Gold Is On The Cusp Of Long-Term Bullish Reversal Ahead Of French Elections

Gold ended 2016 at $1150.62 and since then the metal has been on a winning streak that pushed prices to a five-month high of $1295.46. As of now, the metal trades around $1286; this amounts to 11.76% gain from the Dec closing level.

One may feel confused as the Fed did move interest rates higher by 25 basis points in March. Plus, the financial markets have been on the roll, while inflation has risen across the advanced world. The latest to join the inflation party was New Zealand, which reported CPI at five-year high earlier this week.

So what’s behind the gold rally?

Negative real yields: The bond yields across the advanced world offer negative yields. This is supportive for a zero-yielding safe haven asset like gold.

Geopolitical uncertainty: This one is a no-brainer… all the tensions between US, NKorea and China, US and Russia over Syria forced investors to pour money into traditional safe-haven assets like gold.

Trump trade fades: Trump’s healthcare debacle forced the markets to question his ability to deliver on the fiscal front. Arguments can be made that tax plan/infrastructure spending plan would be a relatively easy job, however, till now Trump has been on the news for all the wrong reasons. Markets are increasingly losing patience, which is evident from the fact that the US dollar barely moved yesterday, despite Mnuchin’s attempt to revive the Trump Trade by talking about delivering a tax plan soon. No wonder, gold is on the rise and looks set to extend gains even further.

Technical factors: Chart factors also supported the yellow metal. A rebound from the December low established a higher low pattern on the monthly chart, thus opening doors for more gains… which materialized over Feb-Apr period.

Factors that are/or may work against gold rally

The two things that could derail the gold rally in the short-term is the normalization on the geopolitical front and peak inflation.

The latest data released across the advanced world showed the inflation may have peaked. Moreover, the whole reflation trade was set in motion by a sudden spike in the China PPI in Q3/Q4 2016. Trump victory only added fuel to the fire.

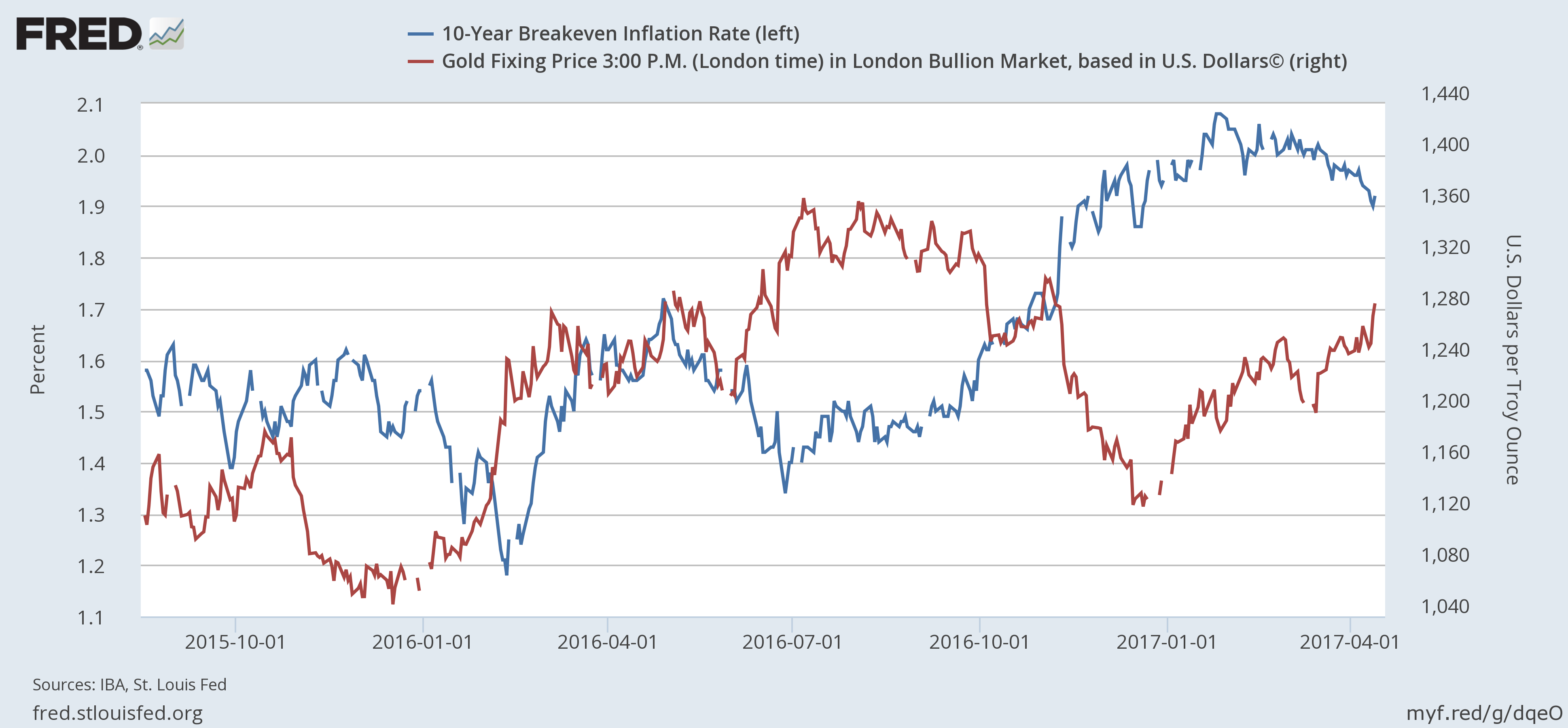

US Inflation Expectations & Gold Comparison chart

The US 10-year Breakeven Inflation rate hovers below 2%. Gold has clearly remained resilient due to geopolitical uncertainty. If things settle down on the geopolitical front, the yellow metal could fall back in line with the declining inflation expectations.

On a slightly larger scheme of things, gold could face severe losses if the Fed begins to normalize its balance sheet - stop reinvesting proceeds and then offload bond holdings. The resulting decline in gold could be short lived as balance sheet normalization would lead to sell-off in the equities. That would boost demand for gold.

Gold Technicals - Will it confirm a bullish reversal?

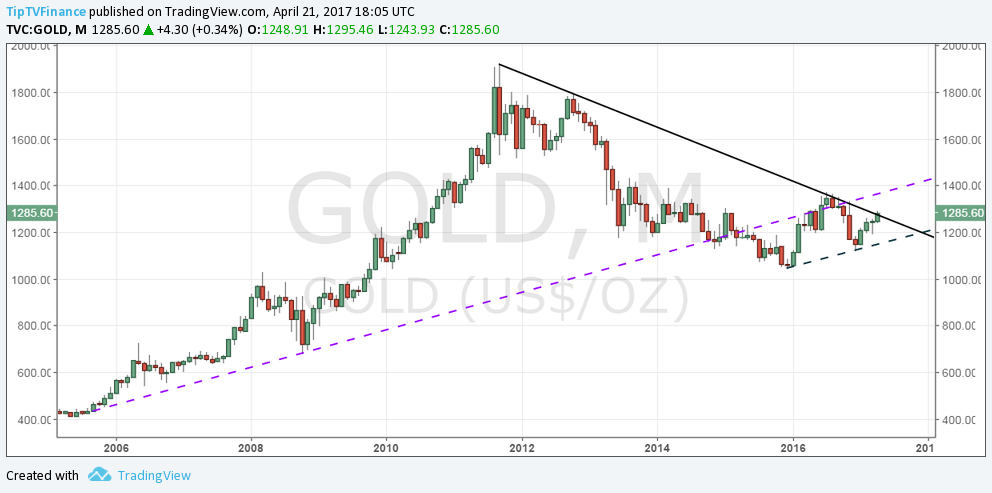

Monthly chart

(Click on image to enlarge)

- The metal currently trades above the resistance offered by the declining trend line drawn from 2011 high and 2012 high.

- Only a close on April 30 above the trend line resistance would add credence to the higher low formation and confirm the long term bullish reversal.

- Take note of the repeated rejection at the trend line resistance in 2016. However, the odds of a bullish break are higher this year, given the higher low formation.

Le Pen-Melenchon victory on Sunday could yield a bullish break in gold

French voters will go to the polls on Sunday for the first round of presidential elections. The four candidates are worth considering-

· Emmanuel Macron - an independent centrist

· Marine Le Pen - anti-EU, anti-immigration candidate

· François Fillon, a conservative from the center-right Republican party

· Jean-Luc Mélenchon, a hard-left candidate, anti-EU, anti-immigration, hard-liner and perceived as a bigger risk to markets than Marine Le Pen

The top two candidates will head to round two of elections on May 7. Le Pen-Melenchon combo is widely considered as the worst case scenario. European equities and the EUR pairs are in for a beating if the combo heads to the second round due on May 7.

What's wrong with Le Pen - Melenchon victory?

Marine Le Pen is a far right anti-EU candidate. She has promised EU referendum and immigration curbs.

Melenchon is a hard left-winger, also wants France out of the EU and NATO. He has promised a £855bn recovery plan to stimulate the French economy, which would be financed through higher taxes, debt, lower tax evasion and higher economic growth.

It is quite clear why experts are worried about a potential Le Pen/Melenchon victory...

Are the fears justified?

Risk assets are likely to take hit in a knee jerk reaction if either of the two comes out victorious. However, we have seen that in a democratic set up it is easy to win elections by adopting nationalist and anti-establishment stance, but at the same time it is equally difficult to deliver after winning elections! Look at Trump... He hasn't been able to do much in the first 100 days. The market is slowly losing the confidence; which is evident from the lackluster reaction in FX markets to Mnuchin's tax reforms comments on Thursday.

To cut the long story short, the odds of La Pen/Melenchon heading the 'Trump way' (failing to deliver on promises) are high. Hence, the risk-off may not be as severe as many are anticipating. Moreover, the risk-off could be short lived.

Nevertheless, the traditional safe havens - Gold, Treasuries, German Bunds, Swiss Franc would strengthen in the worst case scenario.

Conclusion-

Expect gold to confirm a bullish trend reversal on the monthly chart if Le Pen or Melenchon or both Len Pen and Melenchon head to the round two of the French elections. Confirmation would open doors for an extension of a rally to $1375 (July 2016 high), $1392 (Mar 2014 high) and $1433 (Aug 2013 high).

On the other hand, a minor dip in gold prices cannot be ruled out if Macron wins. Note that markets are pretty much expecting Macron to win, hence his victory may not lead to a massive risk-on in the markets and may not single-handedly derail the gold rally.

Disclosure: None.