Forex Ranking, Rating And Score For Week 49 / 2016

For the coming week shows the following stronger currencies being well represented for going long: NZD(4X) followed by the CAD (3x). The weaker currencies are the JPY (4X) followed by the EUR (3X) and the CHF (2X).

A nice combination for coming week may be e.g:

- NZD/JPY with the CAD/CHF

- EUR/NZD with the CAD/JPY

Some of the pairs in the Top 10 comply for a longer term trade based on the Technical Analysis (TA) of the Daily and Weekly chart. For the coming week these seem to be: NZD/JPY, EUR/NZD, EUR/CAD, NZD/CHF, AUD/NZD and USD/JPY.

For more details read both of my articles where the relevant Charts and Tables are provided.

______________________________________

Ranking and Rating list

Analysis based on TA charts for all the major currency pairs. Good luck to all. No advice, just info. Every week the Forex ranking rating list will be prepared in the weekend. All the relevant Time Frames will be analyzed and the ATR and Pip value will be set.

______________________________________

For analyzing the best pairs to trade looking from a longer term perspective the last 13 weeks Currency Classification can be used in support.

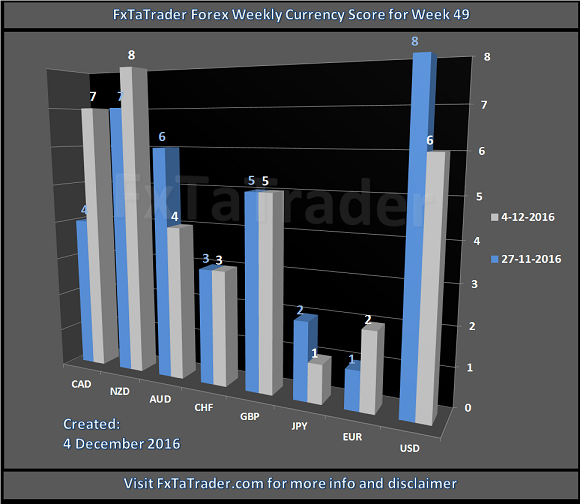

This was updated on 4 December 2016 and is provided here for reference purposes:

Strong: USD, NZD. The preferred range is from 7 to 8.

Neutral: JPY, CHF, AUD. The preferred range is from 4 to 6.

Weak: EUR, GBP, CAD. The preferred range is from 1 to 3.

When comparing the 13 weeks Currency Classification with the pairs mentioned in the Ranking List above some would then become less interesting. On the other hand these pairs are at the top of the list partly also because of their volatility. It seems best to take positions for a short period then and take advantage of the high price movements.

______________________________________

Currency Score Chart

The Currency Score analysis is one of the parameters used for the Ranking and Rating list which is published also in this article. The Currency Score is my analysis on the 8 major currencies based on the technical analysis charts using the MACD and Ichimoku indicator on 4 Time Frames: the monthly, weekly, daily and 4 hours. The result of the technical analysis is the screenshot here below.

Currencies with a high deviation seem less interesting to trade because they are less predictable. A good example at the moment is/are e.g. the CAD, GBP and JPY.

Disclaimer: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for ...

more

Thanks for sharing