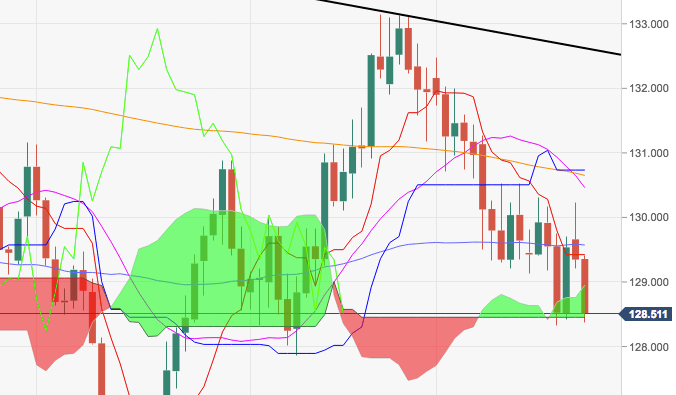

EUR/JPY Technical Analysis: Remains Offered Below Resistance Line At 132.62

The generalized offered bias around the European currency plus the increasing demand for the safe haven Japanese Yen have dragged the cross to fresh lows in the mid-128.00s today.

- The continuation of the down trend carries the potential to visit September’s low at 127.86 ahead of June’s low in the 126.65/60 band.

- The downside pressure could accelerate on a break of the 128.30 area, where converge recent lows and the base of the daily cloud.

- Looking at the broader picture, the stance in EUR/JPY should remain offered as long as the resistance line off 2018 tops, today at 132.62, caps.

EUR/JPY daily chart

EUR/JPY

Overview:

Last Price: 128.35

Daily change: -1.0e+2 pips

Daily change: -0.773%

Daily Open: 129.35

Trends:

Daily SMA20: 130.56

Daily SMA50: 129.76

Daily SMA100: 129.54

Daily SMA200: 130.71

Levels:

Daily High: 130.22

Daily Low: 129.2

Weekly High: 130.32

Weekly Low: 128.32

Monthly High: 133.15

Monthly Low: 127.87

Daily Fibonacci 38.2%: 129.59

Daily Fibonacci 61.8%: 129.83

Daily Pivot Point S1: 128.96

Daily Pivot Point S2: 128.57

Daily Pivot Point S3: 127.93

Daily Pivot Point R1: 129.98

Daily Pivot Point R2: 130.61

Daily Pivot Point R3: 131

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and ...

more