Inflation Rises To 1.7% In Germany

German inflation rose to 1.7% and European inflation increased to 1.1% in December. In a Reuters article, it was stated that these inflation numbers show the dovish ECB policies are working. Firstly, the inflation mainly came from energy. Therefore, OPEC takes more credit for the European inflation than the ECB. Secondly, the policy goal is insane. I don’t see any evidence that proves to me an inflation rate just below 2% is a magic number which creates prosperity. I have a problem with inflation targeting when inflation is below the target, because having a goal of increasing prices hurts consumers. When inflation is above the target, I’m happy to see hawkish tones.

The difference in my philosophy with the ECB’s Keynesian one goes back to the debate between demand and supply side economics. They believe rising prices are caused by rising demand which is a signal of a healthy economy. I believe production creates growth because when producers grow their businesses it creates demand for products. There’s not a stationary demand that always exists. If businesses didn’t create jobs, there would be no demand. We won’t solve this disagreement here, so I’ll leave it at that. We must use their logic to determine their next steps.

German consumer prices increased 1.7% which was much higher than the 1.3% inflation expected. This was the largest sequential increase on record as inflation was only 0.7% in November. The 1.7% inflation is the largest rate since July 2013. Brent increased 12.6% in December which was the largest increase since April. Oil prices may rise more because the OPEC cuts started January 1st. The inflation in energy should lead to inflation in other areas such as food because it’s a raw material used in its production. Food prices already are increasing in Germany as a majority of states saw food prices increase by at least 3%.

The fact that Germany had faster inflation than the average inflation rate in Europe is the exact worst case scenario because Germany is already angry about the ECB’s extension of the QE policy until December to help the Italian economy. If inflation rises to 2% in Germany, there will be calls for Draghi to end the $60 billion per month in QE prematurely. The problem is the ECB needs to buy bonds to keep the market stable in a politically uncertain time period. This further escalates tensions between Germany and Italy. As I said, the inflation increases have been caused by OPEC cuts driving oil prices higher, but the German media and voters will blame Draghi for the inflation. If oil prices rally particularly hard, it could even impact the re-election bid by Angela Merkel. A weakened Merkel already adds uncertainty to the markets; if she loses, it will only further increase the uncertainty.

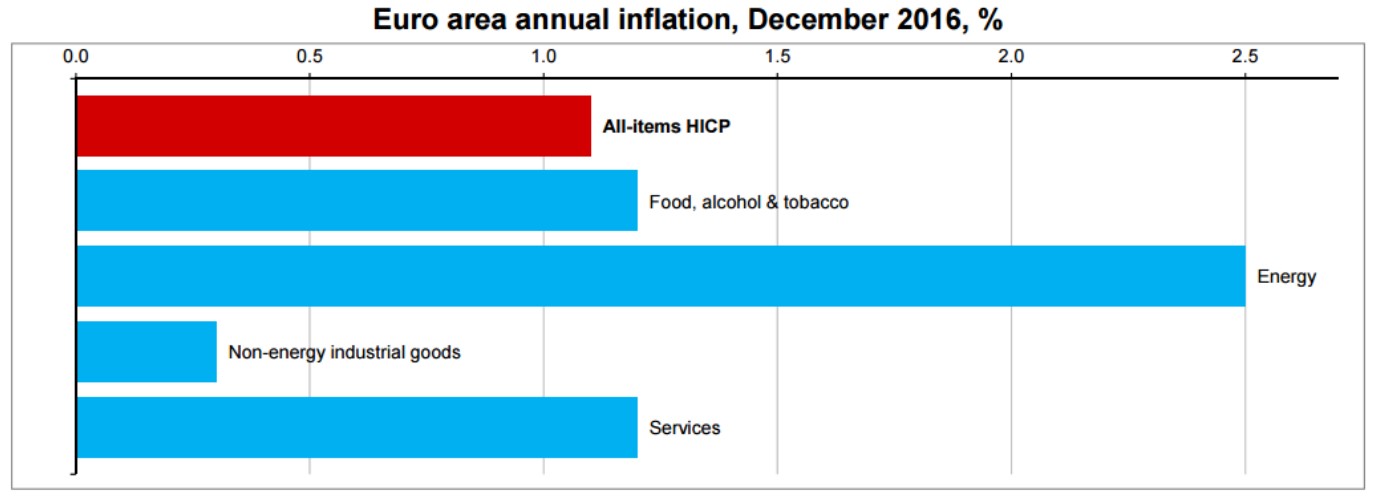

The chart below shows the breakdown of the inflation in Europe which is 1.1% for the month of December. It has nearly doubled from last month as inflation was 0.6% in November. Inflation in energy was 2.5% compared to -1.1% in November. If energy continues to rise, the inflation rate can exceed 2.0% which would cause the ECB to have to stop its bond buying. The ECB has a singular mandate to keep inflation low and the 2% ceiling is much more stringent than the Fed’s 2% ceiling. If inflation did creep up and the ECB was forced to stop the bond buying, Italian bond yields would soar considering its political upheaval, its high debt to GDP ratio, and its unstable banking system. This would exacerbate the problems right at when Italy needs everything to work out because it is already borrowing $20 billion additional euros for its bank bailout fund. Therefore, Italy hopes inflation remains stable in 2017.

The Fed’s policy is reliant on ECB and other central bank policy because if it goes rogue, it can either crash the dollar or cause it to skyrocket. I contest the Fed wants a stable dollar to avoid the negative effects of both scenarios. Because the Fed has had a hawkish tone lately, I think it wants the ECB to end its bond buying. This would halt the rise in the dollar which has become worrisome. The Fed still hasn’t sold any of the bonds on its balance sheet, but at least it stopped buying them with QE 3. With the ECB’s plan continuing until December, the dollar may rise further versus the euro. Therefore, the Fed wants inflation to rise in Europe so it ends QE, but it doesn’t want inflation to rise in America because then it will have to raise rates. Raising rates mitigates the weak dollar effect the ECB ending QE has.

Because inflation in Europe and America is being caused by the same thing which is rising oil prices, the scenario where inflation rises in Europe, but not America is impossible. The best-case scenario for the dollar is if Trump brings inflation into mainly America, so the Fed is forced to raise rates quickly and the ECB doesn’t end QE before December. The dollar is already high. As I showed in a previous article, a strong dollar dampens global trade. Another point I made was that the top 5 largest firms in each sector were the only ones with a return on equity not near recessionary levels. The large stocks have been carrying the market. A strong dollar hurts these firms the most because of their vast international exposure.

As you can see, there are many possible permutations to each scenario. The input to finding out which scenario will take place is inflation. The big uncertainty with inflation is oil prices. I don’t have a crystal ball as to where they will go, so I have to lay out several scenarios. The base case is for inflation to rise moderately causing the Fed to raise rates 2 or 3 times and the ECB to end its QE on schedule in December. If oil prices fall or stay at about $50, then we may have a repeat of 2016 where the Fed raises rates once and the ECB tapers QE, but extends it.