IPO Looks Bright For Chinese Education Company Bright Scholar

Bright Scholar Education (Pending: BEDU) has filed for a $200 million IPO in the U.S. The IPO is expected for Wednesday 5.18; Bright Scholar is expected to offer 15 million shares at a price range of $8 to $10 per share.

The company plans to use proceeds to launch new schools and for curriculum design, brand promotion and marketing, as well as, other development and research efforts.

Underwriters for the IPO include: Morgan Stanley, Deutsche Bank, China Merchants Securities, BNP Paribas

Assuming Bright Scholar prices at the mid-point of its proposed range, it would have a market cap value of $1.05B and trade at a price/sales ratio of 9.01x.

We first covered the deal on our IPO Insights Platform.

Company Overview

Founded in 1994, the Chinese K-12 education company consists of more than 6,000 employees and operates 51 schools as of February 28, 2017. Headquartered in Foshan, China, Bright Scholar operates 34 kindergartens, 11 bilingual schools and six international schools in seven provinces. The company also runs 16 learning centers in Foshan, Shenzhen, Shanghai and Beijing, China. In the first half of the 2017 school year, the company indicated an average of 29,230 total students enrolled at its institutions.

The company's mission is to deliver world-class education to students in China and across the globe and to prepare students for education overseas. As of September 1, 2016, the company is the largest operator of bilingual and international K-12 schools in China in terms of student enrollment.

The company is partly owned by Chinese property tycoon Yeung Kwok-keung's family. Yeung's sister, Ms. Meirong Yang and daughter, Ms. Huiyan Yang, own 92.59% stake in Bright Scholar. Following the completion of the IPO, Ms. Meirong Yang and Ms. Huiyan Yang will own 63.12% and 17.39%, respectively.

(S-1/A)

Executive Management Highlights

Huiyan Yang is one of Asia's richest women and major owner of the company. She co-founded some of their first schools and now serves as a director and chairperson. Her family founded Country Garden Holdings, China's third-largest property developer. Yang graduated from Ohio State University with a bachelor degree in marketing and logistics. She received the "China Charity Award Special Contribution Award" in 2008

Junli He served as Chief Executive Officer and Director of Bright Scholar, positions he has held since October 2015. Prior to joining, He founded and served as CEO of Time Education China Holdings Ltd. He also served as CEO and director of Noah Education Holdings, a private education services provider in China (2009 - 2011).

Financial Outlook

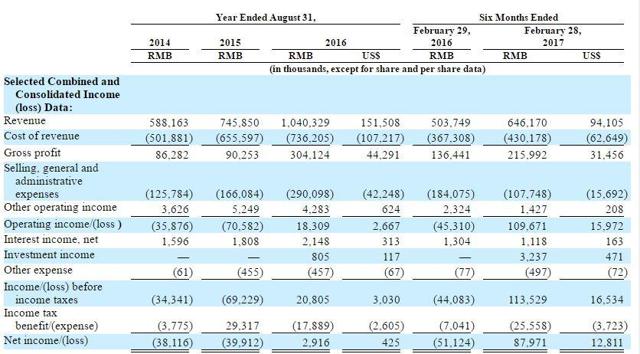

The company has steadily grown revenue and reported a net profit in the most recent fiscal year. Revenue generated was: RMB588.2M, RMB745.9M, and RMB1.04B (US$151.5 million) in 2014, 2015, and 2016, respectively, representing a CAGR of 33%. Revenue has continued to increase in 2017; from RMB503.7 million in the six months ended 02.29.16, to RMB646.2 million (US$94.1 million) from the same time period in 2017.

Net income increased from a net loss of RMB38.1M and RMB39.9M in 2014 and 2015 to a net gain of RMB2.9M in 2016. As of February 2017, it had cash and cash equivalents of RMB637.6M and total liabilities of RMB1.4B.

(S-1/A)

Market Space and Competition

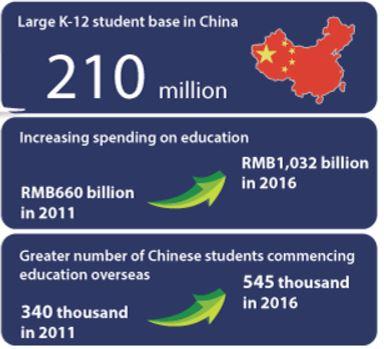

In China, the education service market is competitive, highly fragmented and rapidly evolving. However, the education sector in China has performed well and is positioned to continue growth, with the middle class in China growing rapidly and Chinese families spending a greater percentage of income on children's education. According to the Frost & Sullivan report, the market for K-12 education in China grew from RMB99.2 billion in 2011 to RMB217.3 billion in 2016 and is expected to reach RMB370.3 billion in 2021.

Competitors include: Maple Leaf schools (Private), Nord Anglia schools (NYSE:NORD), and China's TAL Education Group (NYSE:TAL). Assuming Bright Scholar prices at the mid-point of its price range, it would trade at a price/sales ratio of 9.01x. This well below TAL, which trades at a price/sales ratio of 16.7x and above that of NORD, which trades at 3.91x.

A price/sales ratio between the two companies appears reasonable to us, given Bright Scholars' growth rate and gross margins.

|

Market Cap |

Revenue Growth (3 Yrs) |

Price/Sales |

|

|

BEDU |

1.05B |

33.0% |

9.01x |

|

TAL |

10.2B |

42.50% |

16.70x |

|

NORD |

3.35B |

18.94% |

3.91x |

(GoogleFinance)

Conclusion: Consider An Allocation

A growing Chinese education market is good news for Bright Scholar.

We believe the company is well-positioned for success, based on its reputation and brand recognition, scalable business model, teaching quality and ability to recruit and retain students and teaching staff.

The company needs to improve operating margins and show that is can sustain profitability, but it appears to be on a good track. Given its strong growth, and recent profitability, we recommend investors consider a small allocation in this upcoming IPO.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in BEDU over the next 72 hours.

Disclaimer: I wrote this article myself, and it ...

more