Empty Consumers

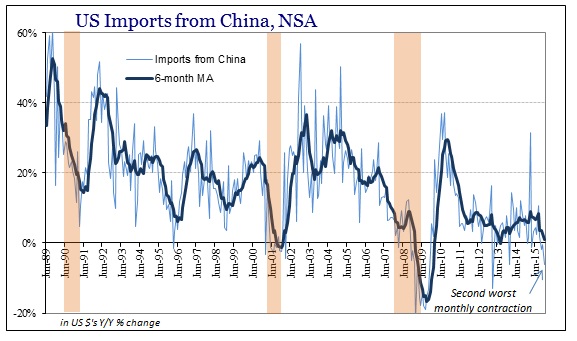

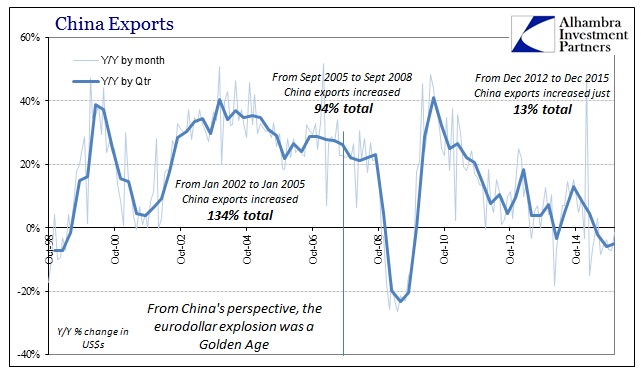

If the Chinese were intent on financial reform, and that meant trying perhaps the impossible task of a managed bubble deformation, the genesis of the idea was forged in the United States. China’s vast industrial machine was made to service US consumers and financed with the full throat of euro/dollar expansion, leaving so many goods for sale in US stores stamped “Made in China.” In terms of numbers, the Chinese expected 20-40% export growth to the US; on this side that meant something like 20-30% growth in US imports from China.

Outside of the brief burst of optimism in the immediate aftermath of the Great Recession, when that economic event seemed then the usual temporary if deep interruption in an otherwise stable and permanent growth baseline, “something” has been wrong. From 2012 forward, those growth rates disappeared and never returned. So when China pushed fully forward into its reform agenda it was direct contradiction on Janet Yellen’s recovery. There may have been vast payroll expansion, but from the Chinese perspective those were just statistical numbers as none of the “best jobs market in decades” was reaching the Middle Kingdom. And they desperately needed US consumers to act the part.

I’ve said this before but it bears constant repetition; the PBOC begs to differ with the FOMC and orthodox economists in their narrative about the US economy. And they are putting their “money” where their thoughts are, crossing their fingers that it doesn’t end catastrophically. That is a remarkable and amazing shift, one that perhaps oil traders and global bank balance sheet managers (“dollar” supply) have taken to heart?

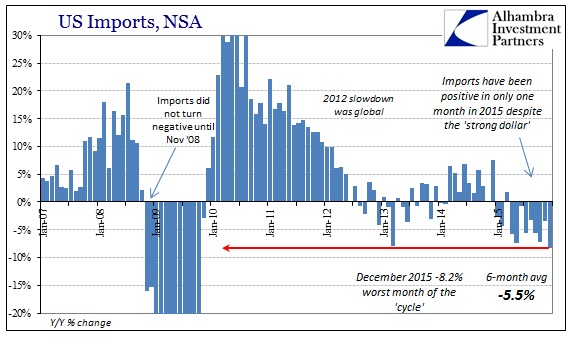

I wrote that the middle of December 2014 as still more weak trade figures suggested that US consumers were nothing like what was being described of them. The fact that China was performing financially as it had been (and, of course, continued to be) meant confirmation of the dead recovery in a way that the FOMC could never have managed to counter with just payroll rhetoric. Instead of being reversed, no matter how terrific the unemployment rate in the US has been over the intervening fourteen months, that negative view has prevailed to the extreme.

December’s trade figures released by the Census Bureau today confirm still further what the Chinese had figured out years ago. Imports from China declined by an alarming 6.2% year-over-year in December – there is no oil or commodities in those trade routes, just pure and unadulterated consumerism, or rather its conspicuous absence. That was the second worst monthly contraction of this cycle, though in reality it was the worst when factoring the two-month process of February and March 2013 (Feb. 2013 was +16.4% followed by the convergence the next month of -13.1%).

As is plain on the charts above, 5% growth is a disaster for China especially month after month; -6% is a catastrophe especially in the reform/disruptive financial context. It wasn’t just December, as US imports from China have fallen for three consecutive months. Unlike the payroll statistics, this highly negative and concerning view of global trade is confirmed on both sides of the Pacific.

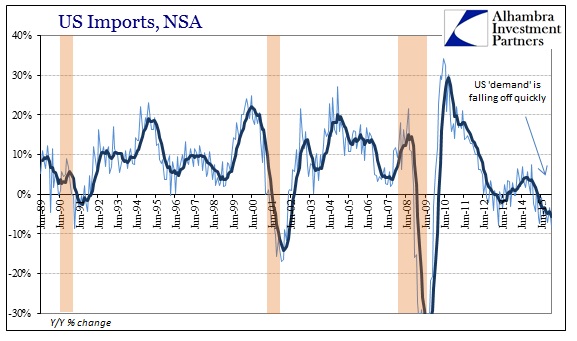

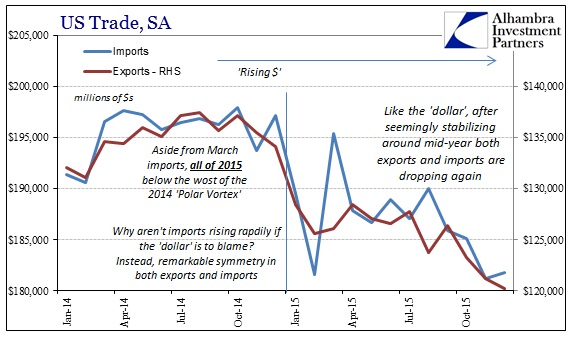

If the US consumer is dead to China’s vast network of factories, it isn’t any better for anywhere else in the world. US imports fell 8.2% at the end of 2015 overall, meaning the Chinese figures were no aberration. While there might be some petroleum effects in total, the US just isn’t buying into global trade that might be available despite the “strong dollar’s” supposed positive boost to domestic buying power. December’s contraction in overall imports was also the worst of this entire “cycle.”

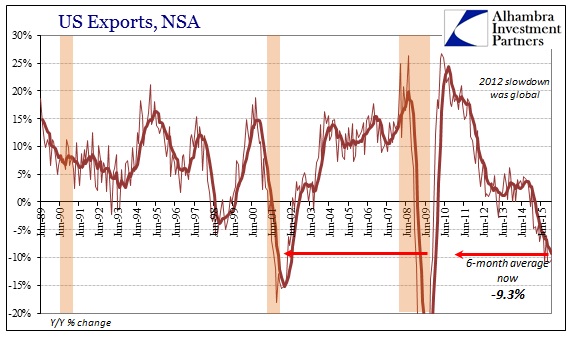

We know well the deep problems with US exports as even economists will admit that end, which remained mired in the global slump/recession. Exports fell more than 10% again in December for the third straight month; and four of the past five. The 6-month average is now -9.3% which is equivalent to February 2009 and October 2001.

Perhaps the only quirk of the entire depressing month of figures was that the Census Bureau’s seasonal adjustments somehow turned the worst month for imports into a slight gain from November. It doesn’t truly make any difference, of course, but it offers yet another reminder about the nature of statistical estimates and the flukes of their mathematics especially in the shortest one-month intervals. The onrushing global recession remains entirely visible no matter the seasonal determination.

From the totality of these figures, it is exceedingly difficult to see the economy the FOMC claimed was close to overheating. They had perhaps convinced themselves that the economic turmoil was entirely overseas, and exports might have suggested as much, but the import numbers as well as market behavior especially about China proved otherwise. It is not coincidence that Chinese industry and manufacturing would fall into something like recession at the very same time US industry and manufacturing would as well – they both sell largely to the same people, US consumers. There is no Chinese recession as separate from the US, and vice versa.

It may have been that some of the more empty suits on the FOMC council, and that would be the majority (I have read far, far too many FOMC transcripts, so I openly claim expertise in at least this one facet of qualitative assignment), actually believed in the unemployment rate despite all this contradictory data and the still-worsening financial association of it all. However, I think it likely that the “rate hike” (subscription required) in December was something of a “fingers crossed” policy; a last ditch attempt to project confidence in the recovery in the final hope that one last display would do the trick before going over the cliff. The trade figures here, especially the large decline from China, suggests again just that sort of end of the beginning.

As manufacturing has been contracting or slowing here and in China, it hasn’t yet attained the full weight of recessionary factors, where adjustment turns to open and even drastic cutbacks in all forms of resource utilization. There have been a few hints of transition between the former to the latter, including announced job cuts here, but in my view the import figures seem to offer further proposition (and not just the one month decline for December) at least in that direction. I have thought all through 2015 that last year’s Christmas season would turn out to be the last straw and these results, unfortunately, do nothing to dissuade that expectation.

Disclosure: NOTE: none of this commentary is intended or should be viewed as offering investment advice about Capital One or FHLB securities in any form. This is ...

more