper this fiscal aggressiveness. Getting fiscal does not sound like a solution to me. And more austerity doesn't sound like a solution either.

Everyone, including Mr Kumagai, wants to give up on monetary policy without trying helicopter money. Real HM does not require debt based spending, but rather base money creating demand in the economy.

The author is correct that Abenomics has not given small business the same breaks that we see in large companies in Japan. That is true in the USA as well. Helping small business helps those who create the most jobs. There is nothing wrong with that.

But when you are bumping along the zero lower bound you need to start dropping the money from the Skytree, before you say monetary policy is now failing.

There is hope, of course, that the Fed may try to accommodate Japan some. The Fed is predisposed to keep the economy in the US slow, because all the banks bet on lower rates, among many reasons. But the Fed sees how Donald Trump is doing and sees the unhappiness of many rank and file Americans. So, a little growth is likely in the cards, but not much. I doubt if our Fed will solve the Japanese deflationary problem.

For further reading:

Nick Rowe, Willem Buiter*, Paul de Grauwe and Simon Wren-Lewis

(These are the economists who agree with Lonergan that base money is not a debt)

(Lonergan's helicopter money articles on his blog)

Pros and Cons of Helicopter Money-Bernanke Misunderstood

Federal Reserve Mandates Slow Growth. So Fed Must Finance American Infrastructure

Central Banker ProCyclical Craziness

China Could Be the Next Basel Victim or Not

Larry Summers 100 Dollar Bill Ban and Westfalia Lost

Clearing Up Negative Interest Rate Confusion. Kocherlakota Weighs In

*Buiter, some will remember, has also called for a cashless society. That cashless concept, an attack on main street, would be rendered completely unnecessary if helicopter money were implemented.

Disclosure: I am not an investment counselor nor am I an attorney so my views are not to be considered investment advice.

The Federal Reserve is copying Japan right into the zirp Q/E hole. The issue is that it leads nowhere but where its hot and lava-like. Japan is seeing that negative rates is close to the mantle. It makes no one better. Rather it will make things worse. Climbing out of hell is not fun.

Sadly, the Federal Reserve also wants to go swimming in lava and wants to try taking money from you for holding money (negative rates). In this system, you have little to no power and they have all the power. This is not capitalism, it's much closer if not completely a socialistic managed economy. You might as well put 666 on your head and declare yourself a slave now.

If the people would demand that the Fed pay out HM, it would change things on main street. But most people have no clue what the central bank does, or doesn't do.