Investors Brace Themselves For Possible EM Contagion

The Turkish balance of payments crisis threatens to spread to key emerging markets which have amassed huge foreign currency debts, especially in the private sector. If the Turkish economy can be knocked so heavily off course, the fear is that South Africa, India, Indonesia, Argentina and, possibly Brazil, could be next line to rattle international investors.

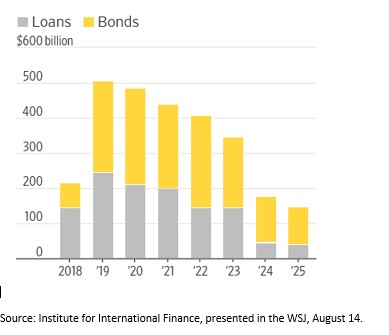

According to the Institute for International Finance, who flagged debt problems for Turkey several months ago, emerging markets have accumulated $2.7 trillion in U.S. dollar-denominated debt that comes due between now and the end of 2025. More importantly, the largest amount of this debt is due for repayment or re-financing in 2019. (Figure 1).Much of this debt was acquired during the period when the Federal Reserve was flooding the international markets under its program of quantitative easing. Investors were encouraged to stretch for yield, to adopt more risk-taking in the expectation that greater liquidity would promote capital investment. Investors embraced this approach whole-heartily and flooded the emerging markets with dollars.

Figure 1: Emerging Market Debt in USD, by year of Maturity

What lies behind the fears in the international credit markets? At a time when so much debt iscoming due, the Federal Reserve has adopted a policy of rising interest rates as well as shrinking its balance sheet. These tightening measures are depriving the banking system of short term liquidity and thus are affecting investors at home and abroad.[1].

The result is a stronger US dollar (weaker emerging market currencies) which makes it tougher to pay back that dollar-dominated debt, particularly for countries where they rely so heavily on exports to generate the needed dollars. This problem is becoming more acute, almost daily, as the Trump Administration unleased protection measures in response to domestic political pressures. The fallout continues as several emerging currencies get hard hit by investors fearing further trade deficits and possible loan defaults. So far, a few European banks with the largest exposure to Turkey have experienced fall off in share value.g. While most analysts do not foresee a systemic threat to the European banking system, investors, nevertheless, are keeping a watchful eye on developments in Turkey and elsewhere. As the saying goes, “there is never just one cockroach in the kitchen”.

The focus is now on the credit markets as these markets cope with foreign debts amounting to nearly 50% of their GDP in some cases. Unlike balance of payments crisis in the past, much of the external debt is owed to private corporations which makes it very difficult for these countries to turn to the IMF for bailouts, such was the case with Greece during the 2012 EU debt crisis.

[1] When It Comes To Financial Crises In The Emerging Markets, History Repeats Itself All Too Often