Wednesday, August 16, 2017 3:04 AM EDT

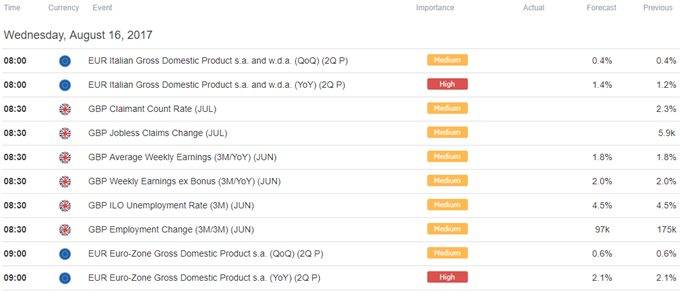

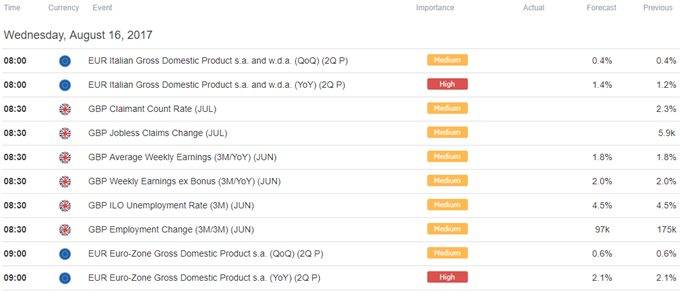

A revised set of second-quarter Eurozone GDP figures headlines the economic calendar in European trading hours. The flash estimate showing a 0.6 percent quarterly gain is expected to be confirmed, as is the trend growth reading putting on-year pace of expansion at 2.1 percent.

News-flow out of the currency bloc has deteriorated relative to forecasts since the initial projection was published at the beginning of this month. This points to downgrade risk. Such a result may hurt the Euro but lasting follow-through seems unlikely amid hopes for on-coming tapering of ECB QE.

The British Pound may be similarly unimpressed by July’s UK jobless claims report. Prospects for BOE policy tightening have dimmed after yesterday’s disappointing CPI numbers, making these numbers something of a moot point regardless of the outcome.

Minutes from July’s FOMC policy meeting will be in focus thereafter. The US Dollar may rise if the document suggests that the rate-setting committee stands by June’s projection for three rate hikes in 2017 – two of which have already materialized – despite a run of sluggish inflation figures recently.

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

Disclaimer: DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the ...

more

Disclaimer: DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the fundamental and technical influences driving the currency and commodity markets. With nine internationally-based analysts publishing over 30 articles and producing 5 video news updates daily, DailyFX offers in-depth coverage of price action, predictions of likely market moves, and exhaustive interpretations of salient economic and political developments. DailyFX is also home to one of the most powerful economic calendars available on the web, complete with advanced sorting capabilities, detailed descriptions of upcoming events on the economic docket, and projections of how economic report data will impact the markets. Combined with the free charts and live rate updates featured on DailyFX, the DailyFX economic calendar is an invaluable resource for traders who heavily rely on the news for their trading strategies. Additionally, DailyFX serves as a portal to one the most vibrant online discussion forums in the forex trading community. Avoiding market noise and the irrelevant personal commentary that plague many forex blogs and forums, the DailyFX Forum has established a reputation as being a place where real traders go to talk about serious trading.

Any opinions, news, research, analyses, prices, or other information contained on dailyfx.com are provided as general market commentary, and does not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

less

How did you like this article? Let us know so we can better customize your reading experience.