Do Long/Short Equity Funds Work?

To paraphrase Kermit the Frog, it’s not easy being long. Long equity, especially.

The volatility introduced into the stock market earlier this year by trade tiffs and tantrums has naggingly persisted into summer. All this has played out against the background of a surging U.S. economy. While domestic growth estimates for the second quarter have risen to an annualized rate of 5 percent, double the pace set in the last quarter, the European, Chinese and Japanese economies are decelerating.

So what’s to worry about? Well, for starters, peak growth as forecast by some economists. The nine-year bull market’s getting pretty long in the tooth. As we move toward the end of a cycle, risk historically tends to increase across the board, from equities to fixed income.

Then there’s the headwind of rising interest rates envisaged by the Fed. Add to that the potential inflationary impact of an all-out trade war, and it’s no wonder the markets are rocky.

Investors are being shaken to their very core. The core of their portfolios, that is. Traditionally, core investments consist of developed market equities and investment-grade debt. Smaller allocations to diversifiers such as emerging markets, high-yield bonds, and hedge fund strategies, among others, are often layered on as satellite investments.

Some satellites differ greatly from the core, some less so. One hedge fund strategy—long/short equity—resembles a typical portfolio core quite closely. Long/short equity, after all, is a stock-based strategy, but because of the interplay between its long and short positions, its net exposure to the equity market is less than 100 percent. That’s pretty much the risk profile of a core position with its combination of stocks and bonds.

Managers of long/short equity strategies attempt to exploit the upside of certain stocks and the downside of others. Freed from a long-only constraint, long/short managers have greater flexibility to search for alpha. Stocks with positive expected risk-adjusted return profiles are purchased while those issues with poor prospects are shorted.

Investors are right to wonder how successful these long/short managers are in actually outperforming the market. More importantly, they should be curious to know how well these money runners tamp down the kind of volatility now besetting us.

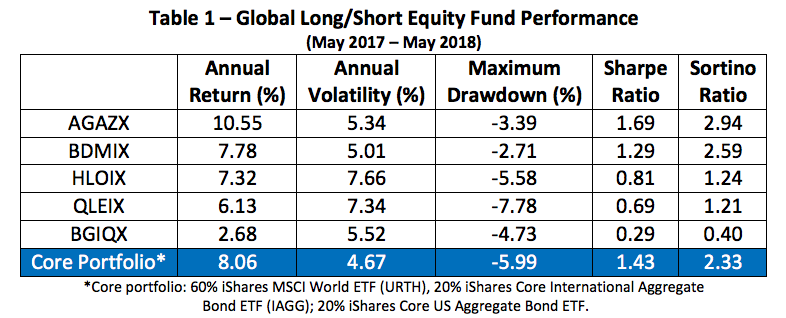

To answer these questions, we tracked five long/short equity funds against a core portfolio with 60 percent exposure to global equities and 40 percent to global high-grade bonds. Here’s the spoiler: We found only one fund that outperformed our core portfolio over the past year.

The Global Long/Short Universe

(Click on image to enlarge)

361 Capital Global Long/Short Equity Fund (AGAZX) attempts to offer a smoother ride on the way to equity-like returns by taking advantage of the low volatility anomaly (i.e., going long on lower-volatility stocks and shorting higher volatility issues) while dynamically allocating to those stocks with high alpha expectations. Basically, AGAZX’s operating thesis is to win by not losing, making the fund well-suited for the current environment. AGAZX’s managers rely on history repeating itself. Research has shown that utilizing risky investments doesn’t correlate well with increased returns.

The fund’s alpha engine is built on a 30-plus factor framework that is constantly assessed to determine which characteristics are driving returns, the strength of these factors’ momentum and their risk for mean reversion.

The fund’s dynamic factor exposure differs greatly from the static beta exposure sought by some other long/short strategies. Still, AGAZX targets a beta of 0.5 against its MSCI World Index benchmark. The fund’s net long exposure has been on either side of 70 percent recently.

The 361 Capital portfolio tops the table on the bases of its gross and risk-adjusted returns, outdoing our core portfolio as well. AGAZX’s annual net holding cost is 2.11 percent.

Lower volatility is also an explicit aim for the Hartford Long/Short Global Equity Fund (HLOIX), which plies its trade by investing primarily in global small-cap companies.

The fund’s portfolio managers use a bottom-up, fundamental approach, overlaid with quantitative and macroeconomic research, to find stocks for the long side of the portfolio. Short sale candidates arise from a quantitative investment model the looks for stocks likely to underperform the benchmark on a quality, momentum and valuation basis.

HLOIX typically maintains a net long exposure of around 50 to 70 percent. Gross long exposure typically exceeds 100 percent of net assets and is generally expected to be around 110 to130 percent. Gross short exposure is generally expected to equal 50 percent of the fund’s gross long exposure.

At least 40 percent—and normally not less than 30 percent—of the fund’s net assets are invested, long or short, in foreign securities. Exposure is typically obtained through common stock but derivatives such as futures and forward contracts, swaps or options may be used to adjust the fund’s risk profile.

HLOIX’s net annual expense ratio is 3.17 percent.

A three-pronged approach to global equities is pursued by the AQR Long/Short Equity Fund (QLEIX). First, the fund’s advisor uses factors such as value, quality, and momentum to select long and short candidates. Proprietary quantitative metrics also figure into the selection of stocks. This time of the trident aims to produce a 0.0 beta exposure.

Passive exposure is the strategy’s second prong. QLEIX managers rely on a basket of futures to obtain the fund’s 0.5 beta target. Around the periphery, country and currency exposures are managed through derivatives.

Lastly, the fund’s advisors, relying on a number of indicators, can throttle beta exposure tactically between 0.3 and 0.7 in response to changing market conditions. This overlay is implemented through equity swaps, equity index futures and foreign currency forwards.

QLEIX’s fund carries a 2.11 percent annual expense load.

Presently, the BMO Global Long/Short Equity Fund (BGIQX) exhibits a 60 percent net long exposure to global equities. To achieve this stance, the fund’s advisor combines a quantitative approach with fundamental, bottom-up and top-down analyses. Stocks targeted for the long side of the portfolio are judged on the basis of their valuation, earnings quality and earnings growth potential as well as the momentum of their earnings and market prices. Companies that are fundamentally challenged, overvalued and are experiencing deteriorating investor interest become short sale candidates, subject to any constraints imposed by their availability.

The fund normally invests at least 40 percent of its net assets in foreign stocks or equity-related securities.

BGIQX charges 2.21 percent annually.

The BlackRock Global Long/Short Equity Fund (BDMIX) is an outlier in our survey in that it’s designated as a market-neutral portfolio. It’s benchmarked to three-month Treasury bills rather than a global equity index.

There’s nothing bill-like about the current returns of the BlackRock portfolio, though. Among the five funds in our universe, BDMIX grew 7.78 percent over the past 12 months, four times the current T-bill yield. With that comes some volatility, but at just 5.01 percent, it’s the category’s lowest. That contributes to the fund’s 2.59 Sharpe ratio, putting it in second place for its risk-adjusted return.

The fund also takes a red ribbon for its Sortino ratio. Like the Sharpe ratio, the Sortino metric describes a fund’s return in relation to its volatility. The Sharpe ratio uses a fund’s standard deviation of returns—both “good” and “bad” volatility—as the denominator of risk. The Sortino ratio narrows the definition of risk to just the downside semivariance, so it measures a fund’s ability to overcome bad volatility. As with the Sharpe ratio, the higher the Sortino number, the better.

BDMIX earns distinction, too, for suffering the shallowest drawdown over the past 12 months and for its relatively low 1.91 percent expense ratio.

The fund maintains its long and short positions primarily through swap agreements and futures and costs investors.

Long/Short Equity as a Core?

In the past year, a single long/short fund, AGAZX, could have replaced a global core portfolio to good effect. Will AGAZX continue to outperform going forward? That’s hard to know. One thing’s for sure, AGAZX has numbers that should make the other funds in its class green with envy.

Disclosure: None.