Did The Bank Of Canada Error In Raising Rates?

This past summer the Bank of Canada made an about face and embarked upon a tightening policy The Bank’s two rate hikes this summer erased the two cuts it implemented in 2015 in response to the oil-price shock. The central bank noted that “recent economic data have been stronger than expected, supporting the Bank’s view that growth in Canada is becoming more broadly-based and self-sustaining”. The Bank relied heavily on recent past performance and on evidence from its surveys regarding business investment in the coming year. With the first half of 2017 recording growth over 4%, annualized, the Bank felt that economy no longer needed the emergency cuts of 2015.

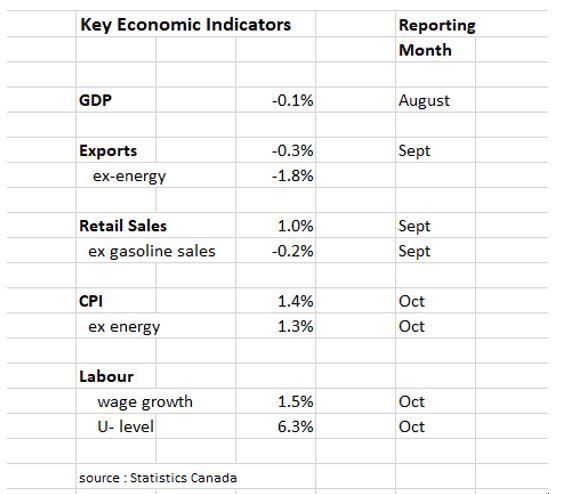

As recent data continues to roll in, however, it is becoming quite evident that the Canadian economy is ailing. The accompanying table highlights some of the key economic measures that characterize the second half of 2017.The data paints quite a different picture than that of the first half of the year.

It can take anywhere from 3-6 months for the economy to adjust to any rate change. So, the results reported in the table largely reflect economic performance prior to the rate hikes taking full effect.

Overall the economy has essentially stalled this past summer. GDP growth was flat in July and then fell 0.1% in August. The most disappointing sector has been exports which usually account for as much a ¼ of national output. September was the fourth consecutive monthly decline in exports with non-energy exports falling by 1.8% in the month.

Retail sales edged up 0.1% in September, largely on the strength of higher prices at the gasoline pump. Excluding gasoline sales, the retail sector declined by 0.2%. Turning to price movements, the CPI in October increased by 1.4% over the last 12 months and just 1.3% excluding the energy component. The Bank has come under some criticism over its insistence that its 2% inflation target is attainable in the near future. These recent data make their case much harder to uphold. Finally, on the labor front, wage growth is barely above the inflation rate with nominal average wages growing at 1.5% yearly. The unemployment rate continues to remain elevated at 6.3%.

The Canadian economy has entered into a marked slowdown, possibly a slight contraction. This performance raises the issue whether the Bank of Canada jumped the gun this past summer when it raised the bank rate from ½% to 1%. It is hard to argue that there is any reason to support further tightening. The question remains whether some of the recent rate hikes should be reversed to forestall a recession.

Disclosure: None.