Is China’s Currency Undervalued? A Reality Check

Short answer: maybe, but probably not.

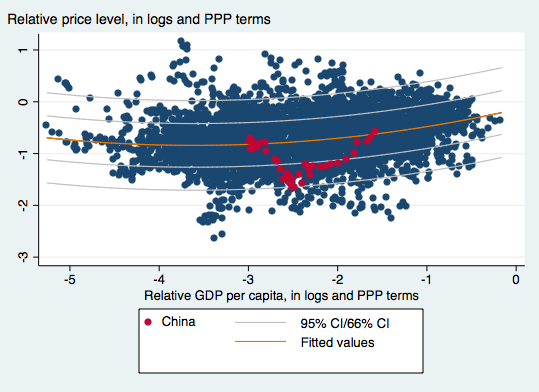

Relying on the relationship between inflation adjusted exchange rates and per capita income (i.e., the Penn effect), China’s currency appears to be near where it’s to be expected, as of 2011.

Figure 1: OLS quadratic fit of price level on per capita income (red line), 66% and 95% prediction intervals; CNY in solid red circles. Sample is developing countries, using PWT8.1 data. Source: Cheung, Chinn and Nong, “Estimating Currency Misalignment Using the Penn Effect: It’s Not As Simple As It Looks,” mimeo (5 March 2017).

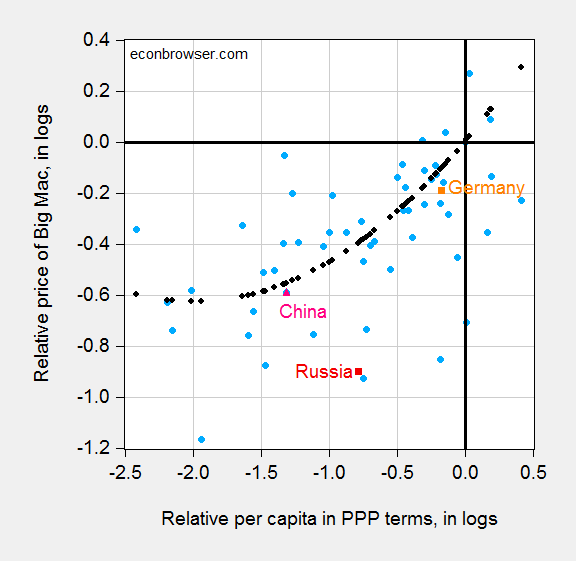

2011 was a few years ago; since then the Chinese yuan has appreciated in value despite recent weakness. Using the Big Mac index, China appears not far off predicted value as of July 2016.

Figure 2: Log relative dollar price of Big Mac against dollar price of US Big Mac (July 2016) versus log relative per capita income in PPP terms (2016 estimates); regression fit from quadratic specification (black dots). Source: Economist, World Bank World Development Indicators, and author’s calculations. Data [XLSX]

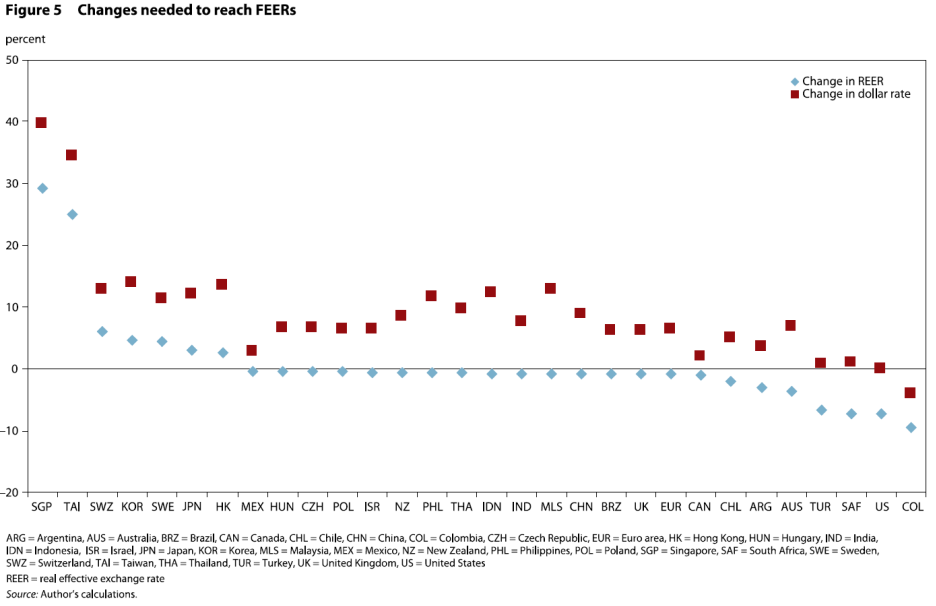

Obviously, there are many different approaches [1]. I’ll cite the Fundamental Equilibrium Exchange Rate approach used by William Cline at the Peterson Institute for International Economics. Figure 5 from the Brief depicts the amount of exchange rate change (in real multilateral terms, or in USD terms) in order to achieve FEER levels, roughly medium term equilibrium. “Down” denotes depreciation.

Source: William Cline, “Estimates of Fundamental Equilibrium Exchange Rates,” Policy Brief 16-6, May 2016.

Using this approach, the required change to hit the target FEER is negligible for China, suggesting rough equilibrium.

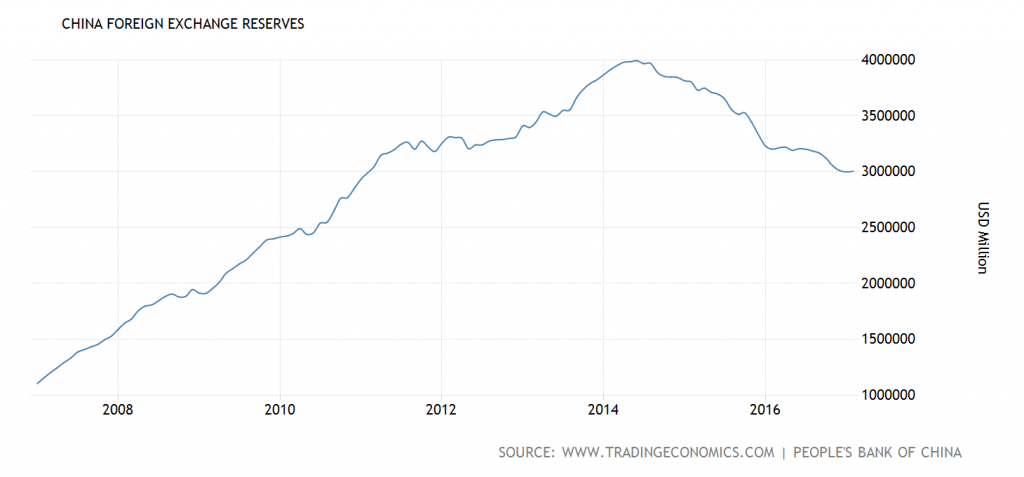

Finally, there is the most simple approach — is the PBoC accumulating Forex reserves to keep the CNY weak, or decumulating them? At a gross level (there are nuances), the answer seems pretty obvious.

Figure 3: Chinese foreign exchange reserves. Source: TradingEconomics.

In other words, asserting a drastically undervalued Chinese currency is so 2005… (or maybe 2010…)

For metrics utilized by the US Treasury, as designated in 2016 legislation, see this post.

Disclosure: None.