Hoover’s Folly

In 1930, Herbert Hoover signed the Smoot-Hawley Tariff Act into law. As the world entered the early phases of the Great Depression, the measure was intended to protect American jobs and farmers. Ignoring warnings from global trade partners, the new law placed tariffs on goods imported into the U.S. which resulted in retaliatory tariffs on U.S. goods exported to other countries. By 1934, U.S. imports and exports were reduced by more than 50% and many Great Depression scholars have blamed the tariffs for playing a substantial role in amplifying the scope and duration of the Great Depression. The United States paid a steep price for trying to protect its workforce through short-sighted political expedience.

On January 3, 2017 Ford Motor Company (F) backed away from plans to build a $1.6 billion assembly plant in Mexico and instead opted to add 700 jobs at a Michigan plant. This abrupt reversal followed sharp criticism from Donald Trump. Ford joins Carrier in reneging on plans to move production to Mexico and will possibly be followed by other large corporations rumored to be reconsidering outsourcing. Although retaining manufacturing and jobs in the U.S. is a favorable development, it seems unlikely that these companies are changing their plans over concerns for American workers or due to stern remarks from President-elect Trump.

What does seem likely? Big changes in trade policy occurring within the first 100 days of Trump’s presidency. The change in plans by Ford and Carrier serve as clues to what may lie ahead and imply a cost-benefit analysis. In order to gain better insight into what the trade policy of the new administration may hold, consideration of cabinet members nominated to key positions of influence is in order.

Trump’s Trade Appointments

As we close in on Trump’s inauguration, his cabinet and team of advisors is taking shape. With regard to global trade, there are three cabinet nominations that most capture our attention:

- Peter Navarro is a business professor from the University of California-Irvine. Mr. Navarro has been very outspoken about China and the need to renegotiate existing trade deals in order to put America on a level playing field with global manufacturers. The author of the book, “Death by China”, will lead the newly created White House National Trade Council.

- Wilbur Ross is a billionaire investor who made his fortune by resurrecting struggling companies. In the words of Donald Trump, Mr. Ross is a “champion of American manufacturing and knows how to turn them around”. The long time trade protectionist will now serve as Commerce Secretary.

- Robert Lighthizer is currently a lawyer with a focus on trade litigation and lobbying on behalf of large U.S. corporations. Earlier in his career, he served as deputy U.S. Trade Representative under President Ronald Reagan. Mr. Lighthizer has been very outspoken about unfair trade practices that harm America. In his new role he will serve as Trump’s U.S. Trade Representative.

Donald Trump said that Mr. Lighthizer will work “in close coordination” with Wilbur Ross and Peter Navarro. The bottom line is that these three advisors have strong protectionist views and generally feel that China, Mexico and other nations have taken advantage of America.

Gettysburg and other Rhetoric

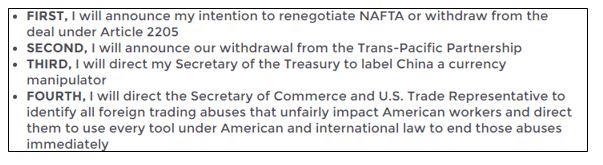

On October 22, 2016 in Gettysburg, Pennsylvania, Donald Trump delivered a litany of goals that he hopes to accomplish in his first 100 days of office. Within the list are seven actions aimed at protecting American workers. Four of them deal with foreign trade. They are as follows:

These four proposals and other trade-related rhetoric that Donald Trump repeatedly stated while running for president suggest that he will take immediate steps to level the global trade playing field. At this point, it is pure conjecture what actions may or may not be taken. However, the article, “We need a tough negotiator like Trump to fix U.S. trade policy”, penned by Peter Navarro and Wilbur Ross from July 2016 offers clues.

In the article, Navarro and Ross took the World Trade Organization (WTO) to task for being negligent in defending the United States against unfair trade. Additionally, they note the WTO “provides little or no protection againstfour of the most potent unfair trade practices many of our trade partners routinely engage in — currency manipulation, intellectual property theft, and the use of both sweatshop labor and pollution havens”.

They also note that the U.S. does not have a Value-Added Tax (VAT). Heavily used in the European Union and much of the rest of world, a VAT is a tax imposed at various stages of production where value is added and/or at the final sale. The tax rate is commonly based on the location of the customer, and it can be used to affect global trade. Manufacturers from countries with VAT taxes frequently receive rebates for taxes incurred during the production process. Because the U.S. does not have a VAT, the WTO has denied U.S. corporations the ability to receive VAT rebates. In fact, the WTO has rejected three congressional attempts to give American companies equal VAT rebate treatment. By denying VAT rebates the WTO is “giving foreign competitors a huge tax-break edge.”

It is possible that, within weeks of taking office, President-elect Trump may threaten to leave the WTO. In what is likely a negotiating tactic, we should expect strong proposals from Trump and his team with the goal of forcing the WTO to alter decisions more to the favor of the United States. Among the actions the Trump administration may take, or threaten to take, is the pulling out of prior trade agreements and/or establishing tariffs on imports into the United States. Because of its efficiency and simplicity, border tax adjustments, which are similar to VAT, seem to be a more logical approach as they would effectively assess a tax on importers of foreign goods and resources without affecting exporters.Border tax adjustments seem even more plausible when considered in the context of a recent Twitter message that Donald Trump posted: "General Motors is sending Mexican made model of Chevy Cruze to U.S. car dealers-tax free across border - Make in U.S.A. or pay big border tax!"

Ramifications and Investment Advice

Although it remains unclear which approach the Trump trade team will take, much less what they will accomplish, we are quite certain they will make waves. The U.S. equity markets have been bullish on the outlook for the new administration given its business friendly posture toward tax and regulatory reform, but they have turned a blind eye toward possible negative side effects of any of his plans. Global trade and supply chain interdependencies have been a tailwind for corporate earnings for decades. Abrupt changes in those dynamics represent a meaningful shift in the trajectory of global growth, and the equity markets will eventually be required to deal with the uncertainties that will accompany those changes.

If actions are taken to impose tariffs, VATs, border adjustments or renege on trade deals, the consequences to various asset classes could be severe. Of further importance, the U.S. dollar is the world’s reserve currency and accounts for the majority of global trade. If global trade is hampered, marginal demand for dollars would likely decrease as would the value of the dollar versus other currencies.

From an investment standpoint, this would have many effects. First, commodities priced in dollars would likely benefit, especially precious metals. Secondly, without the need to hold as many U.S. dollars in reserve, foreign nations might sell their Treasury securities holdings. Further adding pressure to U.S. Treasury securities and all fixed income securities, a weakening dollar is inflationary on the margin, which brings consideration of the Federal Reserve and monetary policy into play.

Investors should anticipate that, whatever actions are taken by the new administration, America’s trade partners will likely take similar actions in order to protect their own interests. If this is the case, the prices of goods and materials will likely rise along with tensions in global trade markets. Retaliation raises the specter of heightened inflationary pressures, which could force the Federal Reserve to raise interest rates at a faster pace than expected. The possibility of inflation coupled with higher interest rates and weak economic growth would lead to an economic state called stagflation. Other than precious metals and possibly some companies operating largely within the United States, it is hard to envision many other domestic or global assets that benefit from a trade war.

Summary

We like to think that the lessons from the Great Depression would prevent a trade war like the one precipitated by the Smoot-Hawley Tariff act. We must realize, however, that nationalism is on the rise here and abroad, and America will soon have a president that appears more than willing to take swift and aggressive action to ensure that it is not taken advantage of in the global trade arena.

It is premature to make investment decisions based on rhetoric and threats. It is also possible that much of this bluster could simply be the opening bid in what is a peaceful renegotiation of global trade agreements. To the extent that global growth and trade has been the beneficiary of years of asymmetries at the expense of the United States, then change is overdue. Our hope is that the Trump administration can impose the discipline of smart business with the tact of shrewd diplomacy to affect these changes in an orderly manner. Regardless, we must pay close attention as trade conflicts and their consequences can escalate quickly.

“The Unseen”, our upcoming subscription service, will provide readers with a perspective that is largely overlooked by other research services, most of which focus only on the obvious. ...

more

I agree with this great insightful article. But I don't believe inflation can be permitted. The Fed will apply the breaks severely, if it sees inflation rising, in a way not seen in the past. Right or wrong, the Fed would always like to err on the side of caution over allowing inflation. But prices rising by limiting foreign cheap imports will hurt the constituency that voted for Donald Trump before it hurts other people in society.