EUR/USD Forecast: Retreating Within Range

The American dollar recovers modestly this Tuesday, as risk aversion eased overnight, following the US Presidential debate, as Democratic Hillary Clinton, seen as more "market friendly" led. Asian shares jumped higher after yesterday´s losses. European stocks opened with a firmer tone, although quickly turned lower, with the banking sector still under pressure. The Japanese yen recovered the ground lost against its American rival, but the EUR/USD pair is under pressure, trimming almost all its Monday's gains.

There were some minor releases in the EU, including the German index of import prices, down in August by 2.6% when compared to August 2015, and monetary developments for the whole area, showing a slight increase of money supply during the same month. But the focus of the day will be on the September preliminary US Services and Composite PMIs, to be released later today.

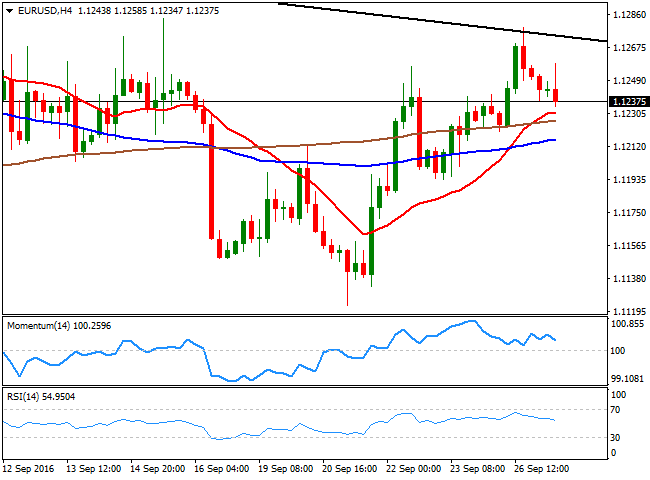

As for the EUR/USD pair technical outlook, the 4 hours chart shows that, after being rejected from the daily descendant trend line coming from this year high at 1.1615, technical indicators have lost their upward momentum, and turned south, although are still holding within bullish territory. In the same chart, the price is standing a few pips above its moving averages that anyway lack directional strength, reflecting the current absence of direction.

If the decline extends below 1.1200, the pair will likely accelerate its decline towards 1.1160, while below this last the next bearish target comes at 1.1120. The EUR/USD pair needs to accelerate beyond 1.1280 to be able to recover further, and extend its gains up to the 1.1330/40 region.