Early Signs That Canada Is About To Enter Recessionary Times

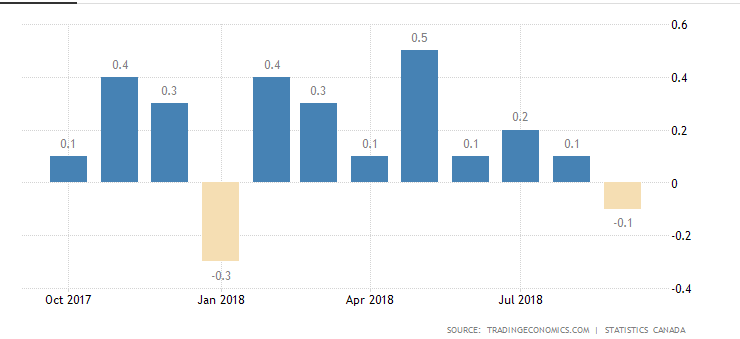

By key economic measures, the Canadian economy is weakening and faces the prospects of worsening as we enter the new year. Looking through the rear-view mirror, in September, overall GDP shrank 0.1 percent month-over-month. Since the first half of the year, growth has been sputtering and in September total output actually contracted (Figure1).

Figure 1 Canada's GDP Growth M/M

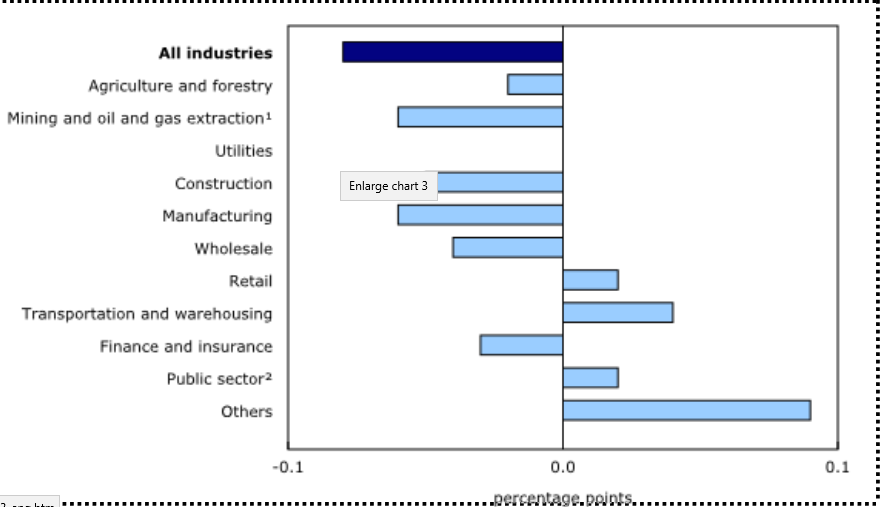

The performance of specific components within the overall measure is even more worrisome. Goods-producing industries fell 0.7 percent; mining, quarrying and oil and gas extraction went down 1.2 percent; manufacturing drop 0.5 percent; finance and insurance sector decreased 0.4 percent; the construction sector was down 0.6 percent and wholesale sector contracted 0.7 percent. (Figure 2). The growth in these sectors have formed the backbone of Canada’s good economic performance in the first half of the year and now all have shrunk in the last month of the most recent quarter.

Figure 2 Contribution to GD Growth by Sector

The Bank of Canada has pinned its hopes on the expansion of business investment as one of the prime reasons for its optimism regarding the outlook for the Canadian economy. On this basis, it has signaled that investors can expect future rate hikes, possibly as early as January 2019. However, non-residential investment fell by 1.3 per cent in September and machinery and equipment dropped 2.5 per cent. Finally, new home building slumped by 4.7 percent.

These disappointing results occurred before two major shocks hit the country in November: (1) the collapse in oil prices and (2) the announcement of the closure of a major GM production facility in Oshawa, Ontario. These additional shocks to the economy will not show up in the data until early in 2019.

Let’s look at oil first. During the summer months the Canadian oil price benchmark was $39/ bbl; by October, the price fell to $27 and at the time of writing this note, the price hit $15 mark. In a desperate move, the Alberta government announced a province-wide reduction in production to alleviate the oversupply situation and help boost prices. There is lots of pessimism to go around within government and at the industry circles to suggest that there is little reason to expect a significant turnaround in prices for sometime. There are very complex political issues affecting pipeline construction and physical constraints affecting the rail transportation. At the same time, U.S. producers are reaching record levels of production at a time when domestic demand is slowing. The nose-dive in prices has already created job losses in western Canada and shortfalls in government revenues at the provincial and federal levels.

Another blow to the economy, this time in Ontario, was the announcement of the closing of the GM plant in Oshawa by December 2019. In addition to the layoff for GM workers, we can expect many suppliers in southern Ontario to be adversely affected. As the automakers re-align production in North America in response to a slowdown in demand and shifts towards non-conventional vehicles, production facilities in other parts of the province may be at risk.

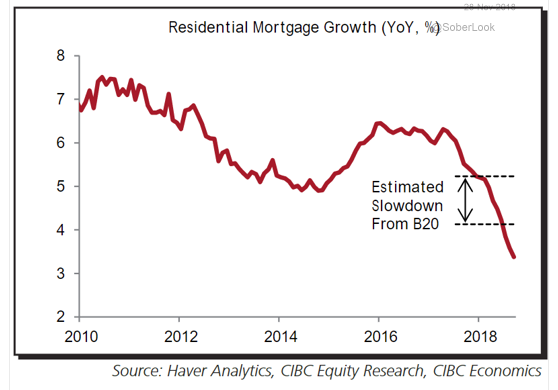

Housing is also undergoing stress as mortgage loan growth slows in response to government policy aimed at moderating housing prices (e.g. B-20 rules which stress-test an applicant’s ability to withstand higher than current interest rates). The growth in mortgage loans is running at 3 per cent, roughly half the rate experienced in the early part of the year (Figure 3). Many first-time buyers no longer qualify for mortgages and have been forced to return to the rental market which itself is in short supply. Developers are finding inventories are piling up and have put projects on hold. The decline in home construction experienced in September will likely worsen during the winter months.

Figure 3 Residential Mortgage Growth. Canada

Taking these developments as a whole, many private sector economists are now anticipating that growth in Q4 will come in at 1 per cent, a feeble handoff to 2019 Q1.

With the best laid plans of men and mice, the Bank of Canada now has to re-calibrate its economic models that form an integral part of their policy decisions. As the oil sector struggles, capital investment drops off, and home construction declines, there is no reason to expect that interest rates are inevitably on the rise. With the yield on 5-yr bonds dropping 30 bps over the last two months, the bond market is signaling to investors that the Bank of Canada may be forced to go on hold.

It likely doesn't help that the US housing market is cooling.